Investing

Where Merrill Lynch Sees AI and Robot Stocks Going From Here

Published:

Last Updated:

This past week, Merrill Lynch announced a few thematic investing ideas in its “A Transforming World” (ATW) report. As part of its work on ATW, the brokerage firm identified a few categories that stand to see the most change and what investors should look for in each. A few of the main ideas included: millennials, cybersecurity, and mobility.

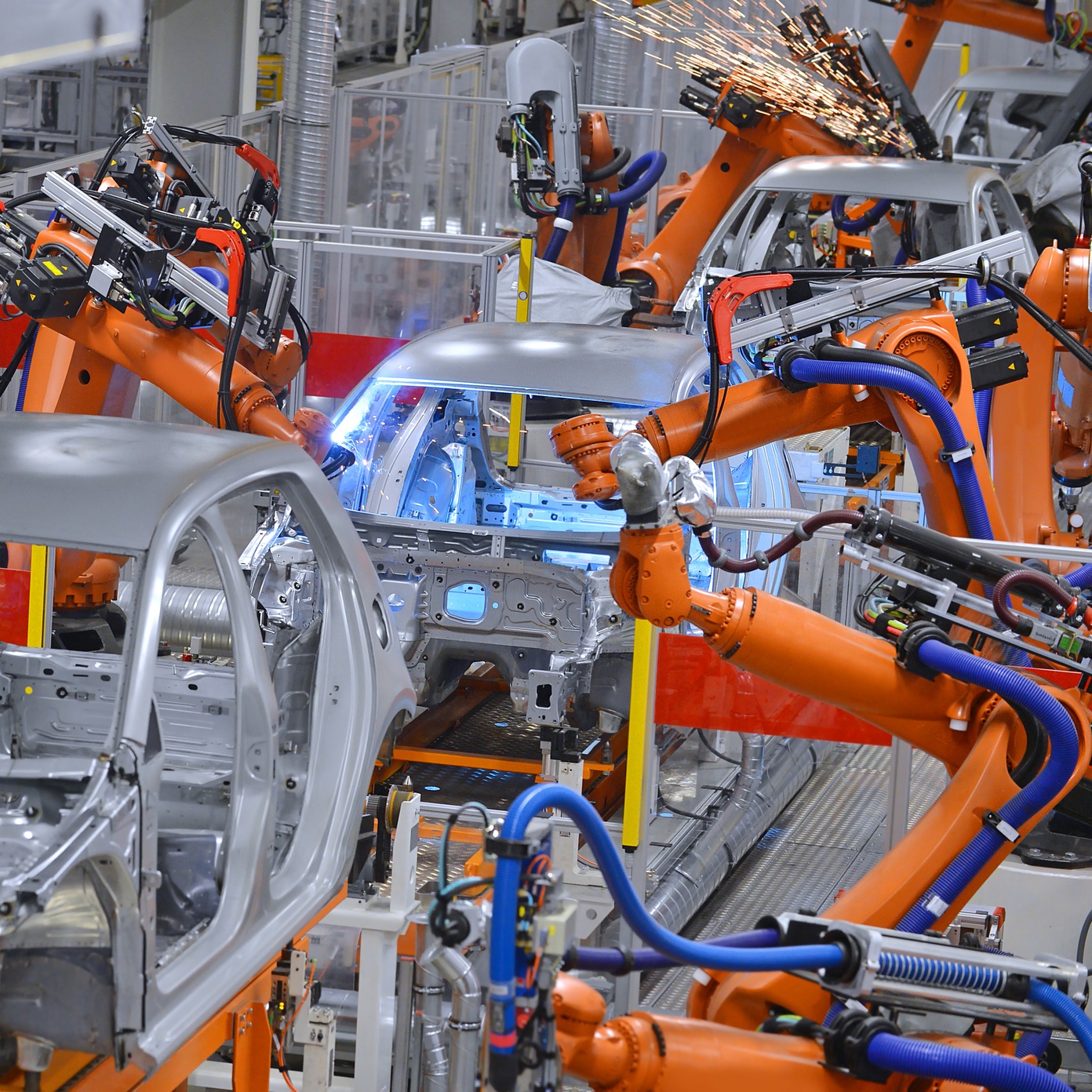

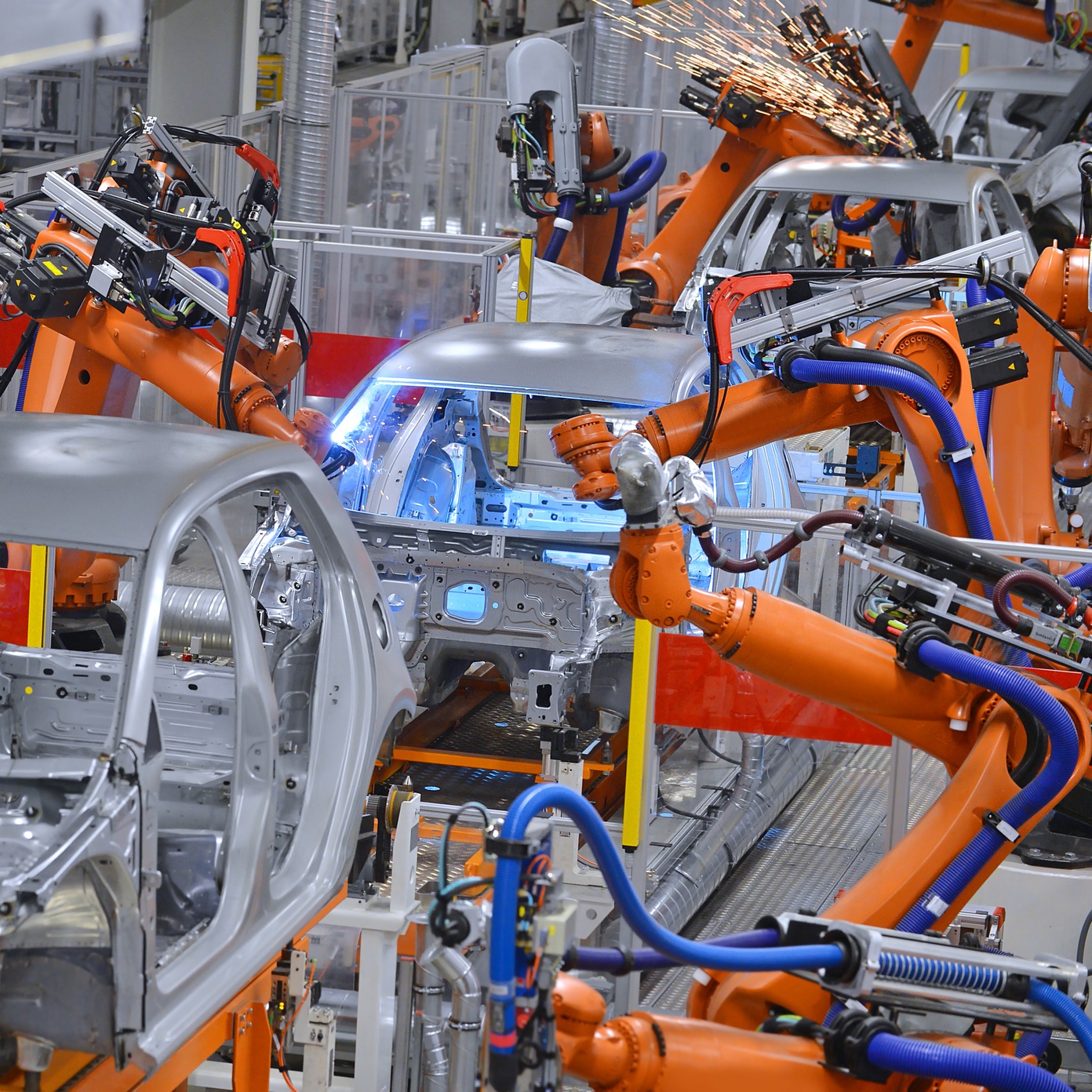

Here we’re looking closely at robots and artificial intelligence (AI), and how these could play a huge role in the future. Already, robots and AI are becoming an integral part of our daily lives as providers of labor, mobility, safety, convenience and entertainment.

Right now, humans are facing a paradigm shift that undoubtedly will change the way we live and work. Merrill Lynch anticipates the greatest potential challenges arising from its ATW theme of People, notably the possible displacement of human labor (with 47% of U.S. jobs having the potential to be automated) and growth in inequality (with an estimated 10% supply and demand gap between skilled and nonskilled workers by 2020). The brokerage firm also anticipates issues around cybersecurity (an estimated 50 billion connected devices by 2020), privacy and longer-term existential threats being posed by AI.

Merrill Lynch first looked back to 2014, which marked the third consecutive year for record sales of robots worldwide (229,000, up 29% year over year). The Internet of Things, big data, cloud computing and 3D printing have meant exponential advancements in the space, while global structural drivers, such as demographics, energy efficiency, productivity, urbanization and wage inflation suggest long-term sustained growth. Merrill Lynch expects that robots likely will be performing 45% of manufacturing tasks by 2025, compared with 10% today.

The firm went on to put some numbers behind its conjectures:

We estimate the robots and AI solutions market will grow to $153 billion by 2020E, comprising $83 billion for robot and robotics, and $70 billion for AI-based analytics. We anticipate $14 trillion – $33 trillion in annual creative disruption impact in 10 years, including $8 trillion – $9 trillion of cost reductions across manufacturing and healthcare, $9 trillion cuts in employment costs via AI-enabled automation of knowledge work and $1.9 trillion in efficiency gains via autonomous cars and drones. Adoption of robots and AI could boost productivity by 30% in many industries, while cutting manufacturing labour costs by 18%-33%.

The firm has identified eight entry points for investors who want to play the robots and AI theme (with some examples for each):

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.