More than 550 U.S.-listed companies are reporting quarterly results on the first three days of next week, May 10 through 12. That’s less than half as many as reported earnings this past week, and the totals will begin to dwindle as the month marches along.

For the end of this week, however, there are no notable companies reporting results after markets close Friday. Looking at companies reporting earnings following Monday’s opening bell, we have two reports. One covers BioNTech, Coty, Duke Energy and Workhorse while the second looks at Kandi Technologies, Marriott, Tyson Foods and Yalla.

This preview covers four firms reporting earnings after markets close Monday and one reporting before they reopen on Tuesday.

Roblox

Since its March initial public offering, online entertainment platform Roblox Corp. (NYSE: RBLX) has seen its shares bounce from down 7% to up more than 18% around its IPO price of around $64.50. The stock recently traded down about 2.9%.

ARK Invest’s Next Generation Internet ETF owns about $62.5 million worth of the company’s stock, just over 1% of all the fund’s assets.

Analysts are going to be most interested in how the gaming platform for pre-teens evaluates its prospects for the rest of the year, now that the pandemic appears to be on the wane. The company presents its first earnings report as a public company after markets close Monday.

Of seven surveyed brokers with coverage on Roblox, three rate the stock a Strong Buy and four at Buy. With the median price target is $80, and shares trading at around $67.50, the upside potential is about 18.5%. At the high target, the potential upside is about 26.0%.

Analysts expect Roblox to report March quarter earnings per share (EPS) of $0.13 on sales of $504.61 million. For the full year, analysts are looking for EPS of $0.44 on sales of $1.92 billion.

At the current price, the stock trades at around 154.0 times expected 2021 EPS and 125.0 times estimated 2022 earnings. The stock’s post-IPO trading range is $60.50 to $83.41, and the average daily trading volume is 10.7 million shares.

3D Systems

3D printer and digital manufacturing company 3D Systems Corp. (NYSE: DDD) posted a share price gain of nearly 20% last year, and it is up more than 82% so far in 2021. In early February, the stock traded up more than 400%. The biggest dip followed lackluster December quarter earnings.

Two of Cathie Wood’s ARK Invest funds combined own about $86.81 million worth of the stock (about 3.65% of outstanding shares). The company is scheduled to report quarterly results after markets close Monday.

Despite the vote of confidence from ARK Invest, brokers are solidly behind a Hold rating (10 of 16) on the stock, with two ratings of Sell and three Underperform ratings. At around $19.20 a share, the upside potential on this stock is around 29% on a consensus price target of $24.83. At the high target of $31, upside potential rises to more than 61%.

Analysts expect the company to post EPS of $0.02 for the March quarter, three times better than the $0.04 per share loss last year. Revenue is forecast to rise by 1.2% to $136.63 million. For the full year, 3D Systems is expected to post EPS of $0.21 on sales of $578.82 million.

The stock trades at 91.3 times expected 2021 EPS and 52.3 times estimated 2022 earnings. The 52-week range is $4.60 to $56.60. 3D Systems does not pay a dividend, and the average daily trading volume is about 4.4 million shares.

Tilray

Canada-based marijuana producer Tilray Inc. (NASDAQ: TLRY) got a big boost on Friday following an upgrade and price target hike from Jefferies analysts. Tilray stock lost about 48% of its value last year but trades up about 64% so far in 2021. After completing its merger with Aphria last week, the stock traded down about 21% for the first four trading sessions of this week. The stock now trades down about 8% for the week.Analysts have mostly rated Tilray stock as a Hold (12 of 16), with a consensus price target of $18.98. At a price of around $16.50, the upside potential on the shares is 15%. At the high target of $32, the upside potential is 94%.

Tilray is expected to post a March-quarter loss per share of $0.07, much better than its per-share loss last year of $1.73. Revenue is forecast to rise by 37% to $71.51 million. For the fiscal year, analysts are forecasting a loss per share of $0.46, compared with a loss per share last year of $2.15. Revenue is forecast to more than triple to $662.6 million.

The company is not expected to post a profit either in 2021 or 2022. Shares have traded between $4.41 and $67.00 in the past 52 weeks. The average daily trading volume is 33.2 million shares. Tilray is on tap to report results Monday afternoon.

Velodyne

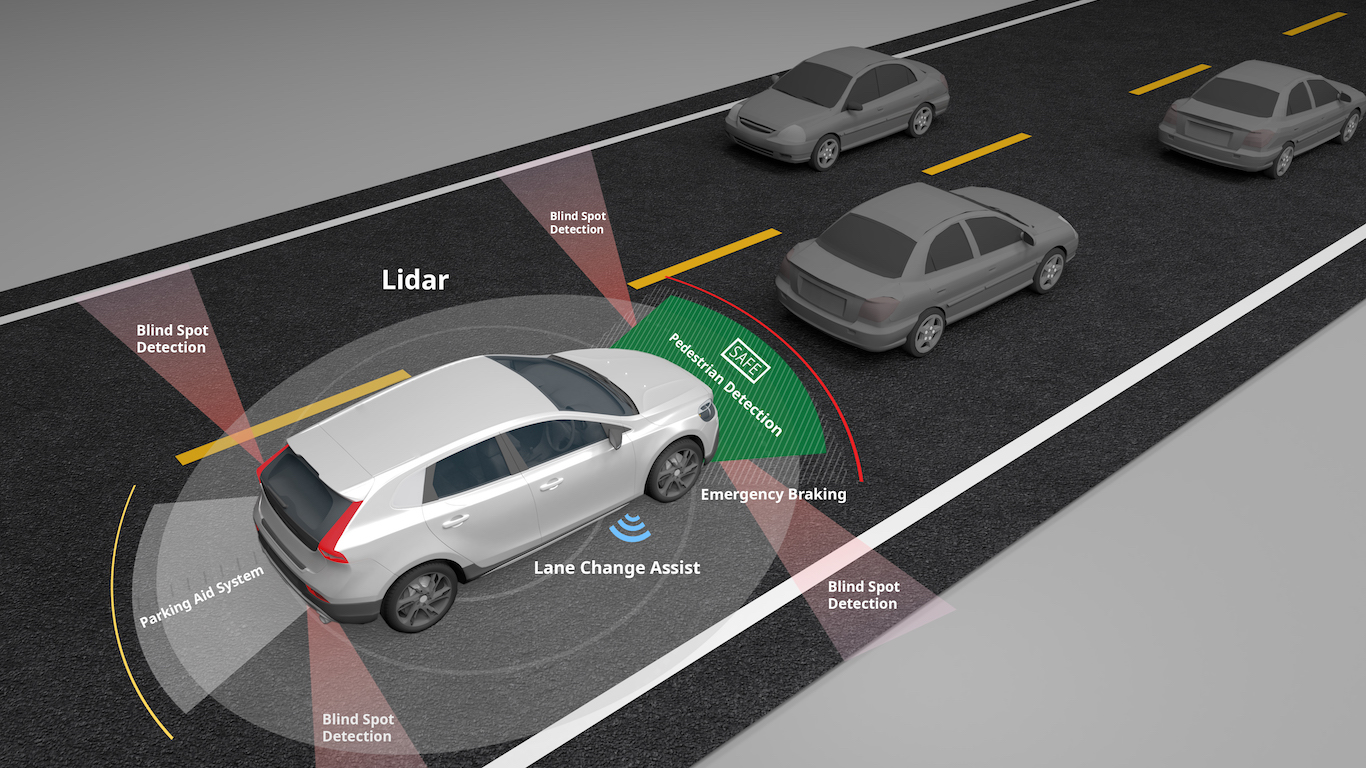

Velodyne Lidar Inc. (NASDAQ: VLDR) makes lidar (light detection and ranging, or laser-light) sensors for autonomous vehicles and drones and came public last October in a reverse merger with a blank-check company. The IPO opened at around $25, but the stock has not traded above that level since then.

Even though the company’s lidar sensors are included in the iPhone 12 and iPhone 12 Pro, the share price cannot overcome investor wariness over the number of competitors and the expected margins for sensors once automakers begin building and selling full-self driving vehicles. The company is scheduled to report results after markets close Monday.

Of seven brokers covering the stock, all but one rate the shares as a Buy or Strong Buy. At a trading price of about $12.00 a share, the implied gain to the consensus price target of $19.44 is 62%. At the high target of $30, the upside potential is 150%.

Analysts expect Velodyne to report a loss per share of $0.12 for the March quarter, with revenue totaling $15.81 million. For the full year, the loss per share is forecast to total $0.39 on revenue of $93.76 million.

Velodyne is not expected to post a profit in any of 2021, 2022 or 2023. The post-IPO trading range is $10.19 to $32.50, and the average daily trading volume is 4.4 million.

Palantir

Security platform provider Palantir Technologies Inc. (NYSE: PLTR) has not yet been publicly traded for a full year, but since its IPO last September, the shares have added about 112%. That’s well off a peak of 310% in late January. In fact, through 2021 to date, Palantir stock is down about 14%.

Two ARK Invest ETFs have been buying the shares since last October. Combined, the two funds own nearly $445 million worth of the company’s stock. Palantir is scheduled to report earnings before markets open Tuesday morning.

While ARK may have been buying Palantir shares consistently since the IPO, brokerages are much warier. Four of seven brokers rate the stock as Underperform or Sell. At around $20.20 a share, upside potential to the $26.33 consensus price target is 30%. At the high target of $40, the upside potential is virtually 100%.

The company is expected to report EPS of $0.04 for the March quarter on sales of $332.23 million. For the full year, analysts are looking for EPS of $0.16 on sales of $1.47 billion.

The stock trades at 126.7 times expected 2021 EPS, 96.1 times estimated 2022 earnings and 78.7 times estimated 2023 earnings. The stock’s post-IPO range is $8.90 to $45.00, and the average daily trading volume is 80.2 million shares.

In 20 Years, I Haven’t Seen A Cash Back Card This Good

After two decades of reviewing financial products I haven’t seen anything like this. Credit card companies are at war, handing out free rewards and benefits to win the best customers.

A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges.

Our top pick today pays up to 5% cash back, a $200 bonus on top, and $0 annual fee. Click here to apply before they stop offering rewards this generous.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.