Investing

Why 5 Stocks Hedge Funds Are Shorting the Most Could Be Huge Q2 Winners

Published:

Ever since the parabolic explosion of GameStop shares higher, much of which was due to the massive short interest, aggressive traders have been scouring the data looking for companies with large short interest, hoping to catch the next parabolic move. While they may indeed find the holy grail, it may be a better idea to find out what stocks hedge funds are shorting the most.

A new Jefferies research report dissects hedge fund holdings after the end of the quarter, and it includes a list of stocks that the top funds are shorting the most. They are hardly the kind of names the WallStreetBets crew is screening to pounce on for a massive short squeeze. In fact, they are some of the top companies in their respective sectors, and they look like great ideas for aggressive growth traders.

The tailwind for these stocks could arrive sooner rather than later, if the companies can deliver solid first-quarter results and have some positive forward guidance. Then it is possible they could see many long accounts buying, which would probably get the hedge fund shorts to do some covering.

Here are the five stocks in the order according to the size of short position at the hedge funds, and all are rated Buy at many top Wall Street firms. It is still important to remember that no single analyst report should be used as a sole basis for any buying or selling decision.

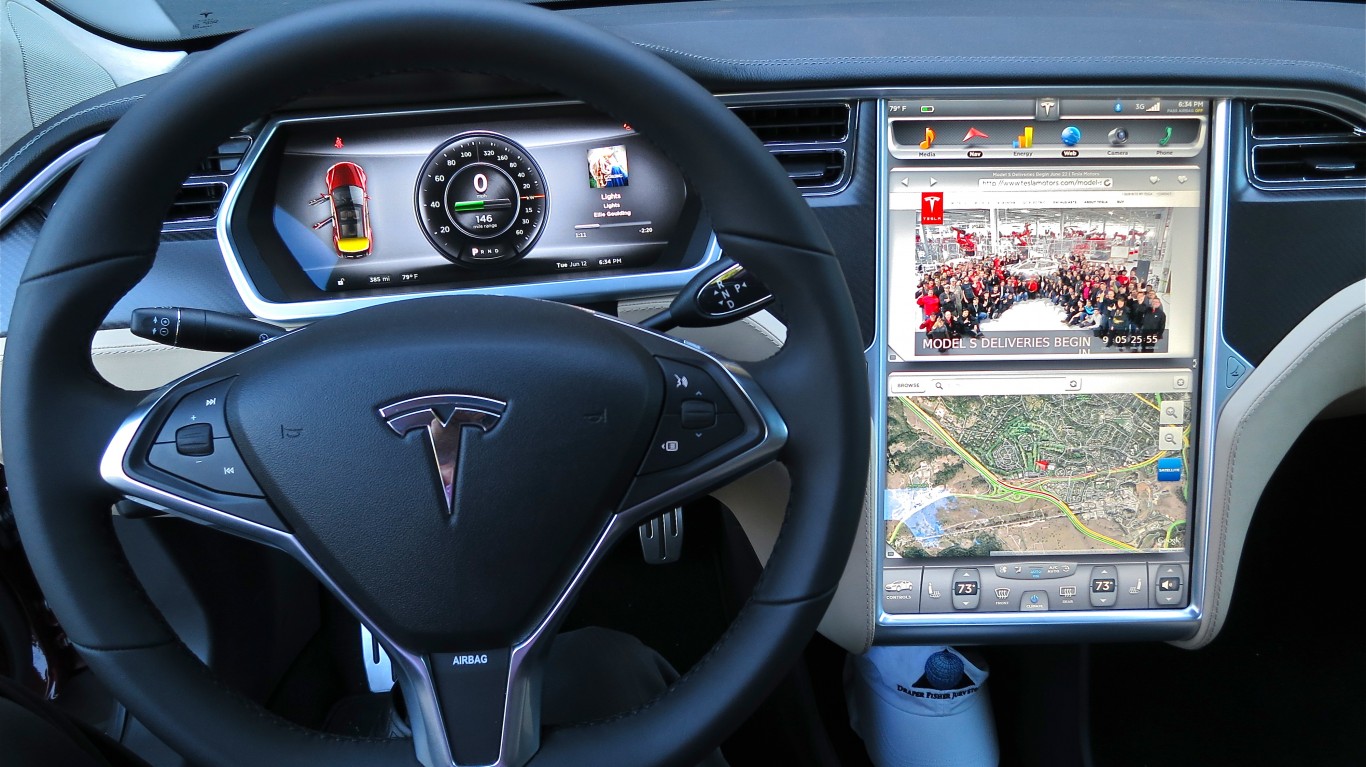

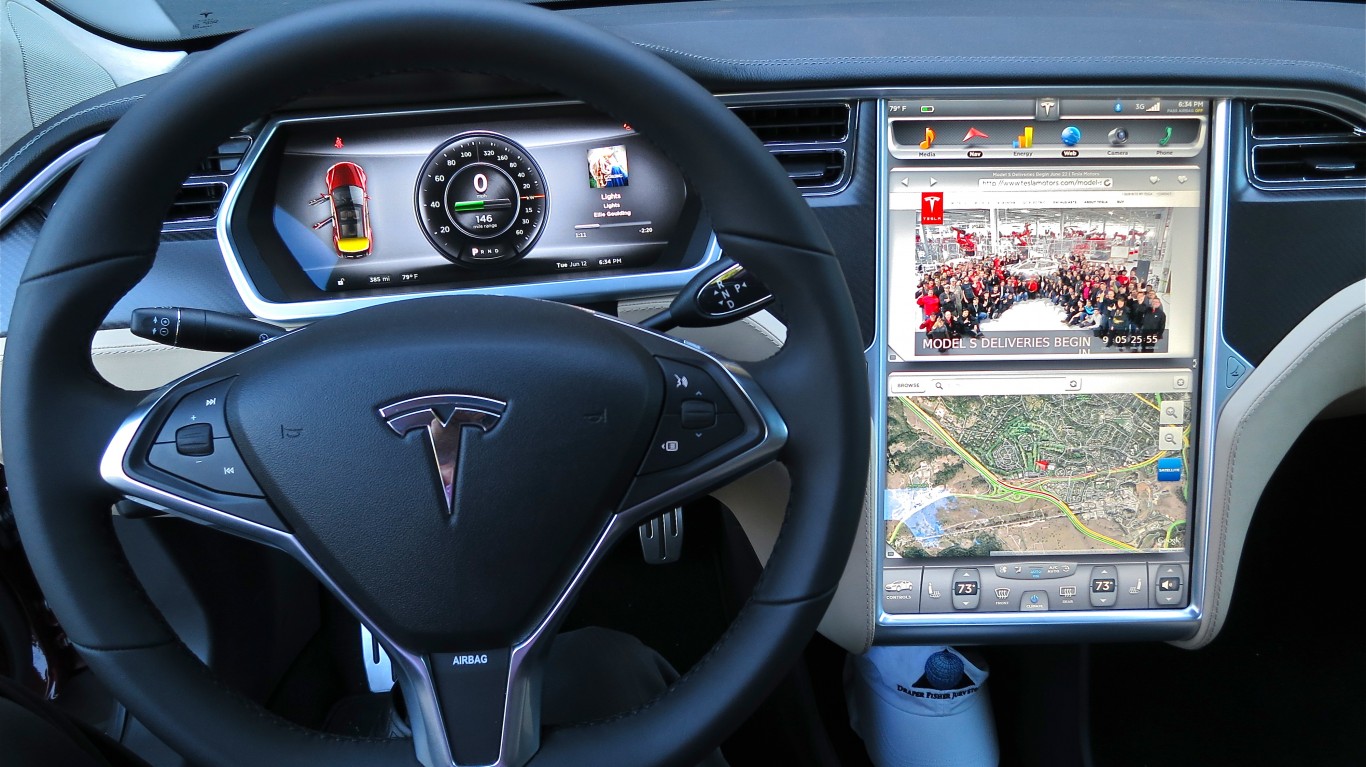

This has been one of the most talked-about companies over the past five years, and it was a short seller’s nightmare until recently. Tesla Inc. (NASDAQ: TSLA) designs, develops, manufactures, leases and sells electric vehicles, as well as energy generation and storage systems, in the United States, China and elsewhere.

Tesla’s Automotive segment offers electric vehicles, as well as sells automotive regulatory credits. It provides sedans and sport utility vehicles through direct and used vehicle sales, operates a network of Tesla Superchargers and offers in-app upgrades and purchase financing and leasing services. This segment is also involved in the provision of non-warranty after-sales vehicle services, sale of used vehicles, retail merchandise and vehicle insurance, as well as sale of products through its subsidiaries to third party customers. It provides services for electric vehicles through its company-owned service locations, and Tesla mobile service technicians, and vehicle limited warranties and extended service plans.

The Energy Generation and Storage segment engages in the design, manufacture, installation, sale and leasing of solar energy generation and energy storage products and related services to residential, commercial and industrial customers and utilities through its website, stores and galleries, as well as through a network of channel partners. This segment also offers service and repairs to its energy product customers, including under warranty, and various financing options to its solar customers.

The company noted late last Friday that first-quarter deliveries totaled 184,800 vehicles, beating the FactSet consensus estimate of 168,000. Tesla said it produced just over 180,000 vehicles in the period. Sales of its Model 3 sedans and Model Y compact SUVs came to 182,780. The consensus forecast was for 122,600 Model 3s and about 10,000 Model Ys sold.

Mizuho has a Buy rating and a $775 price target. The consensus target is just $619, and Tesla stock closed on Wednesday at $670.97.

This blue-chip giant is offering investors a very solid entry point. International Business Machines Corp. (NYSE: IBM) is a leading provider of enterprise solutions, offering a broad portfolio of information technology (IT) hardware, business and IT services, and a full suite of software solutions. The company integrates its hardware products with its software and services offerings in order to provide high-value solutions.

IBM’s five major segments are: 1) Cognitive Solutions, 2) Global Business Services, 3) Technology Services & Cloud Platforms, 4) Systems and 5) Global Financing. Analysts cite the company’s potential in the public cloud as a reason for their positive outlook going forward.

CEO Ginni Rommety, who had been in the position since 2012, stepped down in January, and the stock market greeted the news in a very positive manner. Arvind Krishna, who has led the company’s cloud computing business, was named the new chief executive. Rometty will remain as executive board chair until the end of the year.

Shareholders receive a 4.83% dividend. The BofA Securities Buy rating comes with a $153 price target. The consensus is $137.84, and IBM stock closed at $134.93 on Wednesday.

This stock could very well continue to benefit from the increase in information technology and 5G spending. Analog Devices Inc. (NASDAQ: ADI) is a leader in the design, manufacture and marketing of analog, mixed-signal and digital signal-processing integrated circuits for use in industrial, automotive, consumer and communication markets worldwide.

The company offers signal-processing products that convert, condition and process real-world phenomena, such as temperature, pressure, sound, light, speed and motion, into electrical signals.

Analog Devices has among the best end-market exposure, with high communications and aerospace/defense market exposure, in addition to offering investors a powerful 5G content growth story. Plus, acquisitions over the past few years like Linear Technology and Hittite Microwave should provide revenue and additional cost synergies that are still coming.

Investors receive a 1.73% dividend. The $169 Goldman Sachs price target for the Buy-rated stock recently was raised to $186. The $182.62 consensus target for Analog Devices stock is still well above Wednesday’s close at $159.45.

The stock was crushed recently and is offering an outstanding entry point. ViacomCBS Inc. (NASDAQ: VIAC) is an American multinational media conglomerate based in New York City. It was formed via the re-merger of CBS and the second incarnation of Viacom on December 4, 2019, the two of which were created from the split of the original Viacom in 2005.

ViacomCBS’s portfolio of brands include the CBS network, TV production studio, international broadcast networks, MTV, Nickelodeon, Paramount Network, Comedy Central, BET, VH1, TV Land, Showtime, Simon & Schuster, Paramount Pictures and Pluto TV.

The stock was hammered due to the selling generated by the implosion of hedge fund Archegos Capital Management, which was massively leveraged and was forced to sell stock to cover margin calls. ViacomCBS was one of the stocks they were forced to sell. That, combined with a large secondary offering, put a big dent in the shares.

Investors receive a 2.19% dividend. An $80 price target accompanies Needham’s Buy rating. The posted consensus target is $57.48. The last ViacomCBS stock trade on Wednesday was at $43.89.

This top semiconductor stock has been on fire, and there are many reasons to buy shares at the current reasonable entry level. Advanced Micro Devices Inc. (NYSE: AMD) operates as a semiconductor company worldwide. Its products include x86 microprocessors as an accelerated processing unit, chipsets, discrete and integrated graphics processing units (GPUs), data center and professional GPUs, and development services. They also include server and embedded processors, and semi-custom system-on-chip products, development services and technology for game consoles.

AMD provides x86 microprocessors for personal computers under the AMD Ryzen, AMD Ryzen PRO, Ryzen, Threadripper, AMD A-Series, AMD FX, AMD Athlon, AMD Athlon PRO and AMD Pro A-Series processors brands. It provides microprocessors for notebook and 2-in-1s under the AMD Ryzen, AMD A-Series, AMD Athlon, AMD Ryzen PRO, AMD Athlon PRO and AMD Pro A-Series processors brands, as well as microprocessors for servers under the AMD EPYC and AMD Opteron brands. Its chipsets are sold under the AMD trademark.

The company announced the Milan server CPU launch on March 15, and product and partnership announcements could help re-energize stock. The EPYC-1 launched in June 2017, and since then unit share is up to 8% from 0.4% and the average selling price to more than $700 from $200 to $300 prior. Some on Wall Street that Milan can drive even higher. The dependable roadmap from past success enables share gains, and AMD is already looking towards Zen 4 and Zen 5, which is in concept design.

BofA Securities has set a $115 price target to go with its Buy rating, while the consensus target is $103.21. AMD stock closed Wednesday at $82.80 a share.

These are five top stocks that hedge funds are short the most. If you are scratching your head and wondering why, you should be. They all make money, they all are leaders in their respective silos and all have been around for quite a while, with the possible exception of Tesla. Good earnings and guidance could possibly shoot them all higher and, with first-quarter results around the corner, that is a distinct possibility.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.