By Gene Munster and Will Thompson of Loup Ventures

We think about Apple less as a device maker and more as a company that maintains a large user base with a combination of hardware and software services. To put a finer point on it, we estimate there are 850 million active Apple users worldwide using 1.3 billion devices. The value of Apple’s ecosystem is greater than the sum of its individual products, given the ecosystem provides revenue visibility through customer loyalty and opportunities to cross-sell and increase prices. It will take a year or more for investors to adjust their perspective, but we believe investor adoption of this view is a function of time.

This note is our first step in measuring the strength of the Apple ecosystem. In an effort to do so, we surveyed 300 consumers in the US about their device ownership (smartphone, laptop, smartwatch, streaming device, smart speaker, and Bluetooth headphones). Among those surveyed, 130 were iPhone users and 154 were Android users. Here are a few key takeaways:

- iPhone owners are generally loyal to Apple, owning devices from an average of 2.2 different manufacturers. One of those two, of course, is Apple.

- Android users are less loyal, owning devices from an average of 4.2 manufacturers.

- Said another way, Apple users are 2x more loyal than Android users.

Loyalty is the output of a successful ecosystem. Our reasoning for placing a high value on Apple’s ecosystem is predicated on its stickiness, or its ability to retain users. In our survey:

- 78% of iPhone users own at least one other Apple device.

- The average iPhone user owns 2.8 Apple devices and 3.2 devices overall.

- In comparison, the average Android user owns 3.0 non-Apple devices and 3.4 devices overall.

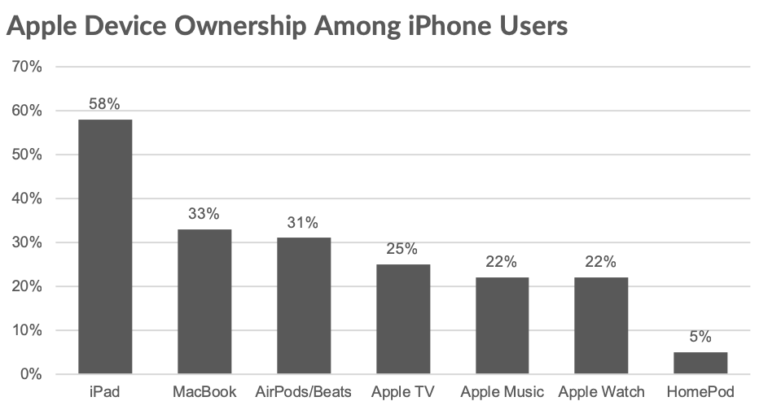

Below is a breakdown of Apple device ownership among iPhone users. Multi-device ownership is important because the more devices a user has, the more likely they are to pay for software services, another critical element of evaluating the ecosystem’s strength. iPad’s are the most common second device for iPhone owners.

When comparing Apple and Android users, overall device ownership is surprisingly similar, but the market for other devices is more fragmented, so loyalty is hardly an option.

Android users are still drawn to Apple devices, as 26% of those surveyed owned at least one Apple device with an average of 0.4 Apple devices per Android user. These devices, mostly iPads, MacBooks and headphones, could serve as future entry points to the ecosystem.

A Baseline To Measure Loyalty

In the future, we will continue to survey for customer loyalty. We believe this will give us insight into the long-term health of the company.

Disclaimer: We actively write about the themes in which we invest or may invest: virtual reality, augmented reality, artificial intelligence, and robotics. From time to time, we may write about companies that are in our portfolio. As managers of the portfolio, we may earn carried interest, management fees or other compensation from such portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Get started right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.