Investing

Earnings Hits and Misses: Best Buy, Medtronic, Nvidia, Pure Storage, Snowflake

Published:

Here’s a quick look at some earnings reports that were released after markets closed on Wednesday or before Thursday’s opening bell.

With just over a month left in the current earnings season, the number of reports issued every day has dropped from a few hundred to a few dozen. Earlier this week, we had reports from Lordstown Motors, Nordstrom and Zscaler.

[in-text-ad]

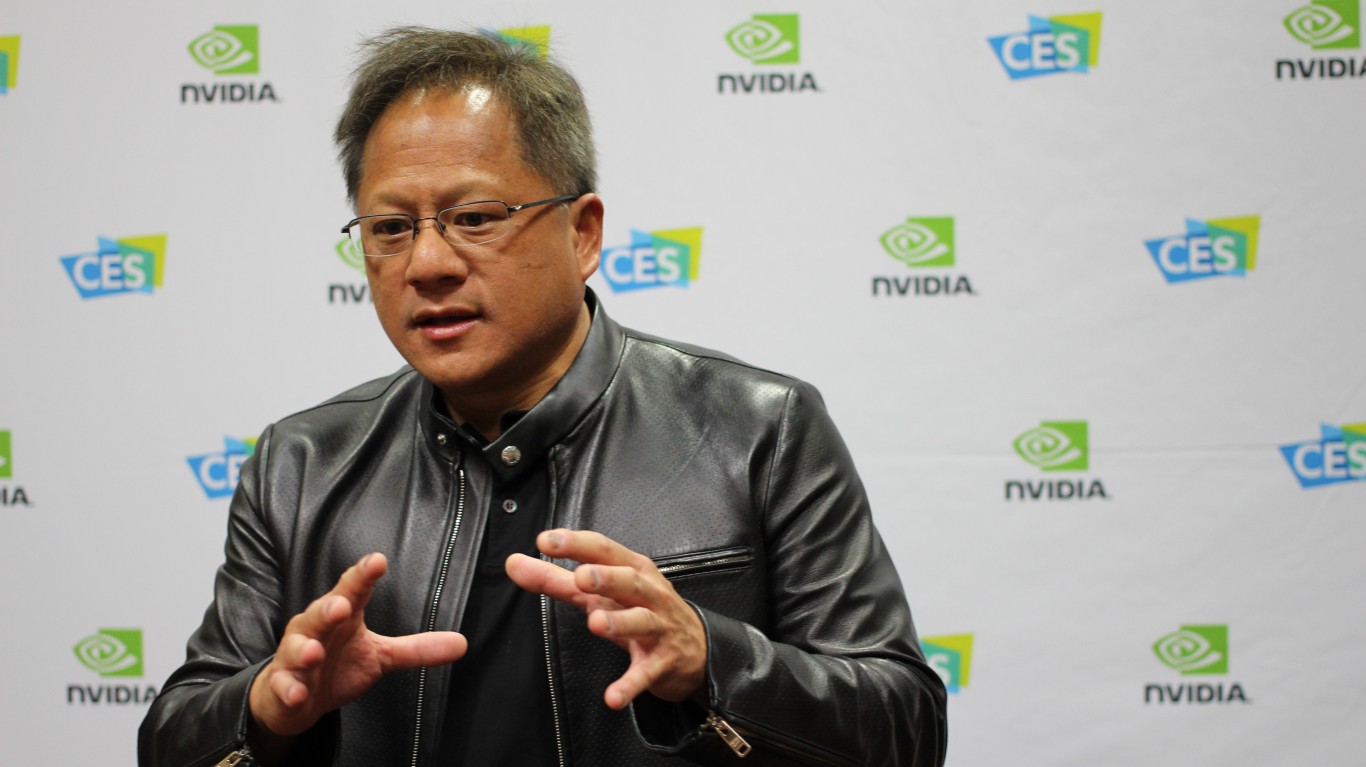

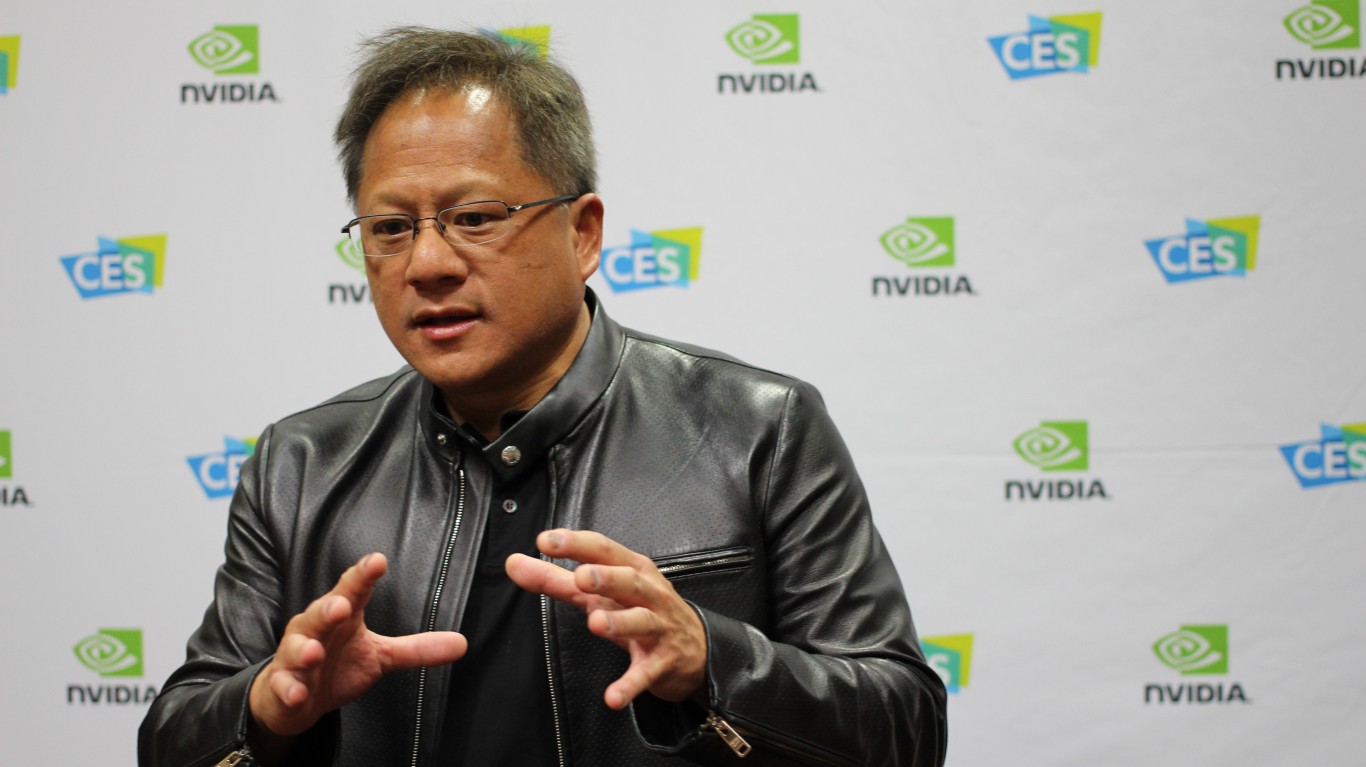

Chipmaker Nvidia Corp. (NASDAQ: NVDA) beat consensus estimates on both the top and bottom lines. Earnings per share (EPS) totaled $3.66, some 11.6% better than forecast. Revenue of $5.66 billion beat the forecast by 4.6%. Nvidia also raised revenue guidance for the current (second) fiscal quarter to a range of $6.15 billion to $6.43 billion, well above the S&P Capital IQ estimate of $5.48 billion.

The stock got only a small boost in Thursday’s premarket trading, and after the opening bell it was down less than 1% to $623.68. The 52-week trading range is $335.17 to $648.57, and the consensus price target is $669.16.

Pure Storage Inc. (NYSE: PSTG) reported results Wednesday evening that exceeded both top-line and bottom-line expectations. EPS broke even, better than the expected loss per share of $0.06, and revenue of $412.7 million topped the forecast of $405.9 million.

The stock traded down about 2.5% to $18.71 early Thursday, in a 52-week range of $13.91 to $29.53. The consensus price target is $28.33.

Cloud platform supplier Snowflake Inc. (NYSE: SNOW) posted mixed results Wednesday evening, with revenue of $228.9 million (more than double year over year) beating the forecast of $213.4 million, while the expected loss per share of $0.16 came in much worse at $0.70. Snowflake guided fiscal second-quarter revenue to a range of $235 million to $240 million (up by around 90% year over year) and full fiscal year revenue in a range of $1.02 billion to $1.04 billion, up from its prior forecast of $1.0 billion to $1.02 billion.

Early Thursday, the stock traded down about 4%, at $226.24 in a post-IPO range of $184.71 to $429.00. The consensus price target is $296.28.

Best Buy Co. Inc. (NYSE: BBY) posted solid beats on both EPS and revenue Thursday morning. The electronics retailer reported EPS of $2.23, which was 57% better than expected, and revenue totaling $11.64 billion, nearly 12% above the forecast. Enterprisewide same-store sales rose 37.2% year over year. The company said it expects same-store sales to rise by 3% to 6% for the 2022 fiscal year, sharply better than the prior forecast for a range of a 2% loss to a 1% gain.

The stock traded up about 3.1% to $120.68, in a 52-week range of $75.27 to $128.57. The consensus price target on the stock is $118.85.

Medical device maker Medtronic PLC (NYSE: MDT) reported Thursday morning that EPS totaled $1.50 for its fiscal fourth quarter and revenue came to $8.19 billion. The company guided fiscal 2022 EPS in a range of $5.60 to $5.75, compared to the S&P Capital IQ consensus of $5.72. Medtronic also increased its cash dividend beginning with the first quarter of fiscal 2022 to $0.63 per quarter, a jump of 9%. The annual dividend will rise from $2.32 to $2.52.

The stock traded up slightly early Thursday to $126.54. The 52-week range is $87.68 to $132.30, and the consensus price target is $135.11.

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.