Investing

Earnings Hits and Misses: Best Buy, Medtronic, Nvidia, Pure Storage, Snowflake

Published:

Here’s a quick look at some earnings reports that were released after markets closed on Wednesday or before Thursday’s opening bell.

With just over a month left in the current earnings season, the number of reports issued every day has dropped from a few hundred to a few dozen. Earlier this week, we had reports from Lordstown Motors, Nordstrom and Zscaler.

[in-text-ad]

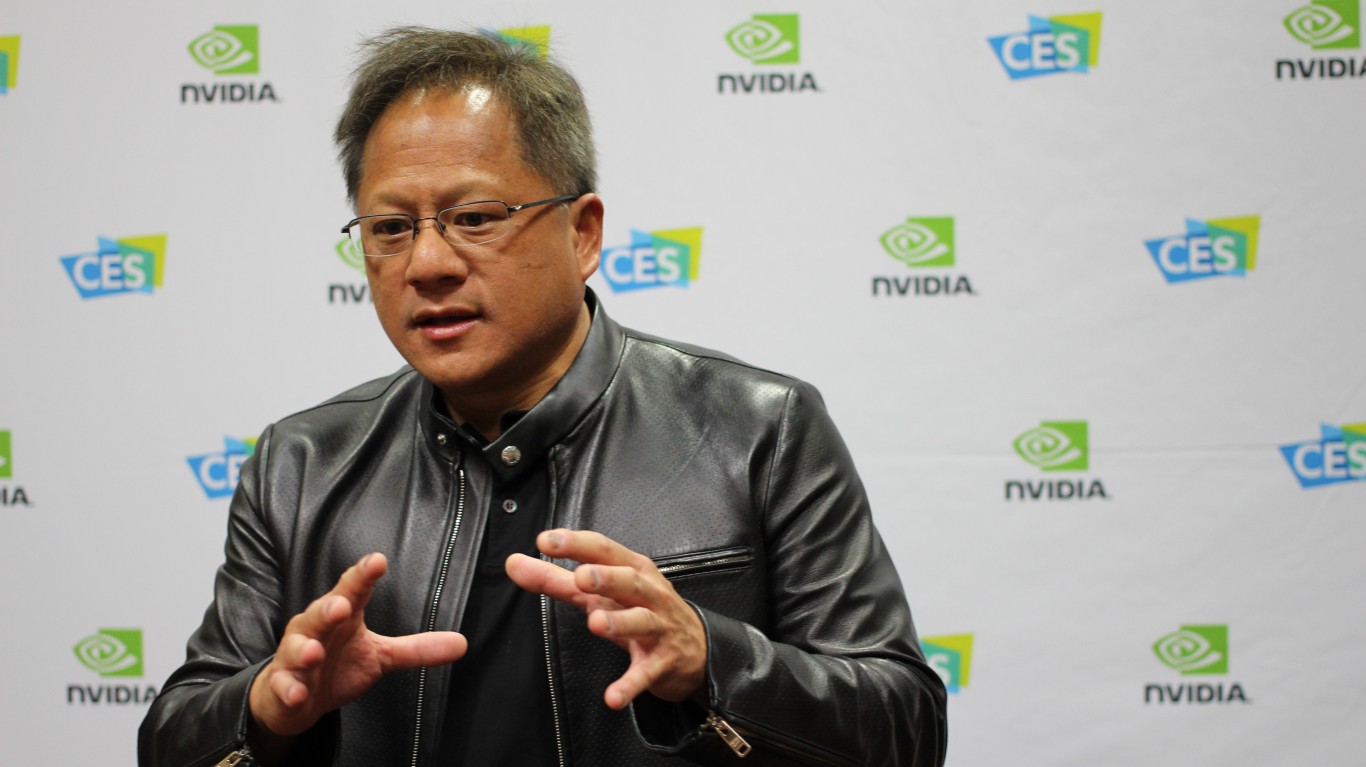

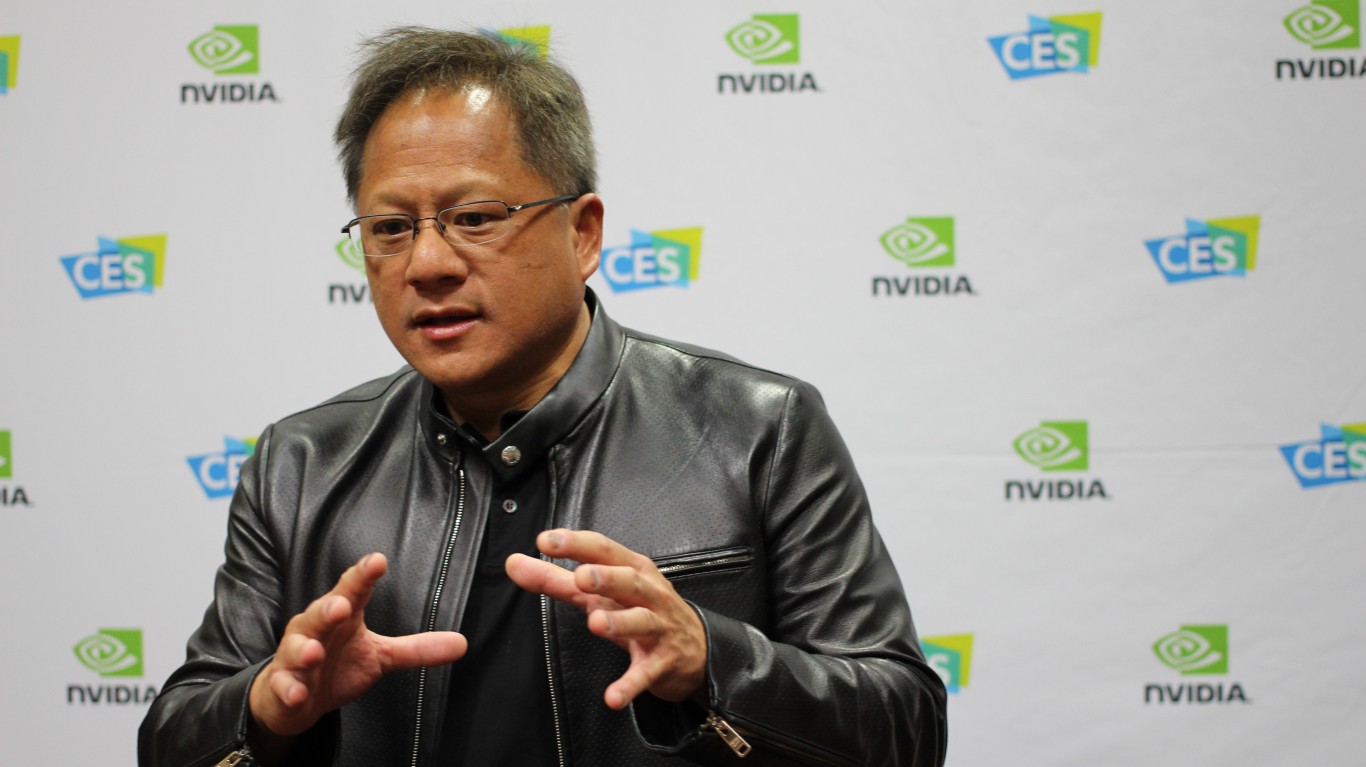

Chipmaker Nvidia Corp. (NASDAQ: NVDA) beat consensus estimates on both the top and bottom lines. Earnings per share (EPS) totaled $3.66, some 11.6% better than forecast. Revenue of $5.66 billion beat the forecast by 4.6%. Nvidia also raised revenue guidance for the current (second) fiscal quarter to a range of $6.15 billion to $6.43 billion, well above the S&P Capital IQ estimate of $5.48 billion.

The stock got only a small boost in Thursday’s premarket trading, and after the opening bell it was down less than 1% to $623.68. The 52-week trading range is $335.17 to $648.57, and the consensus price target is $669.16.

Pure Storage Inc. (NYSE: PSTG) reported results Wednesday evening that exceeded both top-line and bottom-line expectations. EPS broke even, better than the expected loss per share of $0.06, and revenue of $412.7 million topped the forecast of $405.9 million.

The stock traded down about 2.5% to $18.71 early Thursday, in a 52-week range of $13.91 to $29.53. The consensus price target is $28.33.

Cloud platform supplier Snowflake Inc. (NYSE: SNOW) posted mixed results Wednesday evening, with revenue of $228.9 million (more than double year over year) beating the forecast of $213.4 million, while the expected loss per share of $0.16 came in much worse at $0.70. Snowflake guided fiscal second-quarter revenue to a range of $235 million to $240 million (up by around 90% year over year) and full fiscal year revenue in a range of $1.02 billion to $1.04 billion, up from its prior forecast of $1.0 billion to $1.02 billion.

Early Thursday, the stock traded down about 4%, at $226.24 in a post-IPO range of $184.71 to $429.00. The consensus price target is $296.28.

Best Buy Co. Inc. (NYSE: BBY) posted solid beats on both EPS and revenue Thursday morning. The electronics retailer reported EPS of $2.23, which was 57% better than expected, and revenue totaling $11.64 billion, nearly 12% above the forecast. Enterprisewide same-store sales rose 37.2% year over year. The company said it expects same-store sales to rise by 3% to 6% for the 2022 fiscal year, sharply better than the prior forecast for a range of a 2% loss to a 1% gain.

The stock traded up about 3.1% to $120.68, in a 52-week range of $75.27 to $128.57. The consensus price target on the stock is $118.85.

Medical device maker Medtronic PLC (NYSE: MDT) reported Thursday morning that EPS totaled $1.50 for its fiscal fourth quarter and revenue came to $8.19 billion. The company guided fiscal 2022 EPS in a range of $5.60 to $5.75, compared to the S&P Capital IQ consensus of $5.72. Medtronic also increased its cash dividend beginning with the first quarter of fiscal 2022 to $0.63 per quarter, a jump of 9%. The annual dividend will rise from $2.32 to $2.52.

The stock traded up slightly early Thursday to $126.54. The 52-week range is $87.68 to $132.30, and the consensus price target is $135.11.

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.