When International Business Machines Corp. (NYSE: IBM) announced its $34 billion acquisition of Red Hat Inc. (NYSE: RHT), investors were not quite sure what to make of it. Yes, it was expensive, but shares opened down nearly 5% Monday after the weekend announcement. Shortly thereafter the shares gained most of that dip back before trailing lower to close just 30 cents higher than at the opening bell.

By Wednesday the stock had dropped to a new 52-week low. For the week, shares lost 7.3% and Big Blue’s stock ended up ranked as the Dow index’s worst performer for the year to date.

So what didn’t investors like about the deal? Let us count the ways.

First, the $34 billion price tag valued Red Hat at more than 50 times forward earnings and about 10 times expected sales. That 10x sales valuation is roughly double what a software firm normally sells for. Investors were pretty sure that IBM overpaid for Red Hat.

Second, the cloud train left the station long ago and IBM missed it. At the end of last year, research firm Gartner gave Amazon Web Server (AWS) 52% of the cloud computing market while IDC had AWS with a 46% share. IBM’s share according to Gartner was 2%, an also-ran behind Microsoft, Alibaba, and Google. IDC put IBM’s share a bit higher at 6%.

But the catch here is that about half of Red Hat’s sales are made to customers who own and manage their own on-location servers. Red Hat does have a cloud business, but it’s not exactly leading the charge to the cloud.

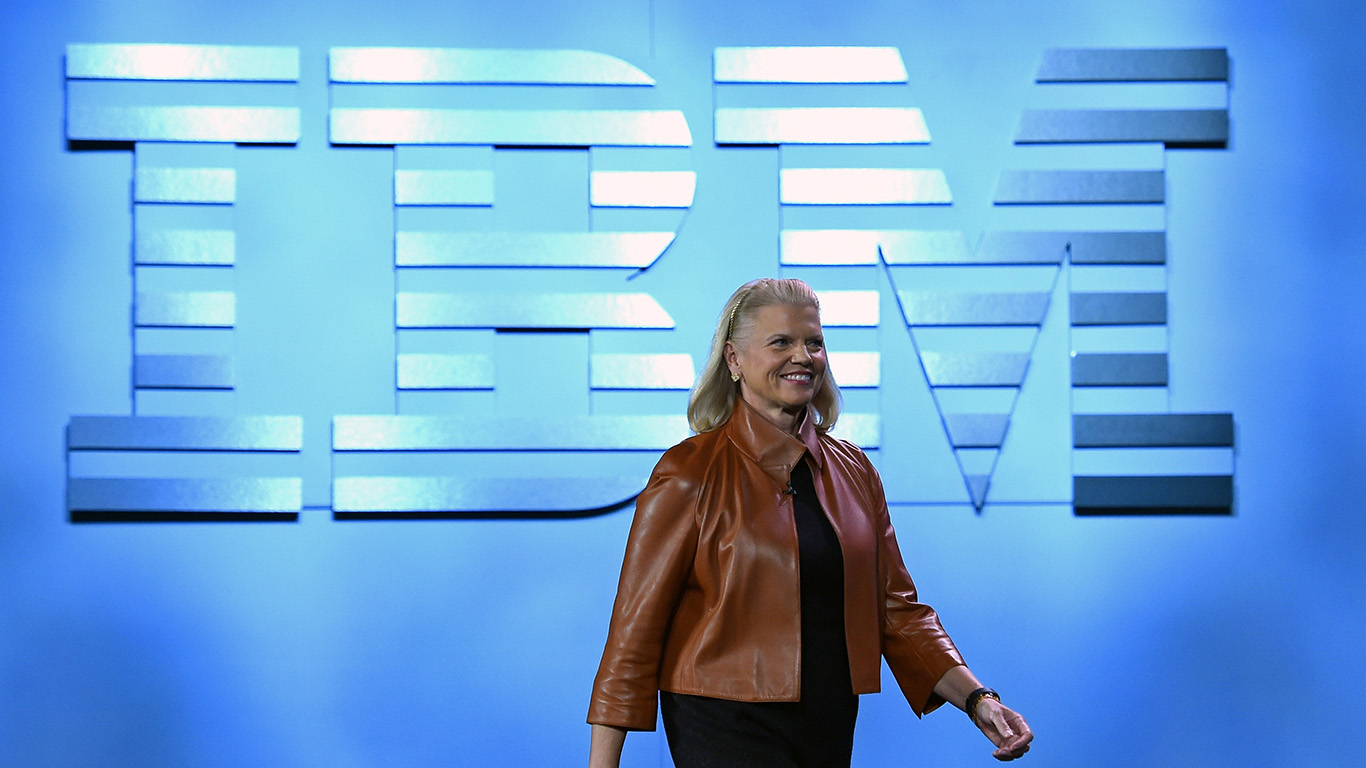

Third, IBM’s rationale sounded corny. Here’s CEO Ginni Rometty from the announcement:

The acquisition of Red Hat is a game-changer. It changes everything about the cloud market. IBM will become the world’s #1 hybrid cloud provider, offering companies the only open cloud solution that will unlock the full value of the cloud for their businesses.

The acquisition is a game-changer–for Red Hat but for IBM, perhaps not so much. What is a hybrid cloud provider? Our guess is that it’s a term used to describe a company that has a big server business and is trying to migrate that to the cloud without having to give up selling high-dollar hardware.

IBM does not want to cannibalize its server business and make a bet-the-company wager on cloud computing. Two or three years ago it wouldn’t have had to, but things have changed and unless the company did something dramatic, it risked being even further marginalized.

Add it all up and it smacks of being a desperation play by Rometty who has presided over a share price loss of more than a third since she took over nearly seven years ago. Watson, the company’s artificial intelligence platform, has not been an unqualified success, so now IBM moves on to the hybrid cloud. The buzzwords may change, but the results, in this case, are likely to be the same.

In 20 Years, I Haven’t Seen A Cash Back Card This Good

After two decades of reviewing financial products I haven’t seen anything like this. Credit card companies are at war, handing out free rewards and benefits to win the best customers.

A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges.

Our top pick today pays up to 5% cash back, a $200 bonus on top, and $0 annual fee. Click here to apply before they stop offering rewards this generous.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.