The broad markets closed higher on Wednesday, bouncing back from a recent string of daily losses. Major indexes gained less than 1%, with strength in the energy and industrials sectors. Neither is a hotbed of meme stock activity.

Without question, the hottest stock of the week so far is IronNet Cybersecurity Inc. (NYSE: IRNT). Since coming public on August 27, the stock price had more than doubled as of Wednesday’s close, after setting a new post-IPO high of $32.72. Shares traded up about 45% in Thursday’s premarket session.

IronNet reported quarterly earnings on Tuesday that were more than modest, except insofar as the company’s projections for a solid increase in subscription revenues this year. The company’s cloud-based subscription revenue jumped 65% year over year and currently accounts for 60% of the company’s total revenue. Subscription revenue is expected to reach $75 million in the fiscal year, a big jump from the $12 million the company reported for the first half of the year.

As of August 31, about 26% of IronNet’s shares were sold short. While that’s a fair-sized target for a short squeeze, the run-up in IronNet’s price may have more to do with a rosy outlook for cybersecurity stocks in general.

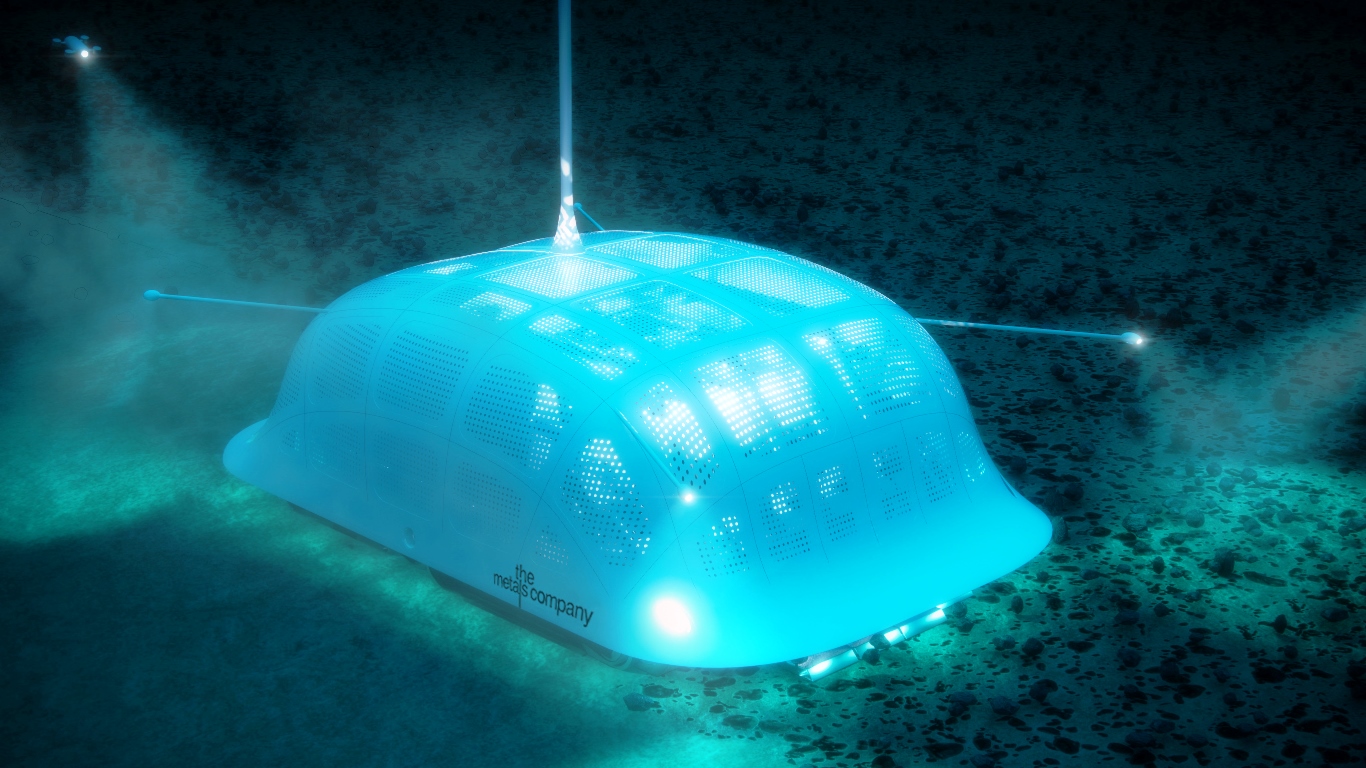

Another stock soaring in premarket trading Thursday was TMC the metals company Inc. (NYSE: TMC). The company came public less than a week ago in a SPAC merger. TMC plans to mine an undersea deposit of metals, including cobalt, copper and manganese, that can be collected from the ocean floor with little to no environmental impact. All the metals are contained in what are known as polymetallic nodules and are in high demand for use in lithium-ion batteries for electric vehicles.

TMC’s initial public offering was anything but a massive success, delivering just $137 million in new cash. Maybe it just took a few days for investors to figure out what the company plans to do. Or maybe it is, as Bloomberg suggests, a case of greenwashing.

In any event, the stock closed at $9.40 on its first day of trading, after dipping as low as $8.31. The stock closed at $10.00 on Wednesday and traded up 43% at $14.31 in Thursday’s premarket session.

AMC Entertainment Holdings Inc. (NYSE: AMC) closed down about 1% on Wednesday despite CEO Adam Aron’s tweet confirming that the company will accept cryptocurrencies other than bitcoin for online ticket and concession payments. The shares traded lower again Thursday morning.

Greenidge Generation Holdings Inc. (NASDAQ: GREE) dropped 22.5% on Wednesday, its second day of trading following a reverse merger with Support.com. Shares traded up by less than 1% in Thursday’s premarket session.

100 Million Americans Are Missing This Crucial Retirement Tool

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.