Two of the nation’s six biggest banks reported June quarter earnings before Tuesday’s opening bell. To no one’s surprise, both beat estimated earnings per share (EPS) and revenue levels. We covered pre-release estimates of both in a Monday report. In a separate preview posted Monday, we previewed Wednesday morning’s quarterly earnings due from Bank of America, Citigroup and Wells Fargo.

Before Thursday’s opening bell, the sixth of the big six banks reports quarterly results, along with the country’s second-largest regional bank, the world’s largest semiconductor manufacturer and a Dow 30 health care stock.

[in-text-ad]

Morgan Stanley

Morgan Stanley (NYSE: MS) has seen its share price rise by around 90% in the past 12 months. The stock’s year-to-date gain is approximately 35.5%, which is down slightly from a percentage gain of 38.4% in early June.

Of 28 surveyed analysts covering the stock, 22 rate the company a Buy or Strong Buy. There is one Strong Sell rating, and the other five recommend holding. The median 12-month price target on the stock is $98, and shares traded Tuesday morning at around $92.10, implying upside potential of 6.4%. At the high target of $116, the potential upside based on the current price is around 26%.

For the second quarter, analysts are forecasting Morgan Stanley’s revenue at $13.96 billion, which would be about 4.1% more year over year, and earnings per share (EPS) of $1.64, down nearly 20% compared with the second quarter of last year. For the full fiscal year, the forecasts call for EPS of $7.08 (up 7.6% year over year) and revenue of $56.1 billion, up almost 16.4%.

The stock currently trades at around 13.0 times expected 2021 EPS, 13.2 times estimated 2022 EPS and 11.5 times estimated 2023 earnings. The stock’s 52-week range is $45.86 to $94.27, and Morgan Stanley pays an annual dividend of $2.80 (yield of 3.02%).

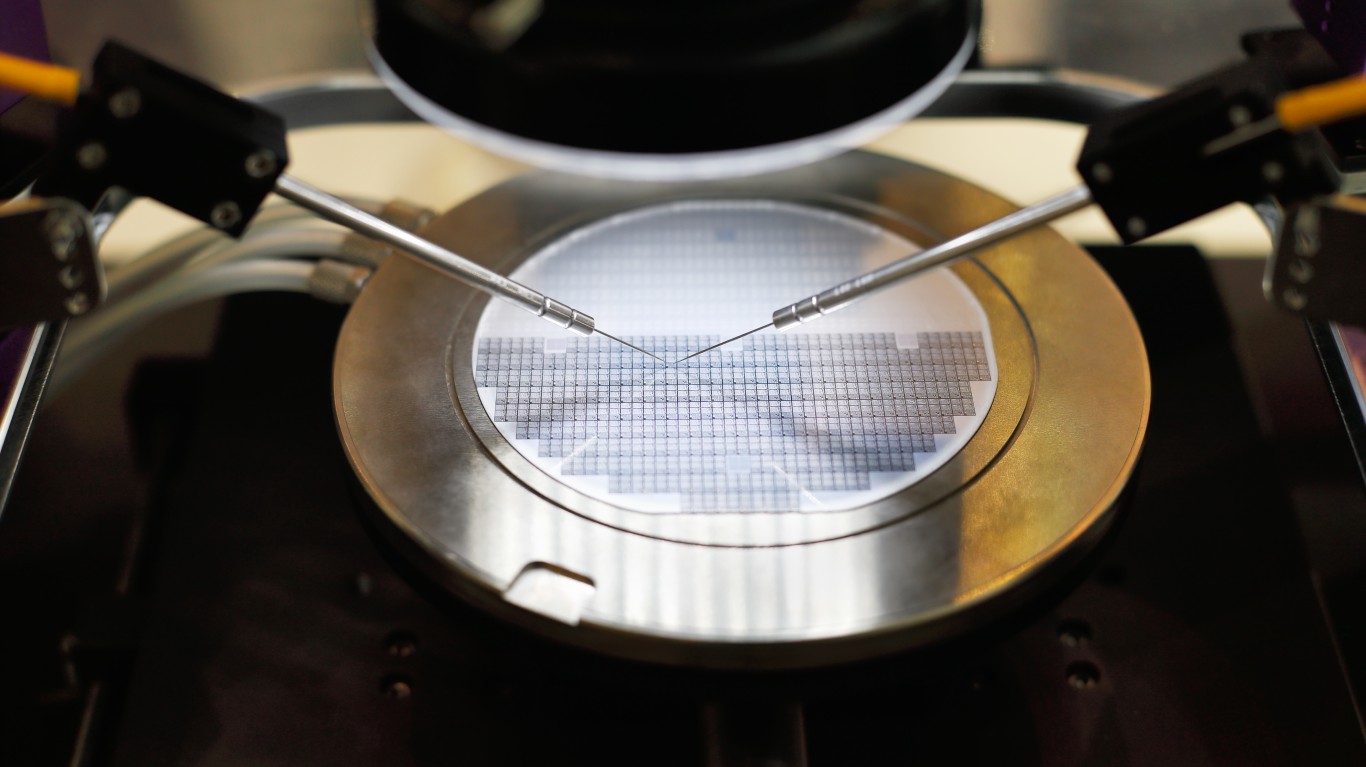

Taiwan Semiconductor

The world’s largest semiconductor manufacturer is Taiwan Semiconductor Manufacturing Co. Ltd. (NYSE: TSM), or TSMC for short. Its $553 billion market cap is more than double that of Intel and about $45 billion higher than that of Nvidia. Over the past 12 months, TSMC’s share price has nearly doubled. Since the beginning of 2021, however, the shares have gained only about 15%, reflecting the market’s outlook on the ability of chipmakers to meet demand for the rest of this year.

Even though the outlook for semiconductors is a bit murky for this year, analysts are bullish on TSMC, with 25 of 28 those surveyed giving the shares a Buy or Strong Buy rating. Just three rate the stock a Hold. At a median price target of $133 and a price of around $124.70, the implied upside on the stock is 7.5%. At a high target of $177, upside potential reaches 42%.

For the company’s fiscal second quarter, analysts are expecting revenue of $13.31 billion, a year-over-year increase of 26%. EPS is expected to improve by a factor of five, from $0.16 a year ago to $0.93. Current estimates for the full fiscal year call for EPS of $3.99, up about 17% year over year, and revenue of $56.24 billion, up 18% year over year.

The stock trades at around 5.4 times expected 2021 EPS, 4.6 times estimated 2022 EPS and 3.9 times estimated 2023 earnings. TSMC’s 52-week range is $64.32 to $142.20, and the company pays an annual dividend of $1.81 (yield of 1.47%).

UnitedHealth

Dow Jones industrial average component UnitedHealth Group Inc. (NYSE: UNH) is the country’s largest health insurer, with a market cap of more than $390 billion. Over the past 12 months, the share price has risen by about 45%, including a gain of nearly 20% to date in 2021. The stock is trading close to its year-to-date high and could break through that level if it beats quarterly expectations.

Analysts overwhelmingly rate the company a Buy (17 of 26) or Strong Buy (5). Just three rate the stock a Hold, with one maintaining a Strong Sell rating. The trading price on the stock is around $417.30, and the 12-month median price target is $440, implying a potential upside of roughly 5.2%. At the high price target of $522, the implied upside is around 25%.

For the second quarter, analysts are forecasting revenue of $69.51 billion, up 5.4% year over year, and EPS of $4.45, down more than 37% year over year. For the full year, current estimates call for revenue of $281.43 billion (up 9.4% year over year) and EPS of $18.58, up 10% year over year.

The stock trades at around 22.4 times expected 2021 EPS, 19.4 times estimated 2022 EPS and 17.3 times estimated 2023 earnings. United Health’s 52-week range is $289.64 to $425.98, and the company pays an annual dividend of $5.80 (yield of 1.39%).

U.S. Bancorp

U.S. Bancorp (NYSE: USB) has a market cap of nearly $83 billion. The stock price has risen by around 61% over the past 12 months, including a gain of 23.4% so far in 2021. At its mid-May peak this year, the stock was up 34.5%.

Analysts’ sentiment on the stock is mixed, with 11 of 24 rating the shares a Hold and 13 rating the stock a Buy or Strong Buy. The median 12-month price target on the stock is $62 and, at a recent price of around $56.60, the implied gain on the stock is 9.5%. At the high target of $73, upside potential is around 29%.

Analysts expect the regional bank to report revenue of $5.62 billion, down from $5.81 billion in the year-ago quarter, and EPS $1.12, up from $0.41 last year. For the full year, analysts are forecasting EPS of $4.75, up more than 55% year over year, and revenue of $22.5 billion, down about 3.1% year over year.

The stock trades at around 11.9 times expected 2021 EPS, 12.7 times estimated 2022 EPS and 11.8 times estimated 2023 earnings. The stock’s 52-week range is $34.17 to $62.47, and U.S. Bancorp pays an annual dividend of $1.84 (yield of 3.20%).

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.