Investing

Forget China, 10 Big Stocks Analysts Want You to Buy Now

Published:

Last Updated:

The week of May 17, 2019, started out as though the China trade tariffs and tit-for-tat retaliation was going to kill the strong economy and the 10-year bull market once and for all. That turned out to not be the case, and the drop in the major indexes ended up being far less than painful. Some companies even managed to see their shares surge. They rallied either on strong earnings or they could point to corporate news and other outside forces, and some companies have proven that they have little to no real threat from China at all in their daily decision-making on running the company.

With the worries of “sell in May and go away” coming right at the same time the stock market is close to all-time highs, many investors are looking at new ideas and at new companies and sectors as a place to hide out in for the summer and maybe even the rest of 2019. Many great ideas may come from analyst research reports and other group forecasts. 24/7 Wall St. reviews dozens of analyst calls every morning, and that makes for hundreds of analyst reports each week. Some of these stock and sector picks are stocks to buy, and some are stocks to sell or avoid.

After a review of the analyst calls for the week of May 17, 10 stocks stood out. They either have large market caps or are well known to the public, and Wall Street analysts have Buy or Outperform ratings and see big upside. Traditionally at this stage of the bull market, total return potential is 8% to 10% in Dow Jones industrials and S&P 500 stocks. Some of the following picks have far higher implied upside.

24/7 Wall St. has added color on each analyst call and included where the stocks have been and the implied upside, and we have even included trading color and how the calls generally compare to the Refinitiv analyst price targets. It is important to understand that there is no free lunch when it comes to investing. That means any analyst call that sounds enticing or looks promising should be a starting point of research and investment decision-making rather than a conclusion.

Here are 10 analyst calls with strong implied upside from the week of May 17, 2019.

Chevron Corp. (NYSE: CVX) was added to the Americas Conviction Buy list at Goldman Sachs on May 15, and the firm’s $144 price implied a total return of 24% for the oil giant at the time. While oil stocks are stuck in a range right now, the firm noted that it supports Chevron’s capital discipline to walk away from acquiring Anadarko as it will collect a $1 billion breakup fee and also will increase its own share repurchases. On May 16, Morgan Stanley maintained its Overweight rating and lowered its target price to $149 from $150.

Chevron shares closed down 0.2% at $120.52 on Friday. The consensus target price is $140.18, and the 52-week trading range is $100.22 to $130.39.

Cincinnati Financial Corp. (NASDAQ: CINF) was raised to Outperform from Neutral and the price target was raised to $110 from $90 at Credit Suisse on May 17. Credit Suisse raised its estimates above consensus because the reserve release likely will exceed expectation, and the firm noted its ability to cherry pick the best risks and that $450 million of capital will be freed up in the coming years.

Cincinnati Financial closed up 0.7% at $97.15 a share ahead of the call, and it has a consensus analyst target of $88.31. It is a member of the 50-year dividend hike club, along with 10 other companies, and the stock closed up by 0.6% at $97.73 on Friday with a consensus target price of $88.31.

Foot Locker Inc. (NYSE: FL) was raised to Buy from Neutral and the target price was raised to $73 from $62 (versus a $55.47 prior close) at B. Riley FBR on May 17. The call cited improving sales trends in its footwear business and a lower effort around discounts and promotions.

Foot Locker’s shares closed down 0.5% at $55.20 on Friday. The consensus analyst target is close to $72, and the 52-week trading range is $43.34 to $68.00. It also has better than a 2.5% dividend yield. This represents a total return opportunity of close to 35% if the firm’s call is proven true.

Johnson & Johnson (NYSE: JNJ) was reiterated as Outperform and the price target was raised to $156 from $152 at Credit Suisse on May 16. The firm’s call came after the Annual Business Review encouraged the perspective on key marketed and pipeline products and the company’s overall bullish commentary pointed to pharmaceutical segment sales alone reaching $50 billion by 2023.

Johnson & Johnson is a dividend-hiking monster that has managed to churn out returns over time. Its shares closed up 0.3% at $138.61 on Friday, in a 52-week high of $148.99 and with a consensus target price of $148.12.

Owens-Illinois Inc. (NYSE: OI) was raised to Outperform from Market Perform and the price target was raised to $24 from $20 (versus a $17.21 close) at Wells Fargo on May 15. The firm believes that Owens-Illinois has made the necessary investments to better position itself to capture more share in the glass container business. A stronger balance sheet is also allowing it to redeploy capital with a dividend and share buyback.

Its shares closed out the week at $17.36, after nearly a 1% drop on Friday. The 52-week range is $15.67 to $20.78, and the consensus price target is $20.69. Owens Illinois also was just featured as one of our own 13 dirt cheap value stocks trading under 10 times earnings as well.

Tyson Foods Inc. (NYSE: TSN) saw two analyst upgrades on May 14 for entirely different reasons. Independent research firm Argus raised its rating to Buy from Hold with a $92 price target and cited strong earnings and expectations. The larger impact call was that Credit Suisse upgraded the stock to Outperform from Neutral with a $96 target price. Credit Suisse sees significant upside for Tyson based on the African swine fever outbreak that is causing the forced killing of much of China’s pig population (perhaps as many as 150 million to 200 million pigs), with reports of it in other Asian countries too.

Shares of Tyson Foods closed down 0.3% at $79.59 ahead of the calls and traded up close to $82.50 late on Friday. Just keep in mind that Tyson shares already have risen from $55 earlier in this year to the current levels.

Under Armour Inc. (NYSE: UAA) was one of Friday’s top winners, with a 7.7% gain to $23.58. Its shares are now back close to a 52-week high after JPMorgan raised the athletic apparel maker to Overweight from Neutral and the target price to $29 from $23 on May 17. The firm cited controlled confidence of management and a disciplined approach to 2020 goals with a combination of products, innovation and marketing.

Under Armour had been indicated to open up 3.5% at $22.64 on Friday morning, so the stock opened higher and closed even stronger. The consensus target price is $22.08.

Valero Energy Corp. (NYSE: VLO) was reiterated as Outperform with a $105 price target at Credit Suisse on May 16. The prior closing price was $83.37, and the firm raised its 2019 and 2020 estimates to $7.21 from $5.55 per share and to $10.37 from $9.73 per share, respectively. Valero has a 52-week range of $68.81 to $126.98, and its consensus target price was $106.19.

Valero shares closed down 2% at $83.71 on Friday, and the call foresaw a gain of close to 25% to the price target, plus there is about a 4% dividend yield.

Wayfair Inc. (NYSE: W) was started with a new Buy rating at Jefferies, and the firm’s $192 price target implied upside of nearly 30%. This was well above the $159.36 consensus target price, and well above the 52-week high and all-time high of $173.72. Jefferies was talking up Wayfair’s marketplace and logistics network, increases in non-domestic site traffic share and a solid international trajectory along with more viral social media usage.

The call only created a 1.4% gain in Wayfair’s share price on Friday to a $150.40 close, even though it was just $3 short of being the street-high target price. This still leaves better than 25% implied upside, if the firm is correct.

Zillow Group Inc. (NASDAQ: ZG) had fallen out of favor compared to past glory days, but the market finally is getting over the shock its own home-oriented “offers” business on top of being a top real estate listings search destination. On May 15, Guggenheim upgraded Zillow to Buy from Neutral with a $45 target price (versus a $36.54 close). The call indicates that perhaps a trough has been found, and the stock traded up 2.5% to $39.78 on Friday as the post-earnings analyst call showed that its revenue rose 51%. The 52-week trading range is $26.20 to $65.42.

The Guggenheim call anticipated further upside of 23% at the time, but Friday’s close left an implied upside of closer to 13%. The late-week gain means that Zillow shares may have to be put on a watch list for when or if the market pulls back.

In addition, for value investors looking for a refuge this summer, we noted 13 dirt cheap dividend payers with steady payouts valued at less than 10 times earnings.

Merrill Lynch has five solid stocks to buy with high dividend yields as well.

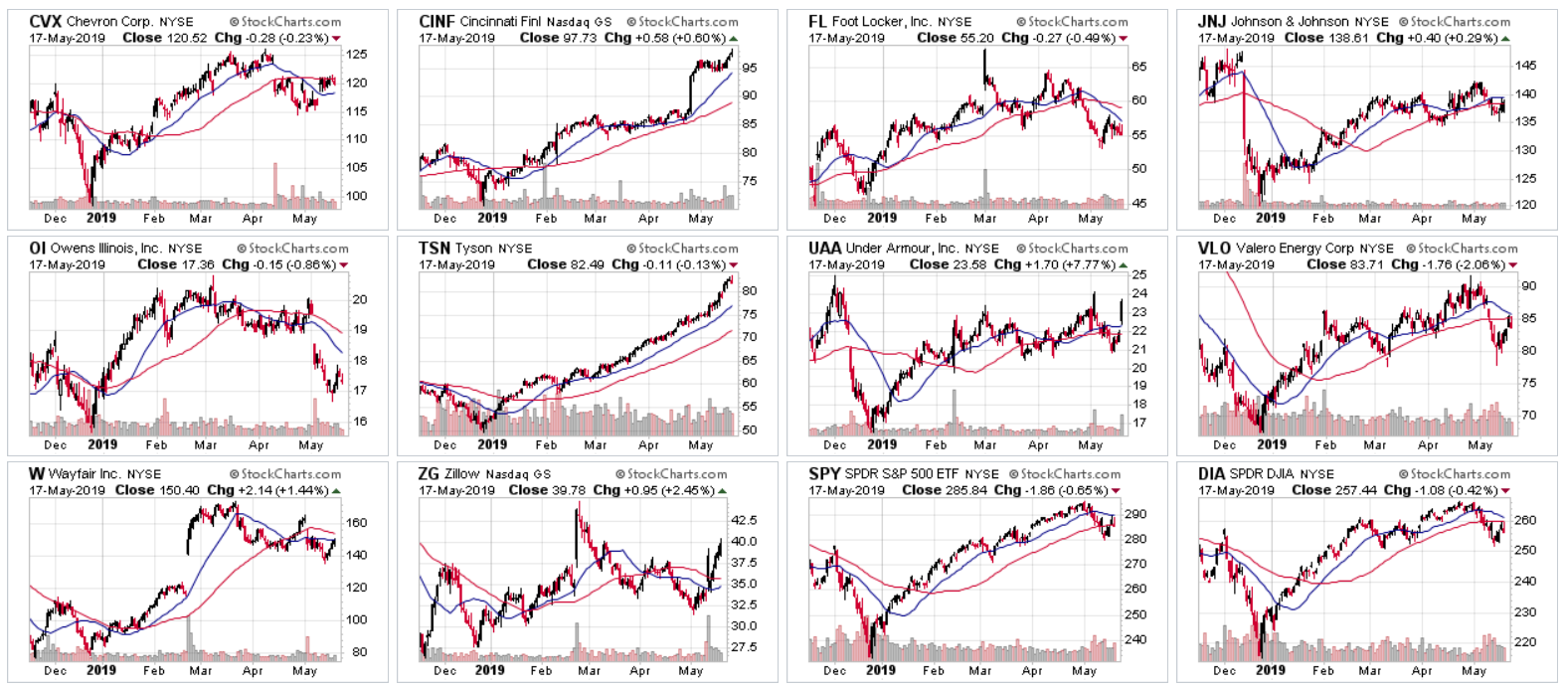

Below is a montage of six-month charts on these 10 stocks (and the SPY and DIA ETFs for the broader market) to see how the performance has looked visually. This is a CancleGlance view from StockCharts.com.

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Have questions about retirement or personal finance? Email us at [email protected]!

By emailing your questions to 24/7 Wall St., you agree to have them published anonymously on a673b.bigscoots-temp.com.

By submitting your story, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.