Investing

Despite Energy Sector Weakness, Why Merrill Lynch Raised Its Energy Weighting

Published:

Last Updated:

Oil may have run into a rough patch in the past week or so, and it was last seen still trading well below the $50 per barrel mark. In a new sector strategy piece, analysts from Merrill Lynch have chosen to ignore the latest price trend for a longer-term view. The firm is raising its official investor weighting in the energy sector from Market Weight to Overweight, and the firm has cut the consumer discretionary sector from Overweight to Market Weight.

While some metrics may be based on performance and valuation, the call is effectively aimed at looking past the most recent price action with a focus on a longer view of higher oil prices rather than lower prices. The consumer discretionary sector had been up almost 8% year to date, making it the third-best performing sector of the S&P 500 this year, despite the secular headwinds from apparel and disruptors (Amazon and e-commerce). Energy has been the worst-performing sector in the market, after having fallen almost 8% and having erased nearly all of its post-election gains.

Here are a few highlights for the Merrill Lynch call.

… [r]ecord US crude inventories have pushed WTI down over 9% [year to date]. Given our commodity team’s expectations for significant upside to oil prices ($70/bbl by June) coupled with the structural headwinds we see facing Discretionary stocks, we now see significantly more upside in Energy and see limited potential for relative gains from here in Consumer Discretionary.

The analysts also weighed in on how positioning and valuation provide a floor for the energy sector:

Energy’s weight in the S&P 500 has now collapsed back to December 2015 levels, well below the 30-year average of 9% and close to its record low of 5% in 1999. In contrast to the S&P 500, which trades at a 13% premium to the last 30 years on price/book value, Energy trades at a 14% discount, even with recent book value impairment. Investors have added exposure but are far from bullish, with active funds still 12% underweight. Speculative positioning has dropped from extreme highs in late February to the lowest exposure in 14 months. Attractive valuations and positioning should provide a floor, with significant upside potential if oil does rally to $70/bbl by June as global oil markets shift from a surplus to a deficit. Encouragingly, Energy already has the second-best earnings revisions of any sector and is one of the few where analysts are raising more estimates than cutting.

Merrill Lynch also thinks the run may be done in the consumer discretionary sector as late-cycle risks increase:

Consumer Discretionary is the third-best performing sector this year led by auto components (+19%), internet retail (+15%) and household durables (+11%), and while we still see some potential positive catalysts, in our view the risk/reward is less favorable today than at the start of the year. The sector remains one of the most crowded sectors by fund managers, is most negatively impacted by rising wages given the labor intensity of its companies, and is the only sector to underperform in each of the last three tightening cycles. Meanwhile, negative forces persist (ongoing apparel malaise, onslaught from disruptors, and risk from the proposed border adjustment tax). On the positive side, the sector is home to many disruptors, consumer confidence is near cycle highs and consumption plays could get a jolt if personal income taxes are cut, which is popularly believed to be part of the next tax reform bill.

What makes the energy sector a solid choice? According to the analysts at Merrill Lynch, the crude oil market will shift from surplus to deficit and the price-to-book ratio for the energy sector is very attractive:

If we are in the later stages of this bull market, fundamentals and valuations typically take a backseat to sentiment and technicals. However with the S&P 500 forward PE ratio at a cycle high of 17.7x in February, 15% above its historical average, and with our year-end target of 2450 for the S&P 500 representing ~3% upside (plus a 2% dividend yield), we believe that playing the market internals may generate more alpha than simply buying or selling US equities.

Bullish oil: Global oil production growth has fallen into negative territory in recent months, helping support a rally in brent oil prices from the lows of $28 per barrel last January to a recent high of $57/bbl this January. On our commodity team’s estimates, the global oil market balances will shift from an average surplus of 900,000 barrels per day in the past 3 years to a deficit of 575,000 barrels per day this year.

Weight in index back to last year’s lows: The energy sector’s percent weight in the S&P 500 has fallen to 6.5%, the same level as December 2015, well below the 30-year average of 9.4% and at a level seen only 17% of the time since 1986 … . The ratio of the Energy sector vs the S&P 500 … is near levels seen at the depth of last year’s oil collapse despite a material improvement in global growth and earnings expectations coupled with the “reflation trade” which has seen the 10 year bond yield move up over 110 basis points from the July 2016 low.

Analyst estimates have been trending higher since last year’s collapse in oil prices and while the three-month estimate revision ratio (ERR) fell in February compared to January, Energy remains only one of three sectors in the S&P 500 with more revisions up than down, second only to Financials.

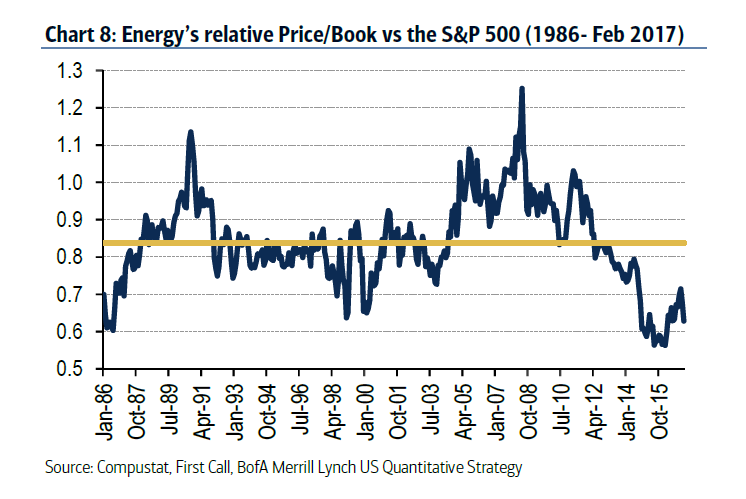

Cheap on Price to Book: The sector remains cheap on a relative price to book basis versus the S&P 500 (see chart below), trading at a 14% discount to its historical average while the S&P 500 trades at a 13% premium. While it remains expensive on a forward price to earnings ratio, the multiple has fallen dramatically as earnings have recovered from last year’s oil collapse, a trend that is likely to continue in our view.

After two decades of reviewing financial products I haven’t seen anything like this. Credit card companies are at war, handing out free rewards and benefits to win the best customers.

A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges.

Our top pick today pays up to 5% cash back, a $200 bonus on top, and $0 annual fee. Click here to apply before they stop offering rewards this generous.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.