By Andrew Murphy of Loup Ventures

On June 16, 2017, at 9:01 am ET, Amazon announced its agreement to acquire Whole Foods Market for $13.7B. Four minutes later, Walmart announced its agreement to acquire online brand Bonobos for $310M.

While the announcements were coincidental, the strategies are not. Amazon is growing its physical retail business to better compete with Walmart; Walmart is growing its online retail business to better compete with Amazon. We believe a retail duopoly is emerging.

We’ve seen a steady cadence of news as Walmart has grown its online retail portfolio, which grew larger [Thursday] with the addition of Art.com. Similarly, it seems like nearly every day comes more news of Amazon extending its reach into physical retail.

Amazon’s Physical Retail Presence

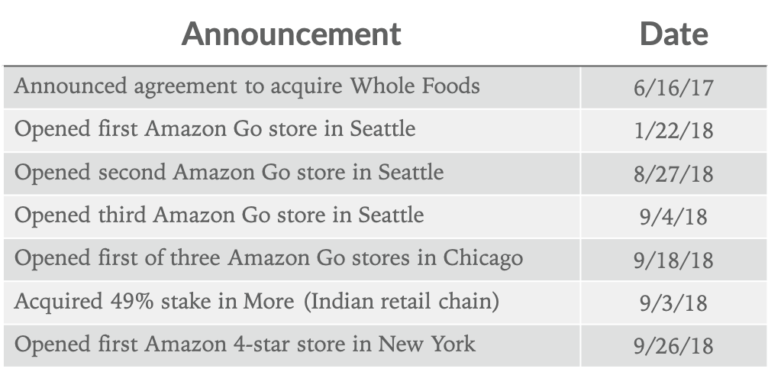

For reference, here’s a select list of Amazon announcements related to physical retail in the last few years:

Amazon now operates 107 of its own physical retail stores (including Amazon Go, Amazon 4-star, Amazon Pop-Up, and Amazon Books), plus another ~500 Whole Foods Market stores. Just recently, Bloomberg reported that Amazon has plans to build up to 3,000 cashier-less stores by 2021. But even an ambitious growth plan leaves Amazon well short of Walmart when it comes to physical retail. While Amazon’s total footprint of ~600 retail stores may be surprising, Walmart dwarfs Amazon’s footprint with more than 11,200 stores globally.

Walmart’s Online Retail Presence

Meanwhile, Walmart has been just as aggressive in its effort to expand its online retail capabilities. Here’s a select list of Walmart announcements related to online retail in the last few years:

Walmart’s announcement of the Art.com acquisition is instructive: Adding Art.com to our Palette. The company is aggressively building a quickly growing portfolio of online brands. And yet, Walmart’s online retail business was just $11.5B in 2017, expected to grow 40% to $16b in 2018. For comparison, Wall Street consensus calls for Amazon revenue of $235B in 2018.

A few related insights

Bottom line: Amazon is way behind Walmart in physical retail and needs to continue making big bets to catch up; Walmart is way behind Amazon in online retail and needs to continue to acquire large online retailers to catch up.

Our prediction that Amazon would acquire Target in 2018 was wrong. We continue to believe the combination makes sense, however, because Amazon needs to acquire Target-like footprints (1,800 stores) in order to continue its growing retail presence.

Amazon’s core retail competency lies in logistics (not merchandising). The Amazon Go initiative, for example, works so well because it leverages logistics in physical retail. Amazon Go is a convenient, self-service “warehouse” for items you know you need. But to build most other physical retail — stores where people love to discover new items — requires a completely different competency: merchandising, curation, details, space, and experience. Amazon isn’t great at product design (cf. Amazon Fire Phone, and even amazon.com or the Echo lineup), and retail stores are products. Perhaps this is why The New York Times review of the Amazon 4-star store was so critical: “It is grim. A permanent store with the harried, colorless mood of a hastily assembled clearance-sale pop-up. Lot-Less Closeouts stores have more vim and charm.”

Disclaimer: We actively write about the themes in which we invest or may invest: virtual reality, augmented reality, artificial intelligence, and robotics. From time to time, we may write about companies that are in our portfolio. As managers of the portfolio, we may earn carried interest, management fees or other compensation from such portfolio. Content on this site including opinions on specific themes in technology, market estimates, and estimates and commentary regarding publicly traded or private companies is not intended for use in making any investment decisions and provided solely for informational purposes. We hold no obligation to update any of our projections and the content on this site should not be relied upon. We express no warranties about any estimates or opinions we make.

100 Million Americans Are Missing This Crucial Retirement Tool

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.