Investing

How the Top 10 US Companies Rank in the $1 Trillion Market Cap Race

Published:

Last Updated:

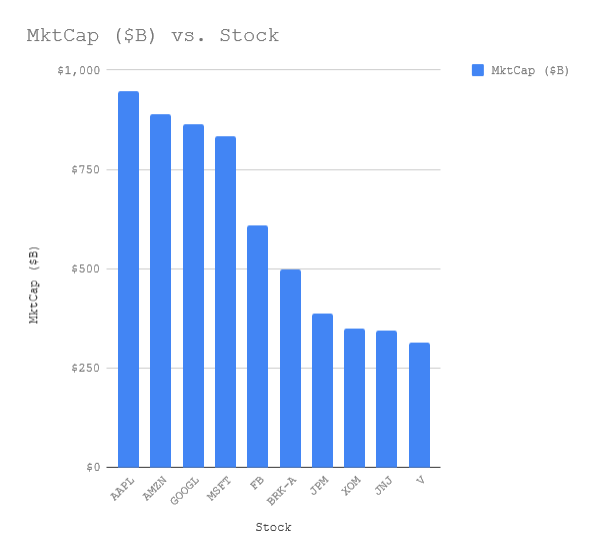

The quest for a U.S. company to reach $1 trillion in market capitalization continues. As of July 24, 2018, Apple was leading the charge to the $1 trillion market cap at $948 billion. What is amazing is that three other technology giants (Amazon, Alphabet and Microsoft) are all within striking distance of that $1 trillion market cap.

Note that no company has ever had a $1 trillion market cap. This is also at a time when the U.S. gross domestic product is almost $20 trillion.

24/7 Wall St. has reviewed the 10 highest valued U.S.-based companies based on market cap. After the four mentioned above, there is Facebook, Berkshire Hathaway, JPMorgan, Exxon Mobil, Johnson & Johnson and Visa. Unfortunately for the companies not in the top four, the difference in size is massive.

Here are the top 10 U.S. companies based on market capitalization and how their stock performance has been in 2018. We have already discussed how stock buybacks could interfere with the $1 trillion race. Only two of the top 10 U.S. companies were trading down so far in 2018, and six of them are members of the Dow Jones industrial average.

Apple Inc. (NASDAQ: AAPL) was at $948 billion, and shares were last seen up 13% so far in 2018.

Amazon.com Inc. (NASDAQ: AMZN) was at $890 billion, and shares were up 54% so far this year.

Alphabet Inc. (NASDAQ: GOOGL) was at $863 billion, and shares were up 15%.

Microsoft Corp. (NASDAQ: MSFT) was last seen at $833 billion, and shares were up 26%.

Facebook Inc. (NASDAQ: FB) was at $610 billion, and shares were up 20%.

Berkshire Hathaway Inc. (NYSE: BRK-A) was last seen at $499 billion, and shares were up only about 1% so far in 2018.

JPMorgan Chase & Co. (NYSE: JPM) was at $387 billion, and shares were up 6%.

Exxon Mobil Corp. (NYSE: XOM) was at $349 billion, and the oil giant’s shares were down by almost 3%.

Johnson & Johnson (NYSE: JNJ) was at $345 billion, and shares had a negative performance of almost 9% year to date.

Visa Inc. (NYSE: V) was last seen with a market cap of $313 billion, and shares were up about 23%.

Please note that every quote system may have slight variations for exact market capitalization rates, annual performance and other metrics using live and near-live data.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.