Investing

Apple: Street Underestimating Timing & Impact of Net Cash Neutral

Published:

Last Updated:

By Gene Munster of Loup Ventures

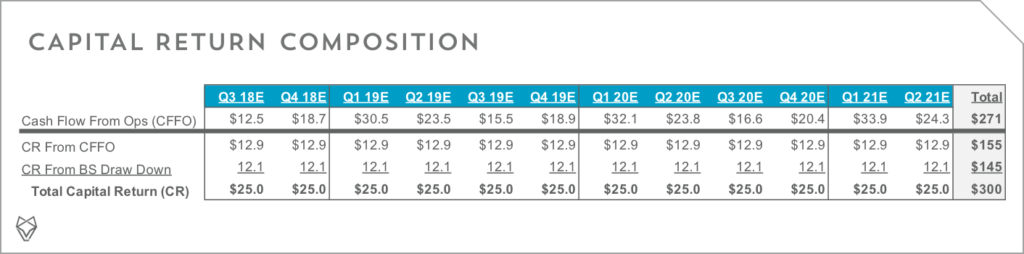

Apple net cash neutral by FY21. Tim Cook said on the Mar-18 earnings call that Apple will be net cash neutral “over time,” but stopped short of specifying a timeline. Over the next 12 quarters, we expect Apple to return $300B to shareholders and to be net cash neutral by the end of the Mar-21 quarter. This would more than double the current pace of capital returns. Apple has distributed $234B over the previous 6 years. As shown in the table below, we expect Apple to maintain, through the Mar-21 quarter, a capital return pace consistent with the just reported Mar-18 pace of $26.8B per quarter ($23.5B buybacks and $3.3B in dividends). This would be made up of about $21B to $22B in share buybacks and cash paid for dividends of $3.4B to $3.7B quarterly. We’re modeling for dividends to increase by 5% each year, in line with the percentage increase in FY17.

Our 3-year expectation is reasonable. While our timeline to net cash neutral may sound aggressive, we believe it is realistic given the amount of cash the company generates from operations alone, as well as the need to draw down the balance sheet an additional $145B to make good on their net cash neutral goal. As shown in the table below, we are assuming capital returned from balance sheet draw down will remain relatively constant at $12.1B per quarter, while the remaining $12.9B will be generated by cash flow from operations. Even after returning this capital, the company will have an additional $6B to $12B quarterly in cash from operations that will be used for content, M&A, vertical integrations, updating there current 499 retail stores (remodeled roughly once every 5 years), and building out new campuses across the U.S.

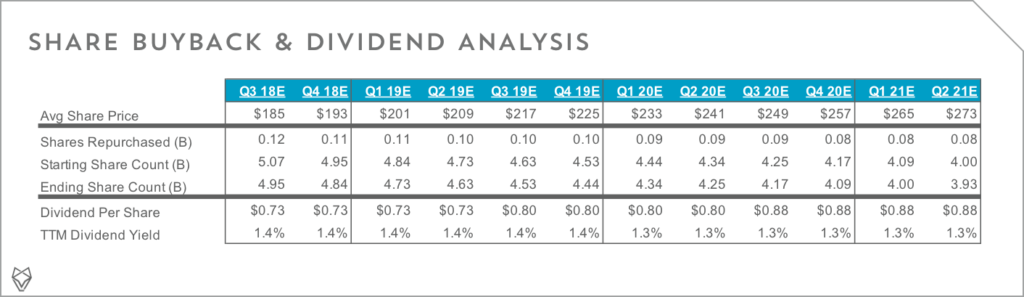

The buyback math that inches AAPL higher. We believe the buyback alone could move shares of AAPL higher by 24% over the next 3 years. This is based on 4 assumptions that would reduce share count by 24%, and raise EPS by a similar amount.

The party can continue beyond 3 years. After a 3-year period, capital distribution levels will normalize, going from about $100B a year to about $50B+. We anticipate Apple to maintain it’s net cash neutral approach into perpetuity. To do this, the company will need to return $50B+ each year, with 85% coming in the form of buybacks. This would still leave the company with about $6B in additional cash per quarter to invest in areas of the business outlined above.

Disclaimer: We actively write about the themes in which we invest: virtual reality, augmented reality, artificial intelligence, and robotics. From time to time, we will write about companies that are in our portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making investment decisions. We hold no obligation to update any of our projections. We express no warranties about any estimates or opinions we make.

Retirement planning doesn’t have to feel overwhelming. The key is finding professional guidance—and we’ve made it easier than ever for you to connect with the right financial advisor for your unique needs.

Here’s how it works:

1️ Answer a Few Simple Questions

Tell us a bit about your goals and preferences—it only takes a few minutes!

2️ Get Your Top Advisor Matches

This tool matches you with qualified advisors who specialize in helping people like you achieve financial success.

3️ Choose Your Best Fit

Review their profiles, schedule an introductory meeting, and select the advisor who feels right for you.

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.