Investing in 2020 has been a wild ride. An 11-year bull market was chopped into an instant recession, only to find the stimulus outweighing the COVID-19 destruction enough that stocks managed to hit new highs again. One trend seen at historic highs that used to be very common in raging bull markets was stock splits. Splits are of course a gimmick, but the stock market usually rewards companies for splitting their stocks.

As a company’s stock would rise to levels that the company thought was becoming a high dollar amount, it would magically split its stock and double, triple or quadruple its share count by lowering stock prices by a similar amount.

While stock splits change nothing about the underlying fundamentals of a company, investors love splits, even though they should know it is just a mechanical function around an actual stock price. Splits do not affect revenues, net income, gross margin and market capitalization. Despite this, there is still a very strong argument that can be made showing just how much investors love seeing stock splits.

24/7 Wall St. has tracked two very high-profile stock splits of late. There are 13 additional stocks that easily could split their own stocks after seeing what happened.

The mighty Apple Inc. (NASDAQ: AAPL) conducted a four-for-one stock split, and that was its first since Apple’s seven-for-one split back in 2014. Apple was trading at $384.07 ahead of earnings and the split announcement, but the shares went on to rise more than 10% before coming back down to earth after the split. Tim Cook even suggested that he wanted to share price lower for more investors to be able to get access. So what if it marked a top in the stock. After all, it’s not as if Apple won’t be selling millions of more new iPhones in the coming years.

Tesla Inc. (NASDAQ: TSLA) had claimed that it wants its own shares more affordable for investors and employees, so it split five for one. Tesla’s stock price then jumped more than 10% to over $1,500 after the split was announced. Eventually, it got well above $2,000 before the dust settled. Its new price of $429.40 is down nearly 15% from its split-adjusted high of $502.49. Tesla was even able to use the hype and momentum of its split to raise $5 billion in a new stock offering, securing its future finances.

The inverse case of a stock split is the dreaded reverse split. That is when a company shrinks its share count and raises its share price by the similar amount. This rather proves that splits matter, even when all other factors remain the same. A reverse split generally is employed to avoid delisting from the New York Stock Exchange or Nasdaq. Reverse splits are often followed by a wave of short sellers betting this was a chance to sell more stock at a higher price.

24/7 Wall St. would never suggest that every single company with a high stock price needs to announce a split. That said, and after seeing how the hype did work, some stocks look and feel like they could use a split to further boost their shareholders’ attitudes. A stock split might even keep the excitement going after earnings.

Some companies may want to appeal to their broad base of customers with a share price adjustment based on the cost of their goods or services. Some companies may even view their own customers as perhaps the most ideal shareholders.

Many investors could argue that 50 or even 100 more companies should consider stock splits. This review focuses on the companies that are more widely traded and are also very well known. We have not suggested how much of a split should be seen, because every company is different. There is also a dark side of stock splits, which is detailed below.

Here are 13 other companies that should seriously entertain splitting their stocks. Some of these are not the so-called FAANG stocks and other high fliers. These all have considerably higher share prices. Key performance metrics have been included for each, along with some additional color.

Amazon Above $3,000

Amazon.com Inc. (NASDAQ: AMZN) was last seen trading at $3,200, and its 52-week range is $1,626.03 to $3,552.25. It has a $1.6 trillion market cap, and its stock has traded with a hefty price for some time, breaking above $1,000 in mid-2017 and then hitting $2,000 for the first time in mid-2018. In some ways, Jeff Bezos may have pioneered the trend of not wanting to make stock splits as fashionable as they used to be. Amazon pays no dividend. The history of splits shows that its stock split twice in 1999 and once in 1998, back before the 2000 dot-com bubble burst.

Alphabet/Google Still Above $1,500

Alphabet Inc. (NASDAQ: GOOGL) had recently been trading above $1,600, and its 52-week range is $1,008.87 to $1,726.10. It now has a $1.05 trillion market cap. Alphabet effected a split in 2014, with the creation of the dual classes of stock. Sadly, most investors today don’t know which Alphabet is which, and many still wonder why the company even bothered changing the Google name. Alphabet pays no dividend and likely will not for the foreseeable future. One issue that might make for a split, even if they don’t want to, is that it could face a government breakup.

AutoZone Close to $1,200 Per Share

AutoZone Inc. (NYSE: AZO) was last seen trading at $1,182, within a 52-week range of $684.91 to $1,274.41 and with a market capitalization of $27.6 billion. AutoZone is in a strange situation, as a car parts store with a massive stock price. This might not tell its customers who come into the store that perhaps they should buy a share of stock for the same price of five car batteries. Its last splits were both two-to-one, way back in 1994 and 1992.

AutoZone oddly enough pays no dividend, but its history of stockholder returns has been focused on repurchasing its common stock. The move of shrinking its outstanding shares is used to boost the earnings per share. Even as of October 2019, the company had authorized a total of $23.2 billion in share repurchases since its repurchase program kicked off in 1998.

Booking Holdings’ Fears of Yesteryear

Booking Holdings Inc. (NASDAQ: BKNG) was last seen trading close to $1,660.00, and its 52-week range is $1,107.29 to $2,094.00. It has a $68 billion market cap that should now be worth the entire airline industry and many hotel chains combined. One interesting aspect of a would-be split here is that it had to engage in a dreadful reverse stock split back in 2003 (by one for six) because its stock price was so low back then. That was when it still was known to investors as Priceline.com. Its trading volume likely would be considerably higher than the 400,000 on average, and its wide bid-ask spread would narrow as well.

Boston Beer’s Stock Above $900

Boston Beer Co. (NYSE: SAM) was last seen trading above $925. The stock’s 52-week range is $290.02 to $986.78, and its market cap is now $11.4 billion. Boston Beer is another stock for which such a high share price just makes no sense on the surface. Many people love to drink their beers and their newer seltzers. One dilemma using the Peter Lynch way of sticking with goods you know and investing in them creates a mental dilemma. When a customer can buy one share of common stock for the cost of maybe 100 six-packs, there may be an incentive to just drink more rather than invest more.

Charter Communications: Up 200% in Five Years

Charter Communications Inc. (NASDAQ: CHTR) was last seen trading at $610.00, and its 52-week range is $345.67 to $621.04. It has a market cap of $125 billion. Charter Communications has the highest price of any cable and media stock. It is what is left of business combinations with Bright House Networks and Time Warner Cable, now under the Spectrum brand. Those roll-ins are long enough in the past that there is no reason to have such a high share price. Charter also pays no dividend.

Chipotle Up 350% Since Peak-Montezuma

Chipotle Mexican Grill Inc. (NYSE: CMG) was last seen trading at $1,335.00, and its 52-week range is $415.00 to $1,384.47. It has a $37 billion market cap, and it now seems almost impossible to fathom that Chipotle was once spun out of McDonald’s. Even after it made customers so ill in the past, its customers tend to have extremely high loyalty rates. It has also been a post-coronavirus winner from its digital and to-go efforts. Turning customers into shareholders may be a tough sell here. When a 20-something or 30-something types in “CMG Stock” as a search on their smartphones and they see the price above $1,300 another thought comes to mind: “I can buy one share of stock or pay for my next 130 meals with the same cash.” It’s a tough mental exercise and Chipotle still pays no dividend.

Equinix Up 200% in Five Years

Equinix Inc. (NASDAQ: EQIX) was last seen trading above $810.00, and its 52-week range is $477.87 to $839.77. It has a $72 billion market cap, and it is a real estate investment trust involved in data centers. As a REIT, it has close to a 1.3% dividend yield. Some investors consider it somewhat as an AWS without all of the other Amazon operations. The company may have a specific reason to avoid a split though. The last split on record was a reverse split of 1-for-32 back in 2002.

Netflix: Up 300% in Five Years

Netflix Inc. (NASDAQ: NFLX) has seen a massive win from the COVID-19 era creating the stay at home economy. Movie theaters may not ever be the challenge they used to be even after a vaccine arrives. Netflix was last seen trading at $529.00 a share. It has a 52-week range of $252.28 to $575.37 and a $233 billion market cap. Analysts keep driving their target prices higher and higher and the stock has witnessed a major triple-top chart pattern.

And using the “buy the service or the stock” scenario sounds like a tough sell also. Customers may think of one share at $529.00 or so as being more than 50 months of service fees. With close to 20 years of trading history, Netflix split seven-for-one back in 2015 and two-for-one back in 2004.

NVR: Homebuilder Up Almost 175% in Five Years

NVR Inc. (NYSE: NVR) is now a $4,280 stock, the highest of any homebuilding stock price by a factor of about 40-to-1. The stock has continued hit new all-time highs and has more than doubled from its lows in March. The company was recently the third-largest homebuilder by market cap, with a $15.8 billion value. NVR also pays no dividend. Imagine what might happen to its trading volume when it currently trades just 21,000 shares on an average day.

Regeneron: Prior Peak in 2015, but Up 100% in a Year

Regeneron Pharmaceuticals Inc. (NASDAQ: REGN) was last seen trading near $585.00, and its 52-week range is $271.37 to $664.64. It has a $62 billion market cap. Regeneron is older than many of the large biotechs as it came public back in 1991. The company has never paid a dividend, and we found no record of any stock splits. Regeneron has many things going for it, but the recent developments of COVID-19 have helped it gain more than 50% in 2020 alone.

Sherwin-Williams Up 900% Since 2010

Sherwin-Williams Co. (NYSE: SHW) was last seen trading at $680.00, and its 52-week range is $325.43 to $725.91. It has a $62 billion market cap. Sherwin-Williams sells paint all around the country and is a very well-known company. While it pays a 0.8% dividend yield, the last time it split its shares was back in the 1990s and 1980s. Many paint-buyers could repaint their entire home or apartment for less than the cost of a single share of stock.

Shopify’s E-Commerce Gain of 3,000% Since IPO

Shopify Inc. (NYSE: SHOP) was last seen trading close to $1,060.00, and its 52-week range is $282.08 to $1,146.91. It has a $129 billion market cap. Shopify has become the next big thing for businesses and it has been a definite COVID-19 economy winner in helping companies small and large build more robust websites for e-commerce. Shopify is a Canadian company, and it has sky-high valuations at more than 50 times revenues. It pays no dividend and probably will not pay one for years. There have been no stock splits since its 2015 initial public offering.

The Past and Future of Stock Splits

These calls for stock splits are not exactly new. We even made some of the same observations in 2015, including about AutoZone, Chipotle, Boston Beer and Sherwin-Williams.

Investors need to know that there are some dangers in splitting a stock by too large of a ratio. General Electric Co. (NYSE: GE) comes to mind. GE is now trading with a rather embarrassing single-digit stock price, and it was even booted out of the Dow Jones industrial average because its weighting in the index became so low.

Berkshire Hathaway Inc. (NYSE: BRK-A) is one name that comes up over and over for a split due to a more than $300,000 share price, but it now has the Berkshire Hathaway Inc. (NYSE: BRK-B) shares that are closer to $210.00 apiece. Those were created back in 1996. Warren Buffett noted back in the 1980s, even at much lower share prices, that he did not intend to split the stock, but those B-shares split 50-to-one in 2010, and now the stock is much more investable by the public.

One modern reverse split that changed how a stock traded was the case of Rite Aid Corp. (NYSE: RAD). The pharmacy chain operator still has only a $550 million market cap, but at about $10.00 now this would still be a sub-$1.00 stock had it not conducted a reverse-split of one-for-20 back in 2019. Rite Aid used to be very actively traded before its reverse split, with tens of millions of shares trading hands each day. Now it trades about 3 million shares per day. The company’s history shows five splits that took place in the 1980s and 1990s, before the company ran into trouble in 1998 and suffered a low share price thereafter.

Announcing a stock split is not supposed to change the fundamentals of a company at all. Still, shareholders just cannot help themselves from getting excited over traditional stock splits.

To show that high stock prices in many key stocks have become a barrier to new shareholders, recent efforts by Schwab, Fidelity and other services have created fractional share purchasing or “slices.” Even if a stock price magically adjusts to $200 or $300 rather than over $1,000, those slices probably are going to remain popular.

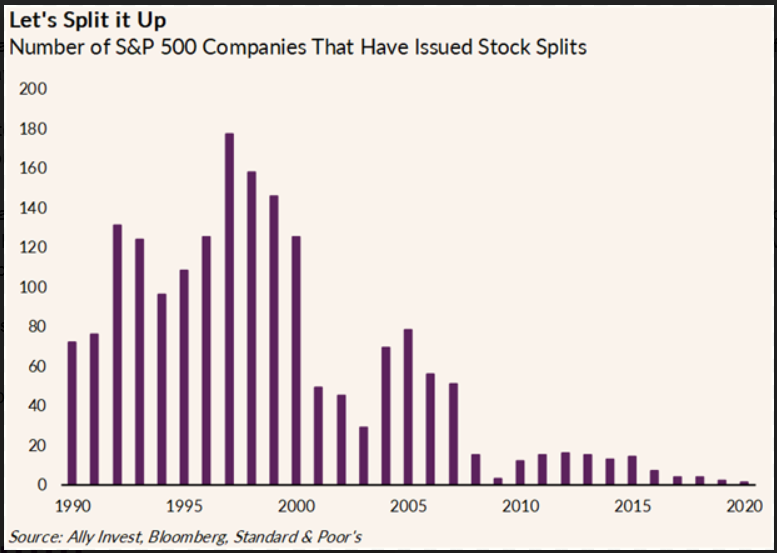

The following chart from Ally recently showed just how out of favor stock splits from S&P 500 companies have become over the past 15 years. Ally also pointed out that stocks splits were less effective as a stock price booster than in recent years, but that did not have the Apple and Tesla hype in there. It showed that since 2010 the S&P 500 stocks announcing splits outperformed their benchmark by about 8% on average in the following 12 months, which might make a CEO and the shareholders overlook the notion that stock splits don’t change the underlying fundamentals.

Find a Qualified Financial Advisor (Sponsor)

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.