Investing

Earnings Previews: AMC, New Oriental Education and 3 Cathie Wood Picks

Published:

More than a third of earnings reports released Friday morning failed to meet consensus estimates for profits, revenues or both. That is a pretty poor showing, given the high percentage of companies that are beating estimates.

There are no reports scheduled after the bell Friday, but we already have previewed five firms reporting before Monday’s opening bell: Barrick Gold, BioNTech, Dicerna, Trade Desk and Workhorse. Though not heavily followed, Dicerna and Trade Desk are included in exchange-traded funds from Cathie Wood’s ARK Investment Management.

There are no earnings reports scheduled for Friday afternoon, but here is a preview of two firms set to report quarterly results after markets close Monday and three more reporting before Tuesday’s opening bell. Three of the five are among stocks included in the ARK Invest ETFs.

For the year to date, the stock with the largest share price gain of any U.S. traded stock is AMC Entertainment Holdings Inc. (NYSE: AMC). Shares are up 1,480% in 2021, but since a recent peak in mid-June, shares have dropped by about 45%, from almost $61 a share to about $33.50. The expected surge in theater attendance during the summer has been stymied by the Delta variant of the coronavirus and the simultaneous release of new movies to theaters and on streaming services.

AMC gets very little attention from brokerages. Only nine surveyed analysts cover the stock, and none rates the shares higher than a Hold. Three give the stock a Sell rating and another has slapped on a Strong Sell rating. The stock traded Friday morning at around $32.20, nearly 10 times the median price target of $3.70, and essentially double the high price target of $16.

Revenue is forecast to reach $382.11 million in the second quarter, up more than 150% sequentially and up about 20 times the $18.9 million revenue total for the second quarter of last year. AMC is expected to post an adjusted loss per share of $0.96, compared to the prior quarter’s loss of $1.42. In the same quarter last year, the company posted a loss per share of $5.36. For the full year, analysts are forecasting a loss per share of $3.37 compared to last year’s loss of $16.15 per share. Revenue is forecast to double to $2.49 billion.

AMC is not expected to post a profit in 2021, 2022 or 2023. The enterprise value-to-sales multiple for 2021 is 10.3, for 2022 is 5.4 and for 2023 is 5.0. The stock’s 52-week trading range is $1.91 to $72.62. The company does not pay a dividend.

Vuzix Corp. (NASDAQ: VUZI) manufactures the display screens used in augmented reality (AR) and other smart glasses. Over the past 12 months, the company’s shares have added about 234% to their share price, most of that coming since early December of 2020. Shares currently trade at about their level in early March, after peaking on April 8. Cathie Wood’s ARK Autonomous Technology & Robotics ETF and ARK Next Generation Internet ETF hold a total of about 6.32 million shares of Vuzix stock, valued at around $88.54 million.

The stock gets little broker coverage, with just three analysts. Two have a Buy rating on the stock and the other one rates the stock at Hold. At a price of around $13.75, the stock’s implied gain based on an average (and high) price target of $30 is 118%.

Second-quarter revenue is forecast at $4.33 million, up about 10.6% sequentially and 42% higher year over year. Vuzix is expected to post a loss per share of $0.10, better than the $0.12 per share loss in the first quarter and the $0.13 per share loss in the same quarter last year. For the full year, the company is expected to lose $0.40 per share, compared to a loss of $0.52 per share last year. Revenue for the year is expected to rise by 90% to $22.04 million.

Vuzix is not expected to post a profit in either 2021 or 2022. The enterprise value-to-sales multiple for 2021 is 33.2, for 2022 is 17.4 and for 2023 is 12.8. The stock’s 52-week range is $3.24 to $32.43. Vuzix does not pay a dividend.

Arcturus Therapeutics Holdings Inc. (NASDAQ: ARCT) develops RNA medicines to treat liver and respiratory care diseases. The stock trades down about 7.5% over the past 12 months, although it has gained 74% since July 29. Cathie Wood’s ARK Genomics Revolution ETF holds about 2.7 million shares of Arcturus stock, valued at around $146.1 million. The company reports second-quarter results Tuesday morning.

Of 14 analysts covering the stock, seven have given it a Buy or Strong Buy rating and another four rate the shares at Hold. At a price of around $52.20, the stock’s implied upside base on a median price target of $71 is 35%. At the high target of $160, the upside potential is more than 200%.

Analysts expect the company to report revenue of $2.55 million, 20% higher sequentially and up 10% year over year. Arcturus is expected to lose $2.25 per share for the quarter, about four times larger than its per-share loss in the second quarter of last year and $0.10 lower than the prior quarter loss. For the year, the loss per share is estimated at $5.99, larger than last year’s loss of $3.55 per share. Revenue, however, is forecast to rise by more than 1,000% to $110.43 million.

After this year’s adjusted loss, Arcturus is forecast to post positive earnings in 2022 and 2023. Based on the current share price, the multiple to estimated 2022 earnings is 13.3 and to estimated 2023 earnings is 5.2. The stock’s 52-week range is $24.87 to $129.71. Arcturus does not pay a dividend.

New Oriental Education & Technology Group Inc. (NYSE: EDU) is a Beijing-based test preparation, after-school tutoring and language training service. The stock has collapsed since late April and now trades down about 85% over the course of the past 12 months. Not only has the Chinese government taken a dim view of overseas-listed companies like this one, but it also has declared that companies would be constrained from making profits from teaching school curricula.

News travels slowly in the analysts’ world apparently. Of 12 ratings on the stock, five are a Buy and five are a Hold. The other two are Sell ratings. At a price of around $2.20, the upside potential to a median price target of $5.35 is 143%. At the high target of $23.55, the implied gain is 970%. Barring a change of heart by Chinese authorities, you’d need to believe in the tooth fairy to think New Oriental is going to reach either target.

Analysts are looking for second-quarter revenue of $887.69 million when the company reports results Tuesday morning. That is down 5.7% sequentially but up about 13% year over year. Adjusted earnings per share (EPS) are tabbed at $0.43, down 68% sequentially and about 19% higher year over year. For the full year, EPS are expected to fall from $3.03 a year ago to $0.28. Revenue, however, is forecast to rise to $4.18 billion, a year-over-year increase of about 17%.

New Oriental stock trades at 7.7 times to expected 2021 EPS, 5.8 times estimated 2022 earnings and 4.7 times estimated 2023 earnings. The stock’s 52-week range is $1.94 to $19.97, and the company does not pay a dividend.

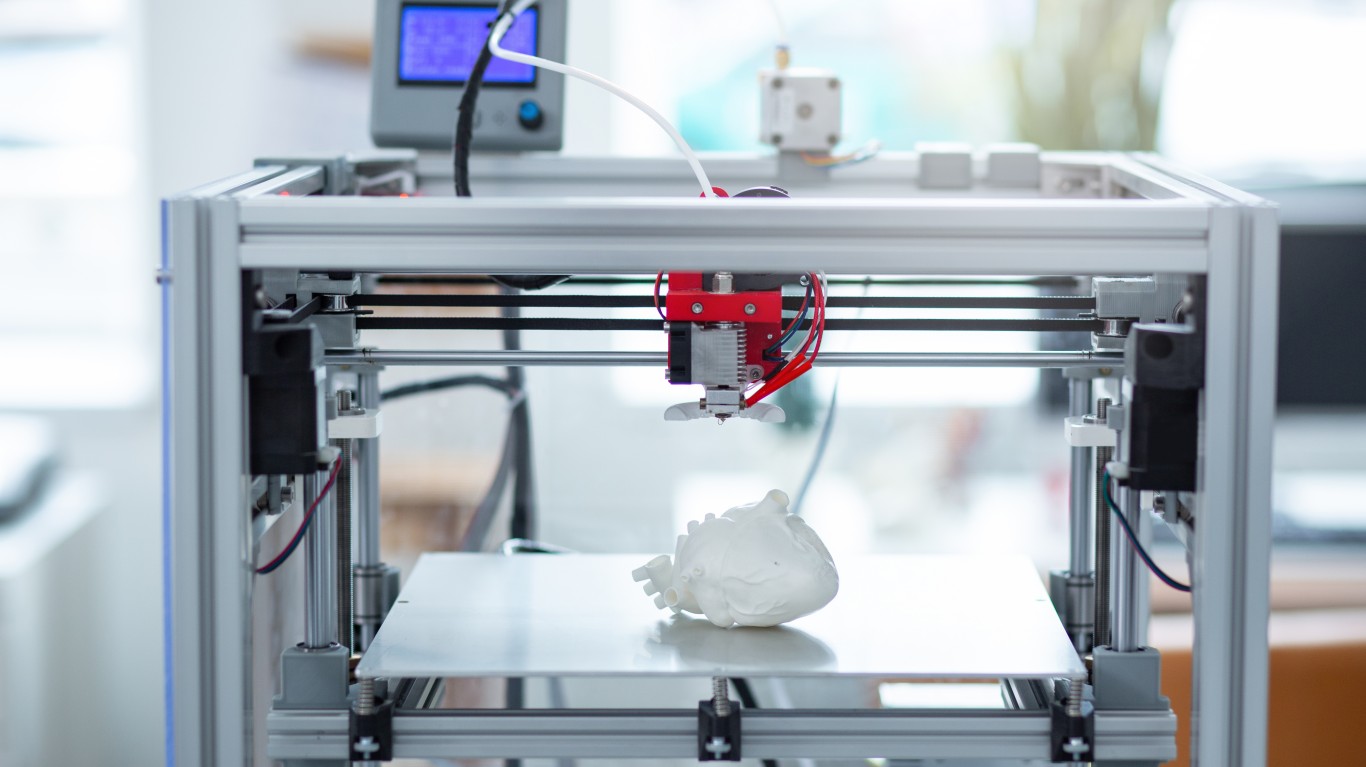

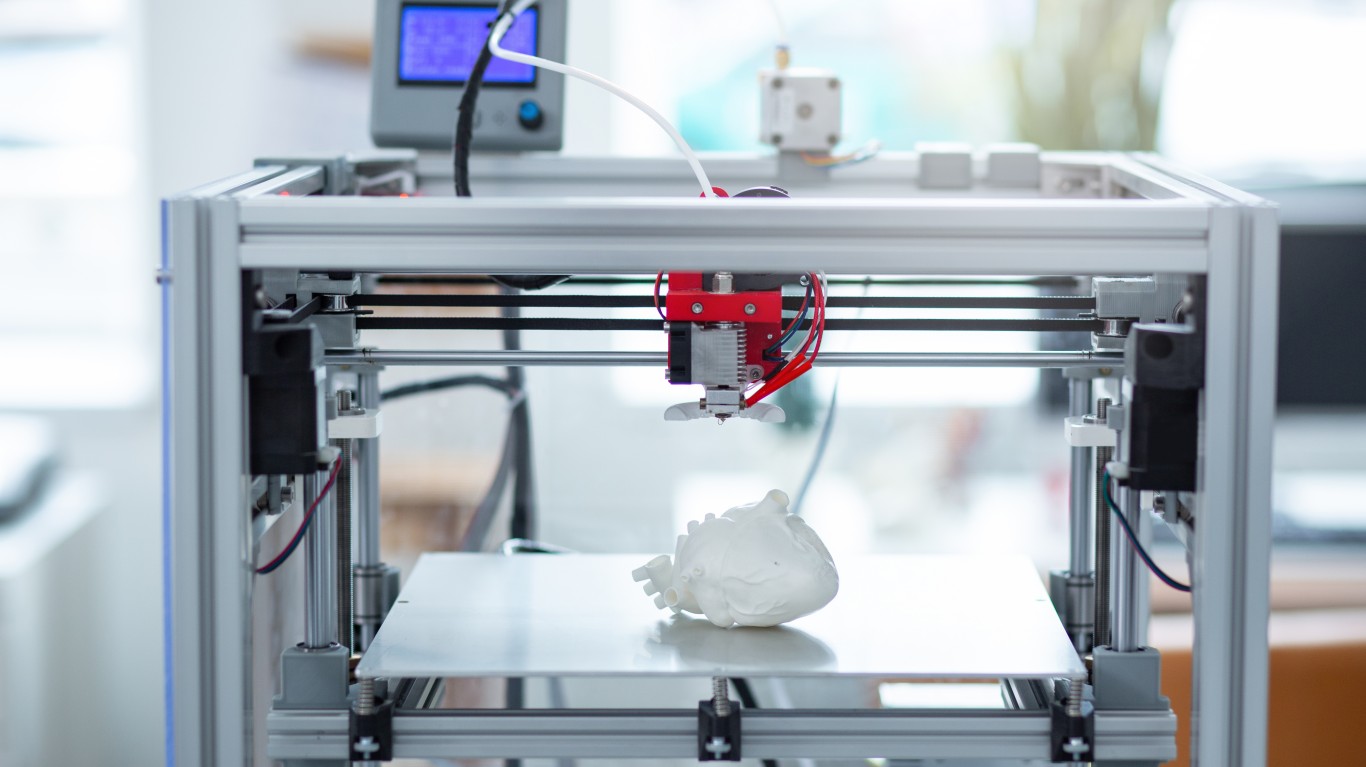

3D Systems Corp. (NYSE: DDD) had its all-star moment in late 2014 when 3D printing was the hot new technology. Since then the stock had fallen by around 90% to September of last year. Over the past 12 months, the stock has added nearly 300%. Cathie Wood’s ARKQ ETF holds about 2.6 million shares of the stock, valued at around $73.1 million. 3D Systems is also the second-largest holding in ARK Invest’s 3D Printing ETF. The company is set to report earnings first thing Tuesday morning.

Only nine analysts cover the stock, with six rating the shares at Hold and just one with a Buy rating. At a trading price of $27.75, the shares have outrun their median price target of $24.50, but they have upside potential of 4.5% to the high target of $29.

The revenue forecast comes in at $143.28 million, down nearly 2% sequentially, but up nearly 28% year over year. Adjusted EPS are forecast at $0.05, down about 70% sequentially, but well above a $0.13 loss per share a year ago. For the full year, EPS are expected to come in at $0.37 compared to a loss per share of $0.11 in 2020. Revenue is expected to improve by about 6.8% to $594.87.

3D Systems stock trades at 71.7 times expected 2021 EPS, 62.9 times estimated 2022 earnings and 40.0 times estimated 2023 earnings. The stock’s 52-week range is $4.60 to $56.50, and the company does not pay a dividend.

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.