Stocks markets sold off after Gary Cohn, the head of the National Economic Council, quit the Trump administration.

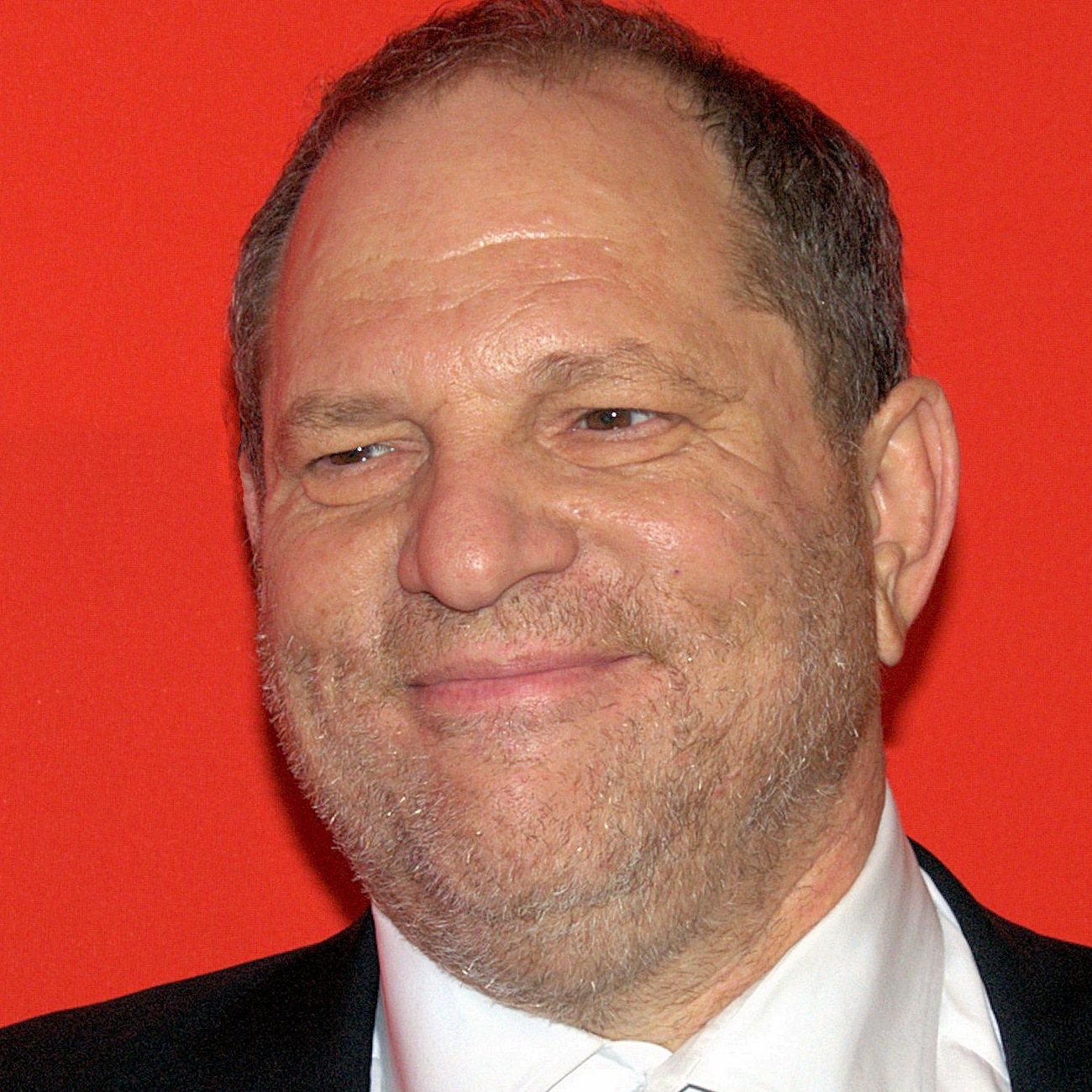

A group of investors killed a deal to buy the Weinstein Company for the second time. According to The Wall Street Journal:

Weinstein Co. once again appeared headed toward a bankruptcy filing Tuesday after its would-be buyer said it was withdrawing from a deal.

A buyers’ group organized by investor Ron Burkle and publicly led by businesswoman Maria Contreras-Sweet said it called off a deal for most of the beleaguered film and TV studio’s assets less than a week after saying it would buy them by assuming $225 million of debt. The group also planned to invest $275 million to relaunch Weinstein Co. with a new name.

“We have received disappointing information about the viability of completing this transaction,” Ms. Contreras-Sweet said in a statement. A person familiar with the group said it had found about $65 million of additional liabilities.

BlackBerry Ltd. (NYSE: BB) has brought patent lawsuits against several companies. According to The Wall Street Journal:

BlackBerry Ltd. claimed in a lawsuit Tuesday that Facebook Inc. FB -0.34% and its WhatsApp and Instagram units have infringed its patents and swiped intellectual property from its BlackBerry Messenger technology.

In its 117-page court filing in U.S. federal court in Los Angeles, BlackBerry says the defendants “created mobile messaging applications that co-opt BlackBerry’s innovations, using a number of the innovative security, user interface, and functionality enhancing features that made BlackBerry’s products such a critical and commercial success in the first place.”

The suit alleges the defendants improperly used BlackBerry’s intellectual property that streamlines notifications to “prevent users from being inundated,” as well as the display of time stamps on messages and the tagging of friends and family in social-media photographs.

Oprah Winfrey sold some of her shares in Weight Watchers International Inc. (NYSE: WTW), a company for which she is the primary spokesperson. According to Bloomberg:

Oprah Winfrey has sold part of her holdings in Weight Watchers International Inc. as part of a portfolio diversification and donated some shares to her foundation engaged in philanthropy.

The media mogul continues to be a significant shareholder of the New York-based weight-loss company as well as a board member, adviser and ambassador, according to the statement distributed by PR Newswire Tuesday. She won’t sell additional shares this year.

Amazon.com Inc. (NASDAQ: AMZN) invested in smart thermostat company Ecobee. According to CNBC:

Smart thermostat maker Ecobee raised around $62 million (C$80 million) in a series C round of funding from investors including the Amazon Alexa Fund, the company told CNBC.

The deal comes just one week after Amazon acquired video doorbellmaker Ring in a deal reportedly valued at $1 billion. Amazon consequently made plans to stop selling competing products made by Google-owned Nest.

Regulators have blocked a deal for Broadcom Ltd. (NASDAQ: AVGO) to buy Qualcomm Inc. (NASDAQ: QCOM), at least for the time being. According to CNNMoney:

American regulators have held up Broadcom’s hostile takeover of Qualcomm over concerns the deal could harm national security. Now, we know why.

The Committee on Foreign Investment in the United States laid out some of its concerns in a letter to Broadcom and Qualcomm dated Monday. Qualcomm made the letter public Tuesday.

The memo provides rare insight into the thinking of the notoriously secretive inter-agency body, which is chaired by the Treasury Department and vets deals that could give a foreign investor control of a US business.

In 20 Years, I Haven’t Seen A Cash Back Card This Good

After two decades of reviewing financial products I haven’t seen anything like this. Credit card companies are at war, handing out free rewards and benefits to win the best customers.

A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges.

Our top pick today pays up to 5% cash back, a $200 bonus on top, and $0 annual fee. Click here to apply before they stop offering rewards this generous.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.