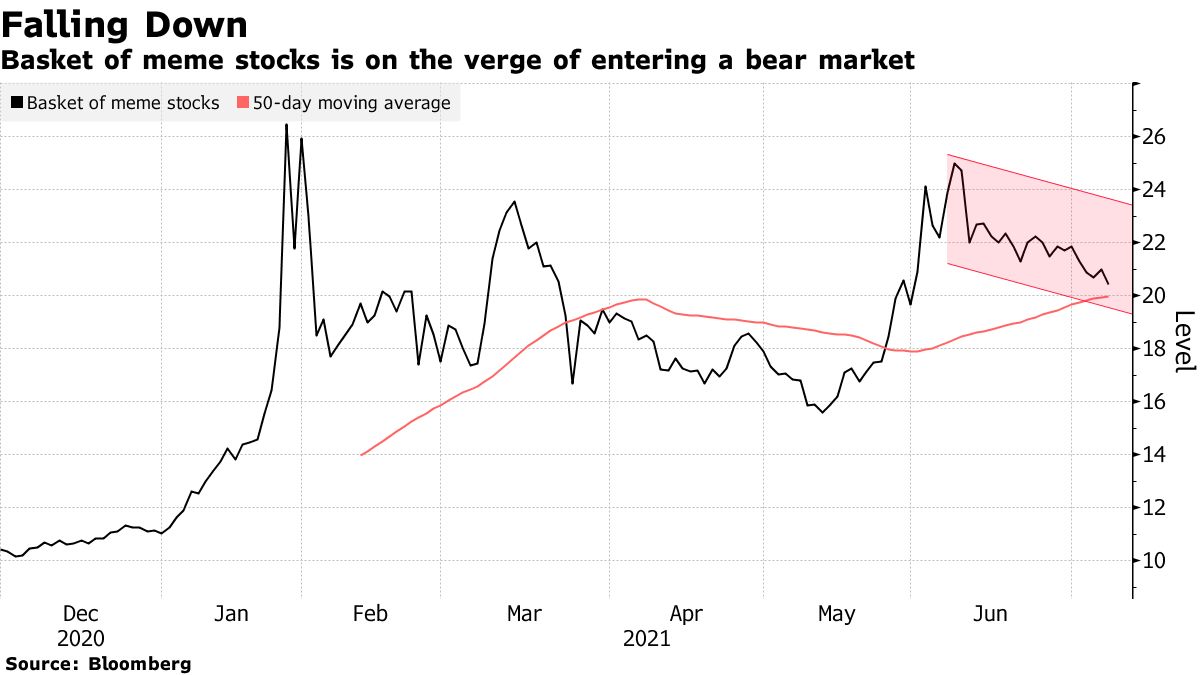

A basket of 37 meme stocks tracked by Bloomberg is nearing a bear-market dive of 20%. At market close on Thursday, the basket’s price was just short of being down 20% from the recent high posted on June 8.

Four of the best-known meme stocks have shed at least 25% of their value over the past month, according to Bloomberg. BlackBerry Ltd. (NYSE: BB) and Naked Brand Group Ltd. (NASDAQ: NAKD) are both down about 27%, GameStop Corp. (NYSE: GME) is down 36.2% and Clover Health Investments Corp. (NASDAQ: CLOV) is down nearly 58% as of Thursday’s closing bell.

There has been a drop of 30% in retail trading, according to Goldman Sachs analyst Will Nance. Eric Liu, co-founder and head of research at Vanda Securities, told Bloomberg, “Retail flows overall have been fairly healthy over the past couple of weeks, though we’re clearly seeing a moderation in buying among the traditional meme names like AMC.”

It’s a sign of the impact that meme stocks have had on the market in just six months that Liu can use the word “traditional” to describe meme stocks like AMC Entertainment Holdings Inc. (NYSE: AMC).

In addition to price, meme stocks tend to trade at high volumes. AMC trades an average of nearly 160 million shares a day, Naked Brands trades almost 94 million and Clover Health trades about 60 million. BlackBerry is the laggard, trading 42 million a day. Alphabet, with its market cap of around $1.7 trillion, trades about 3.5 million shares on an average day, including both its share classes. Only Apple of the country’s five largest companies could break into the top four meme stock volume leaders. More than 83 million Apple shares change hands every day.

Of course, Bloomberg also said in April that the meme stock movement “appears to be petering out,” noting that its basket of 37 meme stocks had traded essentially unchanged after skyrocketing in late January. Less than six weeks later, the basket had bounced to its highest point since the January peak.

Here’s a Bloomberg chart showing price movements in the basket.

Can the meme stocks reverse their decline and stay out of bear territory? They’ve done it before.

Want to Retire Early? Start Here (Sponsor)

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Have questions about retirement or personal finance? Email us at [email protected]!

By emailing your questions to 24/7 Wall St., you agree to have them published anonymously on a673b.bigscoots-temp.com.

By submitting your story, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.