Early this month, the broader markets continued their retreats from all-time highs, and volatility seemed to be the name of the game, not only in stocks but the price of oil as well. Plus investors were waiting for the first-quarter earnings reporting season to begin. Judging by the most shorted stocks traded on the Nasdaq, short sellers seemed comfortable overall. Moves in those shorted stocks were mostly positive between the March 31 and April 13 settlement dates.

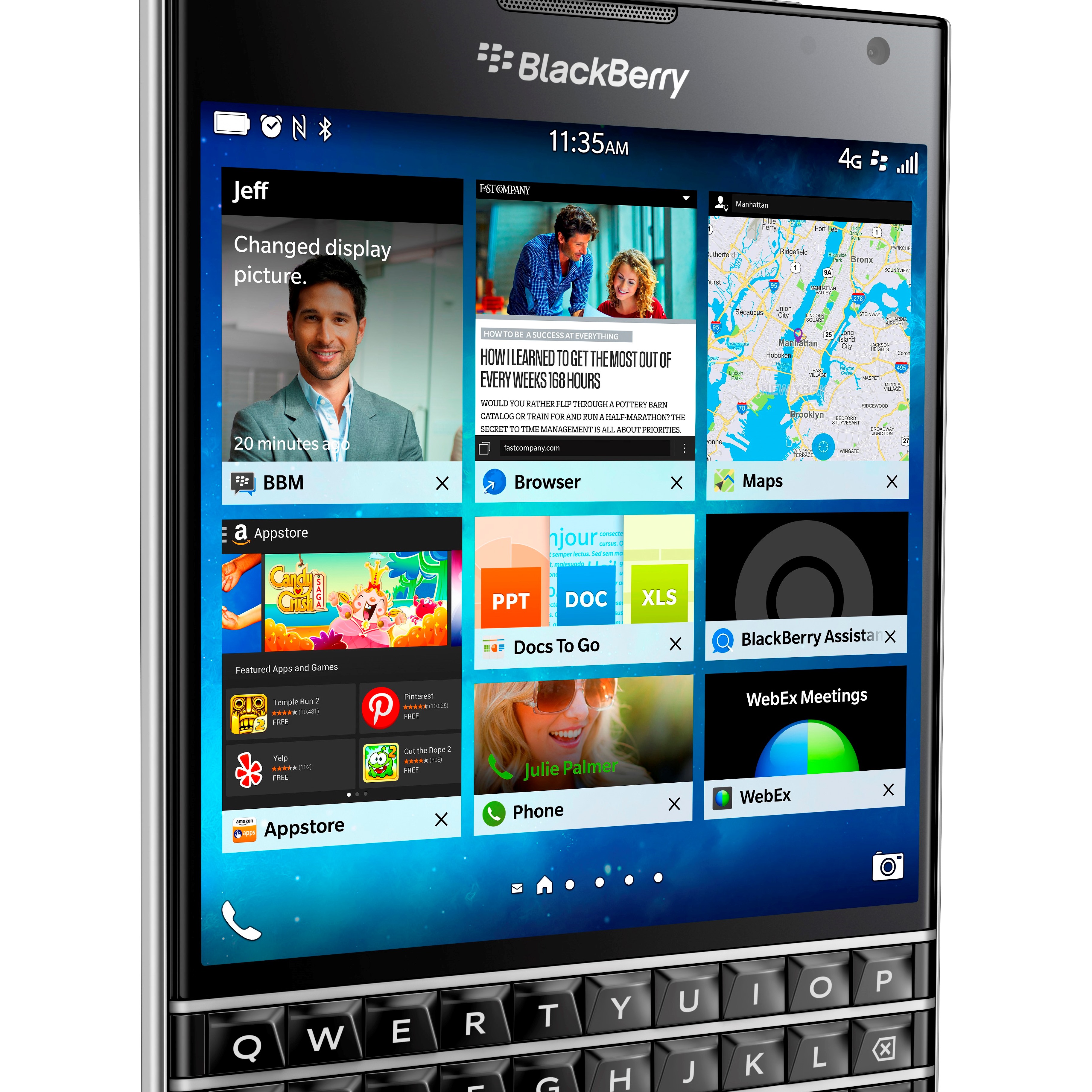

AMD saw one of the most notable gains, while short interest in rival Intel shrank marginally. But it was BlackBerry that led the trend, with double-digit percentage growth in the number of shares short in those two weeks. However, it just missed making the top six.

Note that still only three Nasdaq stocks had more than 100 million shares short, as of the middle of this month. However, two of them remain very far ahead of the pack.

Sirius XM

The more than 266.00 million Sirius XM Holdings Inc. (NASDAQ: SIRI) shares short by mid-April was more than 1% higher than on the previous settlement date. That was only the second period so far this year in which the number of shares short grew, and it was 17.2% of the total float. At the most recent average daily volume, it would take more than 13 days to cover all short positions.

JPMorgan downgraded Sirius, but that was after the short interest period. The stock ended the first two weeks of the month less than 1% lower, while the Nasdaq retreated almost 2% between the settlement dates. After hitting a 52-week high of $5.53 last month, the stock closed om Tuesday at $5.20 a share. The 52-week low of $3.74 was seen last summer.

Frontier Communications

After pulled back almost 8% in the previous period, the number of shares short in Frontier Communications Corp. (NASDAQ: FTR) rose around 2% to almost 257.30 million as of the most recent settlement date. That was 22.1% of the telecom’s float, as well as the 16th consecutive period with more than 200 million shares short. The daily average volume dropped sharply, and the days to cover jumped from around three to about seven.

Concerns about whether Frontier can maintain its dividend have held the stock back recently. The share price was down more than 9% by the middle of this month. The stock has fallen further since then, and it hit a 52-week low of $1.84 last week. The 52-week high of $5.70 was seen about a year ago. The shares closed most recently at $1.96 apiece.

AMD

By the middle of April, Advanced Micro Devices Inc. (NASDAQ: AMD) had almost 119.42 million shares short. That was a gain of more than 7% from the total on the previous settlement date, and it represented 14.4% of the company’s float. Note that short interest has grown in seven of the past nine periods. And it still would take less than two days to cover all short positions.

During the period, Goldman Sachs predicted the stock would underperform, and the April 13 share price was more than 15% lower than on the previous settlement date. The stock has reclaimed some of that ground since and closed at $13.49 on Tuesday, about 19% higher year to date. Shares have changed hands at between $3.18 and $15.55 in the past year.

Intel

More than 92.28 million Intel Corp. (NASDAQ: INTC) shares were sold short as of the most recent settlement date. Short interest fell about 1% during the period to total 2.0% of the company’s float. Note that it was still the second greatest number of shares short in at least a year. As of the middle of the month, it would take more than four days to cover all short positions.

Intel saw an analyst upgrade just ahead of the latest short interest period, and its share price ended the two weeks more than 2% lower. It has bounced back a little since and is now up less than 2% since the beginning of the year. The most recent close at $36.87 a share compares to a 52-week trading range of $29.50 and $38.45.

Opko Health

Opko Health Inc.’s (NASDAQ: OPK) short interest of more than 74.98 million shares on the most recent settlement date was up less than 2% from the previous period. And it was 22.4% of the total float, as well as the sixth consecutive period with more than 70 million shares short. The daily average volume retreated to about half of what it was in mid-March, so the days to cover rose to a year-to-date high more than 20.

For well more than a year, the CEO frequently has bought batches of Opko shares. The stock closed most recently at $7.83 a share, in a 52-week trading range of $7.11 to $12.15. The share price ended the two-week short-interest period more than 4% lower, most of that drop coming in the first couple of days of the month. The stock is now down almost 16% since the beginning of the year.

Synergy Pharmaceuticals

Short interest at Synergy Pharmaceuticals Inc. (NASDAQ: SGYP) totaled more than 65.10 million shares on April 13, or up almost 5% from the prior settlement date. That was by far the highest level of short interest in at least a year, and it was a whopping 30.2% of the total float. The days to cover slipped from less than eight to more than nine during the period.

This biopharmaceutical company is focused on treatments for constipation and irritable bowel syndrome. Short sellers watched the stock sink more than 12% but the recover most of that ground during those two weeks. The most recent closing share price was $4.21, which is down almost 31% from the beginning of the year. The 52-week trading range is $2.62 to $7.15.

And Others

Rounding out the top 10 were BlackBerry Ltd. (NASDAQ: BBRY), Novavax Inc. (NASDAQ: NVAX), Yahoo! Inc. (NASDAQ: YHOO) and Comcast Corp. (NASDAQ: CMCSA). BlackBerry was the standout in this group, with a double-digit percentage rise in the number of its shares short in those two weeks. On the other hand, short interest in Novavax and Comcast was essentially flat.

Lingered just beyond the top 10 most shorted Nasdaq stocks, Apple Inc. (NASDAQ: AAPL) and Micron Technology Inc. (NASDAQ: MU) saw little change in the period. Microsoft Corp. (NASDAQ: MSFT) and Groupon Inc. (NASDAQ: GRPN) were there too, just outside the spotlight of the top 10.

Optical components maker Oclaro Inc. (NASDAQ: OCLR) continued its run toward the top 10 and could be there soon if short sellers keep piling on.

Cash Back Credit Cards Have Never Been This Good

Credit card companies are at war, handing out free rewards and benefits to win the best customers. A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges. See our top picks for the best credit cards today. You won’t want to miss some of these offers.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.