Investing

Gates Foundation to Sell Almost $10 Billion Worth of Berkshire Hathaway Shares

Published:

Last Updated:

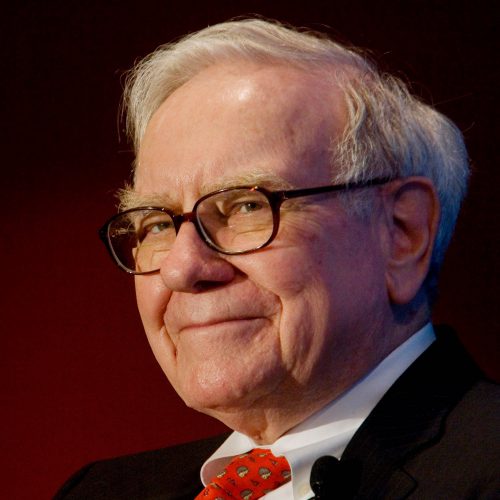

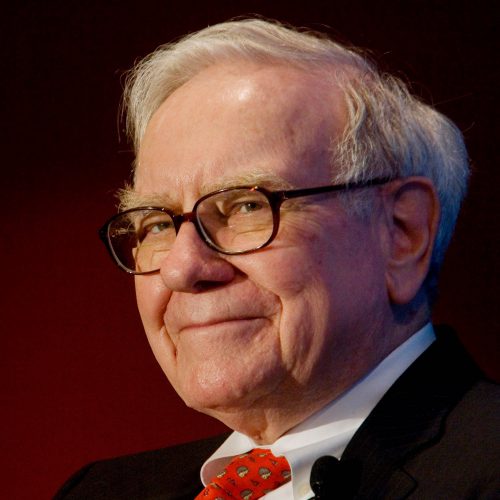

Investors and the public still seem to be enthralled by Warren Buffett and Berkshire Hathaway Inc. (NYSE: BRK-A). Many of those same people still know Bill Gates as well. Many people forget about the close ties between the two billionaires. A filing with the Securities and Exchange Commission (SEC) on Monday should only serve to remind how deep the ties between Gates and Buffett go.

It turns out that an overwhelming majority of the Berkshire Hathaway holdings held by the Gates Foundation will be sold over the next three years. This is a figure nearing $10 billion. If that is not a large insider trading (the legal kind, that is), then what is?

The Bill & Melinda Gates Foundation Trust has filed a Schedule 13D with the SEC showing a shared dispositive power of 68,705,171 shares. What matters is that this was listed as 5.3% of the outstanding class of shares, based on 1,289,055,322 Class B shares of the issuer outstanding as of October 27, 2016.

During the period November 14, 2016, through January 12, 2017, the Gates Foundation sold 3,267,000 Class B shares of Berkshire Hathaway pursuant to the 10b5-1 sales plan. Tuesday’s SEC filing showed that the share sales were made to facilitate compliance with federal excise tax rules limiting excess business holdings by private foundations.

What stands out about the filing further down is that the new sales plan will have the Gates Foundation Trust sell some 60,000,000 Class B shares of Berkshire Hathaway over a three-year period. Those sales will commence on July 1, 2017, and is set to end on June 30, 2020. The filing did specify:

The Trust may terminate the sales plan at any time. Sales under the plan will be disclosed as required by applicable law in public filings with the Securities and Exchange Commission, including any required amendments to this Schedule 13D.

Tuesday’s SEC filing did show that shares had been gifted by Buffett to the trust in prior years. This was part of the Buffett legacy gift.

As far as what the 60 million Class B shares really translates to, with a $159.64 share price it would be $9.58 billion. That compares with a $392 billion market cap. And note that the filing does not require the foundation to fully divest the number of shares they suggested. Some filings fall short. Still, that was over 3 million shares sold in the past two months alone.

The Gates Foundation supports issues around lifting people from poverty, with a focus on health and education. Its health focus around the planet is for the discovery and translational sciences, enteric and diarrheal diseases, HIV, malaria, pneumonia, tuberculosis and neglected tropical diseases.

With a $159.64 share price as of the close on January 17, 2017, Berkshire Hathaway’s B shares have a 52-week range of $123.55 to $167.25. While a dollar amount nearing $10 billion sounds massive, it is important to consider that this is just not the end of world for Berkshire Hathaway or Warren Buffett.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.