If Nomura Securities analyst Masanari Takada is right, U.S. equity markets could be headed for a decline similar to the one that followed the collapse of Lehman Brothers in 2008. Current market patterns hark back to June 2008, a time when investors also worried about global economic growth and a correction in stock prices.

Takada told Bloomberg News that the S&P 500 Index could drop by an average of 20% and by as much as 40% if current trends follow the run-up to Lehman’s bankruptcy in September 2008.

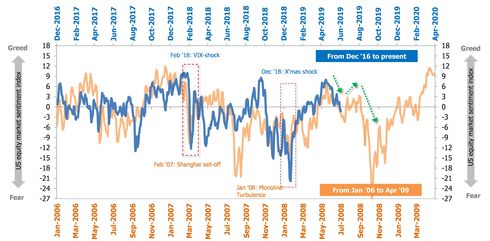

The similarity in market movements in this chart is spooky. The blue scale across the top and the blue line on the graph show current price movements and overlay almost exactly the orange scale along the bottom and the orange line that show what happened in 2008.

In a comment to Bloomberg, Takada said, “We are probably at the point after the big second wave and before the final big wave. That’s why any positive surprises are necessary as soon as possible for the market sentiment to deviate from such an ominous pattern.”

So what, then, are the chances of that bounce? Looking at Takada’s chart, a recovery bounce is not due to start until October after stocks have plunged more than 25% from the beginning of May. If this happens, it could be a lot more serious for equity investors than the usual “sell in May and go away” (maybe until October) advice.

Current concerns over the trade war with China and possible new tariffs on Mexican goods and auto imports from Europe, a sagging global economy and uncertainty about what the Federal Reserve will do about interest rates are all contributing to the dim view investors have of equities. Yields on 10-year Treasury notes have fallen below 2.1% as investors continue to seek safety. Even gold broke above $1,300 an ounce on May 31 and has stayed there for three straight days.

Takada believes that the equity markets are most sensitive to a failure by the Fed to cut interest rates as Chair Jerome Powell indicated the central bank might do if necessary: “The Fed could decide not to act now, in which case investors with longer investment horizons might be pressed into reducing their equity market exposure. If that were to happen, a bear market much like that of December 2018 could take shape.”

Fasten your seatbelts, we’re about to hit some bumpy air.

Want to Retire Early? Start Here (Sponsor)

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Have questions about retirement or personal finance? Email us at [email protected]!

By emailing your questions to 24/7 Wall St., you agree to have them published anonymously on a673b.bigscoots-temp.com.

By submitting your story, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.