Next week promises to be just like the past week, with more than 900 publicly traded companies scheduled to report March quarter earnings. Energy exploration and production companies will be among the industries heavily represented next week. Some top brands like Google, Ferrari, Pfizer and T-Mobile are on deck as well.

[in-text-ad]

Looking ahead to companies reporting earnings after Thursday’s closing bell, we have previewed Amazon, First Solar, Nio and Twitter. Four more stocks reporting results before markets open Friday, AbbVie, AstraZeneca, Chevron and Exxon Mobil, were previewed in a second story also posted Tuesday.

The four companies previewed in this story include one scheduled to report earnings before Friday’s opening bell, along with two others set to report before Monday’s opening bell.

Weyerhaeuser

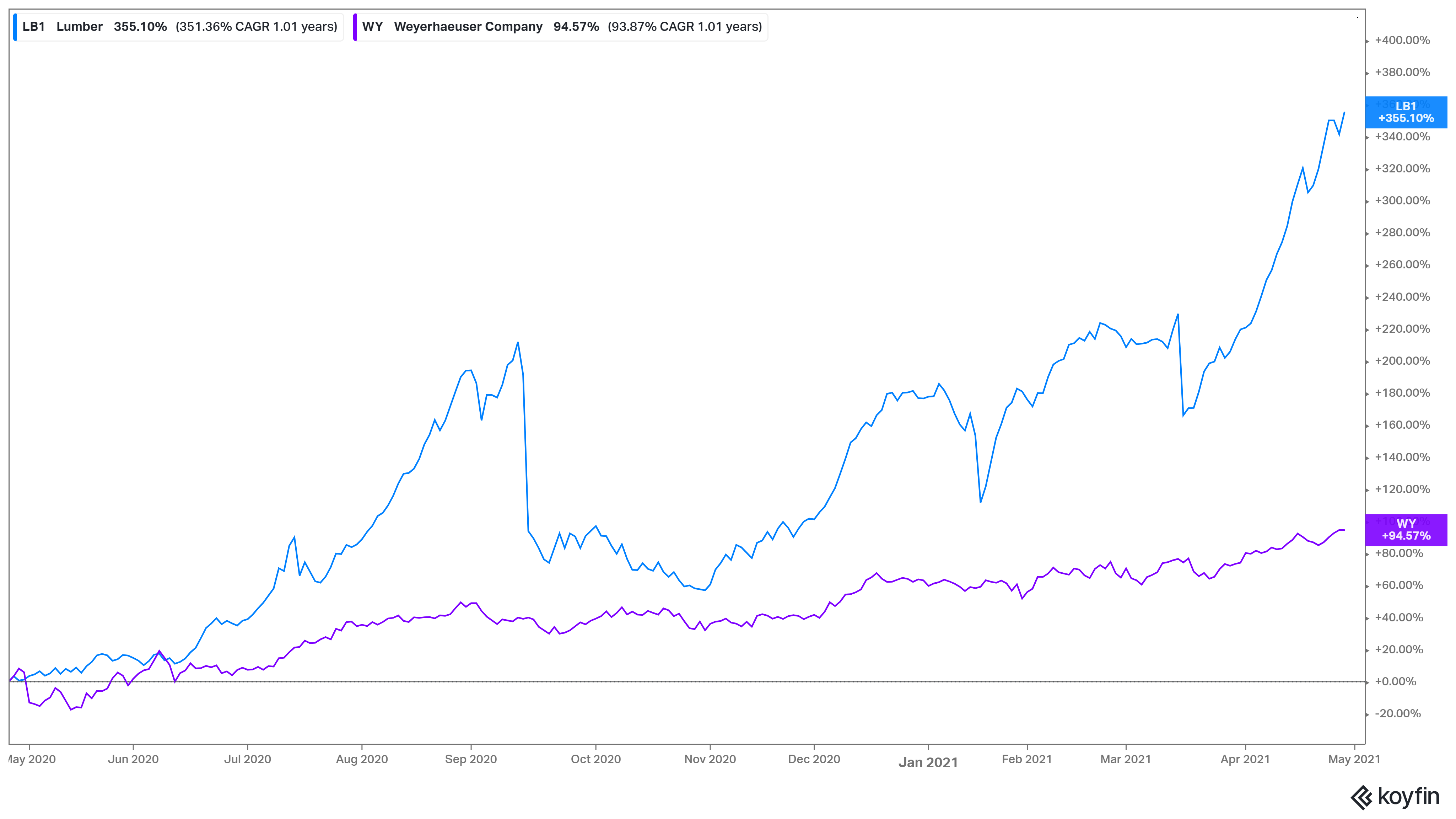

Lumber and wood products giant Weyerhaeuser Co. (NYSE: WY) is set to report March quarter results before markets open Friday morning. Lumber prices have more than tripled over the past 12 months and homebuilders, home buyers and just about every investor with a pulse has a theory about what’s caused the price hikes, but the short answer is that demand has outrun supply. As the chart indicates, Weyerhaeuser stock nearly doubled over the past 12 months. Since the beginning of 2021, shares are up another 64%. The company is organized as a real estate investment trust (REIT).

Analysts have kept a rein on their enthusiasm, however, with eight of 14 rating the stock a Hold, while six rate the shares as Buy or Strong Buy. The stock already has blown past its consensus price target of $38.50 to trade around $39.75 Thursday morning. At the high target of $46, upside potential in Weyerhaeuser shares is nearly 16%.

The consensus earnings per share (EPS) estimate for the March quarter is $0.91, a year-over-year increase of more than 400%, on sales of $2.52 billion, a jump of 46% year over year. For the full fiscal year, EPS is forecast at $2.45, up 90% year over year.

At the current price, Weyerhaeuser shares trade at 17.0 times expected 2021 earnings, 31.2 times estimated 2022 earnings and 24.0 times estimated 2023 earnings. The stock trades in a 52-week range of $16.05 to $40.56. The high was posted Thursday morning, but shares dropped back to around $39.70. The company pays an annual dividend of $0.68 (yield of 1.71%).

Enterprise Products

Enterprise Products Partners L.P. (NYSE: EPD) is the second-largest oil and gas midstream (pipeline and infrastructure) company in the country, with a market cap of about $51 billion. While pipeline companies are typically insulated from the price swings of the commodities they transport, Enterprise has sued a natural gas company in Texas to recover $100 million in transport fees during the February/March freeze in the state. The brutal weather could drive Enterprise’s March quarter profit up by as much as $475 million, according to one analyst.

[in-text-ad]

Of the 24 firms covering the stock, 22 rate the shares a Buy or Strong Buy. At a recent price of around $23.25, the stock trades nearly 19% below its consensus price target of $27.63. At the high target of $33, upside potential on Enterprise stock is almost 42%.

March quarter EPS is forecast at $0.48, a 21% drop year over year, on sales of $7.18 billion, down 4% compared with the year-ago quarter. For the full year, analysts expect to see $2.00 in EPS, up 17% year over year, on sales of $30.03 billion, an increase of 10.4%.

At the current price, Enterprise stock traded at 11.8 times expected 2021 EPS, 11.4 times estimated 2022 earnings and 10.4 times estimated 2023 earnings. The stock’s 52-week range is $14.90 to $23.71, and the company pays an annual distribution of $1.80 (yield of 7.61%).

Estée Lauder

Cosmetics and skincare products maker Estée Lauder Companies Inc. (NYSE: EL) is the third-largest beauty products company traded on U.S. exchanges. Its market cap is nearly $114 billion. Like most of its peers, Estée Lauder had a dismal June quarter last year, but sales and profits picked up again in the third and fourth quarters as the company’s sales in China rebounded. That was due to more growth in China, along with an expected boost in Estée Lauder’s travel business. Shares have gone up in value by more than 88% in the past 12 months.

Analysts are hugely favorable to the stock, with 19 of 24 rating the shares a Buy or Strong Buy. The stock already trades above its consensus price target, but there is plenty of headroom to the high target of $355, which implies upside potential of more than 12%.

Fiscal third-quarter EPS is forecast at $1.31, a year-over-year jump of 54%, while revenues is forecast to reach $3.93 billion, up more than 17% year over year. For the full fiscal year ending in June, EPS is projected at $5.99, up 44% year over year, on sales of $15.96 billion, up 11.7%.

At a current price of around $316.25, the stock trades at 52.8 times expected 2021 EPS, 45.3 times estimated 2022 earnings and 39.0 times estimated 2023 earnings. The stock’s 52-week range is $158.25 to $317.46, and Estée Lauder pays an annual dividend of $2.12 (yield of 0.67%).

Are You Ahead, or Behind on Retirement? (sponsor)

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention.

Finding a financial advisor who puts your interest first can be the difference between a rich retirement and barely getting by, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors that serve your area in minutes. Each advisor has been carefully vetted, and must act in your best interests. Start your search now.

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.