Before markets opened on Thursday, department store giants Kohl’s and Macy’s both reported results that topped analysts’ expectations.

After markets close, and before Friday’s opening bell, we shall hear from Applied Materials and Deere, respectively. There are no earnings reports scheduled for release after markets close on Friday.

Here’s a preview of two companies scheduled to report quarterly results first thing Monday.

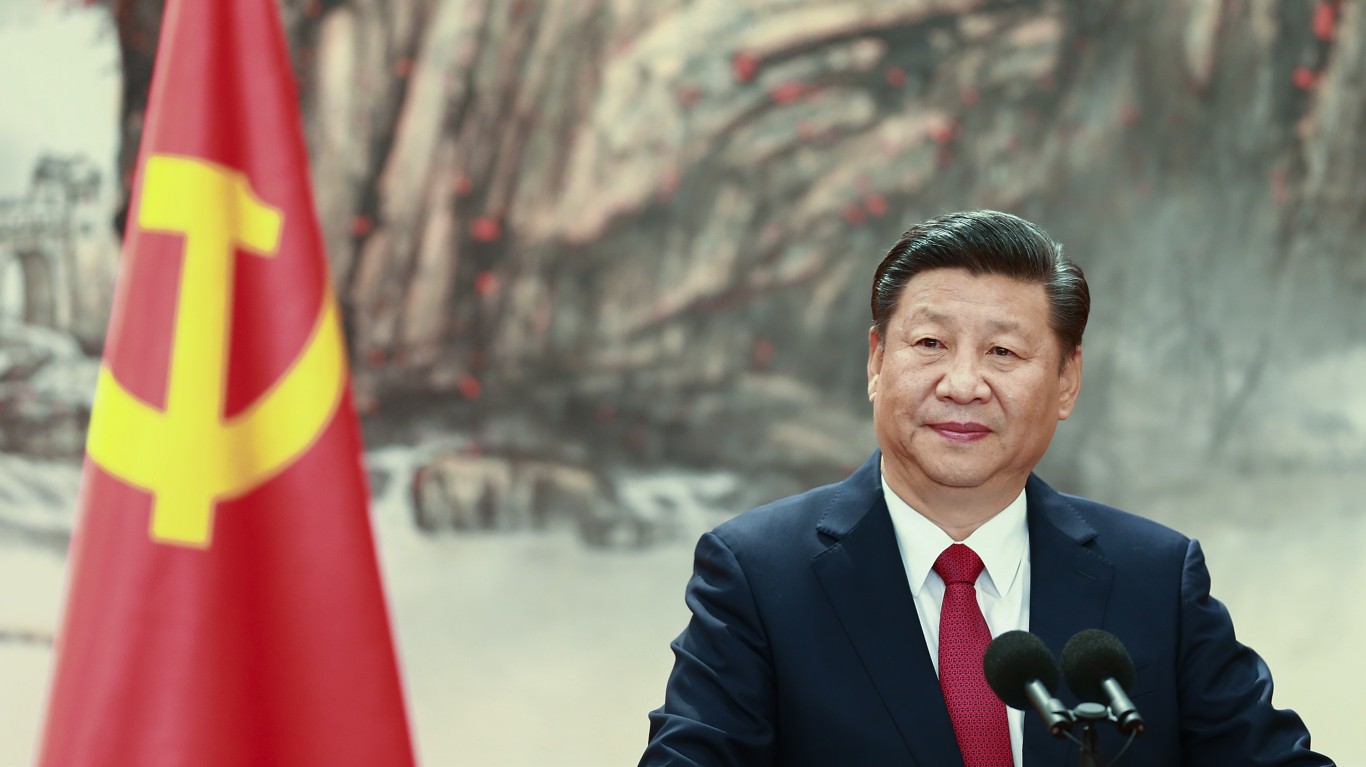

JD.com

Beijing-based JD.com Inc. (NASDAQ: JD) is the second-largest Chinese e-commerce company, but a distant second to Alibaba and in a virtual tie with Pinduoduo. Over the past 12 months, the stock has dropped by about 11%, including a drop of almost 29% in 2021. Two of Cathie Wood’s ARK Invest funds include shares of JD.com: ARK Fintech Innovation ETF and ARK Autonomous Technology & Robotics ETF. Two other ARK Invest funds have exited their positions in the stock. At the end of June, the ARK funds held a total of 6.27 million shares in JD.com. As of Wednesday’s close, the holding had shrunk to around 2.15 million shares.

Of 38 analysts covering the stock, 36 give the company a Buy or Strong Buy rating. At a price of around $62.30, the stock’s implied upside based on a median price target of $96.03 is about 54%. At the high price target of $129.63, the upside potential is about 108%.

Analysts expect JD.com to report second-quarter adjusted earnings per share (EPS) of $0.35, up by about 128% sequentially and down 30% year over year, on revenue of $38.29 billion, up about 23.5% sequentially and up about 28% year over year. For the full fiscal year, EPS are forecast at $1.34, up about 65%, on sales of $147.03 billion, up about 29% year over year.

JD.com stock trades at 47.9 times expected 2021 EPS, 29.1 times estimated 2022 earnings and 20.3 times estimated 2023 earnings. The stock’s 52-week range is $61.65 to $108.29, and the company does not pay a dividend.

TAL Education

Like JD.com, TAL Education Group (NYSE: TAL) is based in Beijing. Also like JD.com, the company’s business model is under scrutiny by the Chinese government. While JD.com has seen its shares fall over the past year, and especially in 2021, TAL’s shares have plunged, down about 93% for the past 12 months, all of it since late February of this year.

Thursday morning, TAL posted a press release announcing significant changes in its after-school tutoring business stemming from new government regulations. Here’s the money quote: “[T]he excessive burden upon students from school homework and after-school tutoring, the education expenditures from their families and the burden on their parents’ energy will be effectively reduced by the end of 2021, with significant impact achieved within two years.”

Analysts definitely have mixed opinions about TAL stock. Of 26 brokerages covering the stock, nine rate the shares at Buy or Strong Buy, nine give the stock a Hold rating and eight have assigned ratings of Sell or Strong Sell. At a share price of around $5.10, the stock’s potential upside based on a median price target of $21.25 is about 317%. At the high target of $117.79, the upside potential is about 2,200%.

For the company’s first quarter of fiscal 2022, analysts have forecast revenue of $1.29 billion, down about 5.5% sequentially and up about 42% year over year. TAL is expected to post a loss per share of $0.02, much worse than the year-ago profit per share of $0.18. For the full year, estimated EPS are $0.57, up more than 300%, and revenue is estimated to reach $5.26 billion, an increase of 17%.

TAL Education stock trades at 9.1 times expected 2022 EPS, 5.4 times estimated 2023 earnings and 6.0 times estimated 2024 earnings. The stock’s 52-week range is $4.03 to $90.96. The company does not pay a dividend, and the average daily trading volume exceeds 32 million shares.

100 Million Americans Are Missing This Crucial Retirement Tool

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.