Yet another look at some of the more than 900 publicly traded companies scheduled to report March quarter earnings this week. Two U.S. oil behemoths and two pharmaceutical giants are the subjects of this preview.

Looking ahead to companies reporting earnings after Wednesday’s closing bell, we have previewed Apple, Facebook, Ford and Qualcomm. Four more stocks reporting results before markets open Thursday, Altria, Caterpillar, McDonald’s and Merck, were previewed in a second story also posted Tuesday. We also have looked at four companies reporting results after markets close Thursday.

[in-text-ad]

The four companies previewed in this story are scheduled to report earnings before Friday’s opening bell.

AbbVie

Another widely traded pharmaceutical stock, AbbVie Inc. (NYSE: ABBV), owns the patent on Humira, the best-selling drug in the world, with 2020 revenue of around $20 billion. The company has launched two new drugs that it hopes can help offset Humira’s 43% share of AbbVie’s total annual revenue. Humira loses patent protection in 2023. The May 2020 acquisition of Allergan for $63 billion also adds about $15 billion annually in sales.

Brokerage firms are evenly split on AbbVie, with 10 of 20 rating the stock a Buy or Strong Buy and the others assigning a rating of Hold. At a recent trading price of around $111.80, the stock’s upside potential to a consensus price target of $122.17 is 9%. At the high target of $144, the upside potential rises to nearly 30%.

Estimates for the March quarter call for earnings per share (EPS) of $2.83 (up about 17%) on revenue of $12.76 billion, up 48%. For the full fiscal year, analysts are looking for EPS of $12.45, a gain of 18% year over year, and sales of $55.34 billion, up nearly 21%.

AbbVie stock trades at 9.0 times expected 2021 EPS, 8.2 times estimated 2021 earnings and 9.3 times estimated 2023 earnings. The stock’s 52-week range is $79.11 to $113.41, and AbbVie pays an annual dividend of $5.20 (yield of 4.67%).

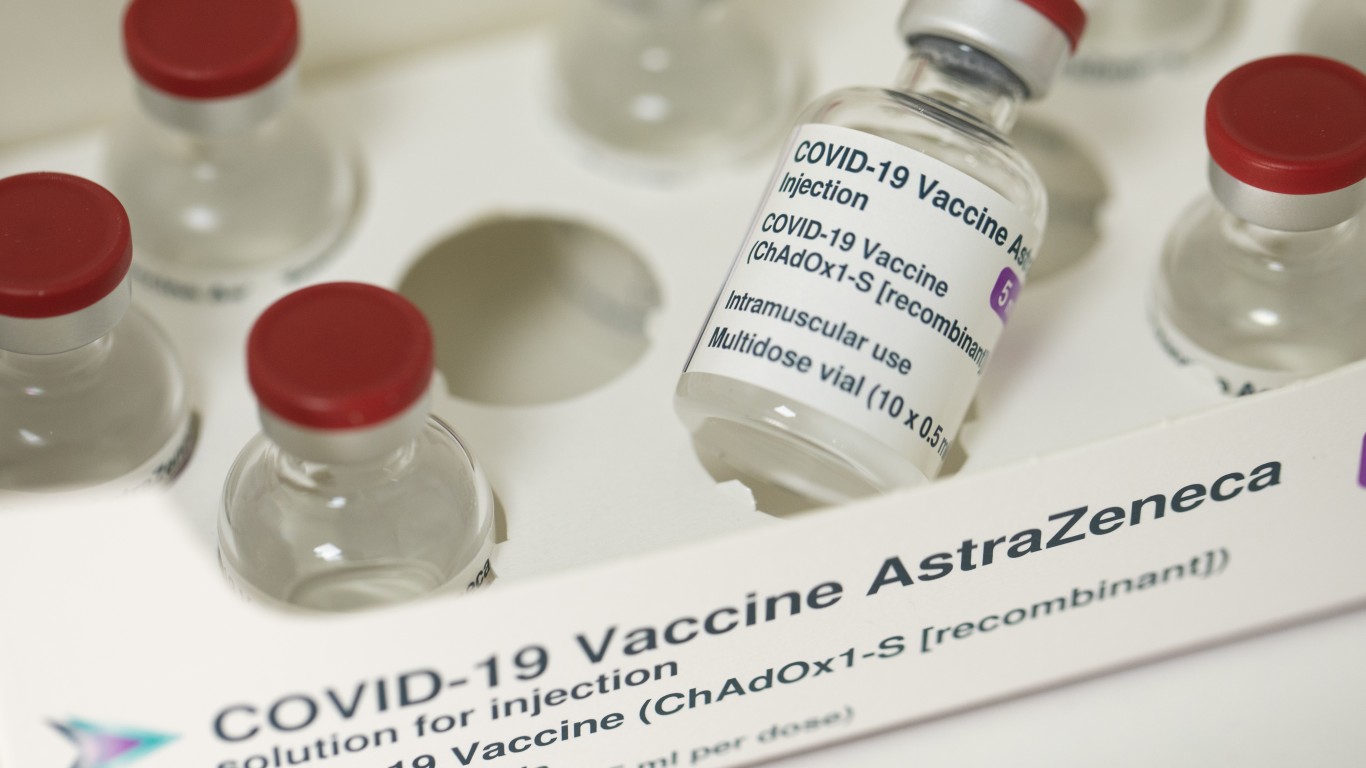

AstraZeneca

U.K.-based AstraZeneca PLC (NYSE: AZN) already has said that it will not earn a profit from the vaccine it developed with Cambridge University as long as COVID-19 is treated as a pandemic. The vaccine also has hit a few headwinds due to rare blood clots, manufacturing delays and supply issues. Despite not making a profit on its coronavirus vaccine, the drugmaker said in February it expected 2021 revenue to rise by a low-teens percentage on the strength of its core products for treating diabetes, heart and kidney disease, and cancer.

The stock is lightly covered in the United States, with just five brokerages total, of which four have the stock as a Buy or Strong Buy. The consensus price target on the stock is $63.60, and at a current price of around $52, the implied upside on the shares is 22%. At the high target of $69.40, the upside potential rises to more than 33%.

A single analyst expects AstraZeneca to report EPS of $0.73, an increase of nearly 50% year over year, and revenue of $7.14 billion, up 12.4% year over year. For the full year, EPS is forecast at $2.11, up 5% year over year, and revenue is tabbed to come in at $31.47 billion.

AstraZeneca stock trades at a multiple of 14.9 times to expected 2021 EPS, 11.9 times estimated 2022 earnings and 9.7 times estimated 2023 earnings. AstraZeneca’s 52-week range is $46.48 to $64.94 and the company pays an annual dividend per share of $1.40 (yield of 2.67%).

[in-text-ad]

Chevron

Integrated oil giant Chevron Corp. (NYSE: CVX) suffered through a miserable 2020. Its share price dropped more than 25% as lockdowns weighed on demand for transportation fuel, including aircraft fuel. Since the beginning of the year, the stock is up 27%, as investors expect life to begin returning to normal and demand for transportation fuel to pick up. Chevron is holding the line on capital spending, choosing instead to keep investors happy with a solid dividend payment.

Of 24 brokerages covering the stock, 16 rate Chevron stock as a Buy or Strong Buy. At a current price of around $105.65, the stock’s upside potential based on a consensus price target of $119.74 is about 13.3%. At the high target of $152, the upside potential is nearly 44%.

For the March quarter, analysts expect Chevron to post EPS of $0.90, a decline of 30% year over year. Sales are tabbed to dip by 3.6% to $30.37 billion. For the 2021 fiscal year, analysts are calling for EPS of $5.50 compared to a year-ago loss of $0.02 per share. Sales are forecast to rise by 43.3% to $135.7 billion.

Shares currently trade at 19.5 times expected 2021 EPS, 16.8 times estimated 2022 earnings and 16.5 times estimated 2023 earnings. Chevron’s 52-week range is $65.16 to $112.70 and the company pays an annual dividend of $5.16 (yield of 5.08%). Chevron is the last remaining energy component of the Dow Jones industrial average.

Exxon Mobil

Exxon Mobil Corp. (NYSE: XOM) has a slightly higher market cap than Chevron but it was dropped from the Dow last August. Even though crude oil prices are up for the year to date, Exxon (and Chevron) face heavy revenue hits related to the week-long freeze that hit Texas in March. Exxon has said it expects first-quarter revenue to be down by $800 million year over year. Also like Chevron, Exxon is keeping capital spending low as it tries to boost cash flow and protect its generous dividend.

Brokers are much more mixed on Exxon, with 11 of 25 rating the stock a Hold and another five rating the stock at Underperform. The consensus price target of $62.52 implies an upside potential of 6.9% to a recent price of $58.20. At the high target of $90, Exxon’s upside potential is nearly 36%.

Analysts are looking for EPS of $0.59 on revenue of $54.6 billion for the March quarter. That’s a year-over-year increase of 11% in EPS and a decline of 2.8% in revenue. For the year, Exxon is expected to more than reverse its 2020 loss per share of $0.33 by posting EPS of $3.33. Revenue is forecast to rise by 37.6% year over year to $249.7 billion.

Exxon Mobil stock trades at 13.7 times expected 2021 EPS, 11.3 times estimated 2022 earnings and 11.5 times estimated 2023 earnings. The stock’s 52-week range is $31.11 to $62.55 and the company pays an annual dividend of $3.48 (yield of 6.17%).

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.