A couple of financial sector heavyweights lead off the September quarter earnings season Tuesday morning, with many of the sector’s other giants coming later in the week.

Scattered among the financials this week are the world’s largest chipmaker, a couple of Dow Jones industrial stocks, and a major materials producer. Next week, the floodgates open.

[in-text-ad]

Here’s a look at three major earnings reports due before markets open on Wednesday.

BlackRock

The world’s largest investment management firm, BlackRock Inc. (NYSE: BLK), claims more than $9 trillion in assets under management. Over the past 12 months, its shares have added about 45%, including a drop of 11% since late August. The Financial Times reported Monday morning that three of the firm’s top fixed-income bond ETFs have posted net outflows of nearly $24 billion this year. Not a huge dip, considering BlackRock’s massive asset base, but a signal, perhaps, that chasing returns could continue the erosion in fixed-income exchange-traded funds.

Analysts remain bullish on the firm, with 10 of 13 giving the shares Buy or Strong Buy ratings and the rest rating the stock at Hold. At the recent price near $846.50, the upside potential on the shares, based on a median price target of $989, is 16.8%. At the high price target of $1,117, the upside potential is 32%.

Third-quarter 2021 revenue is forecast at $4.89 billion, up about 1.5% sequentially and nearly 12% higher year over year. Adjusted earnings per share (EPS) are forecast at $9.61, down 4.2% sequentially and up 4.2% year over year. For the full 2021 fiscal year, analysts are currently forecasting EPS of $37.85, up 12.9%, on sales of $16.2 billion, up 20.0%.

BlackRock stock trades at 22.3 times expected 2021 EPS, 19.8 times estimated 2022 earnings and 17.7 times estimated 2023 earnings. The stock’s 52-week range is $587.90 to $959.89. The company pays an annual dividend of $16.52 (yield of 1.96%).

JPMorgan

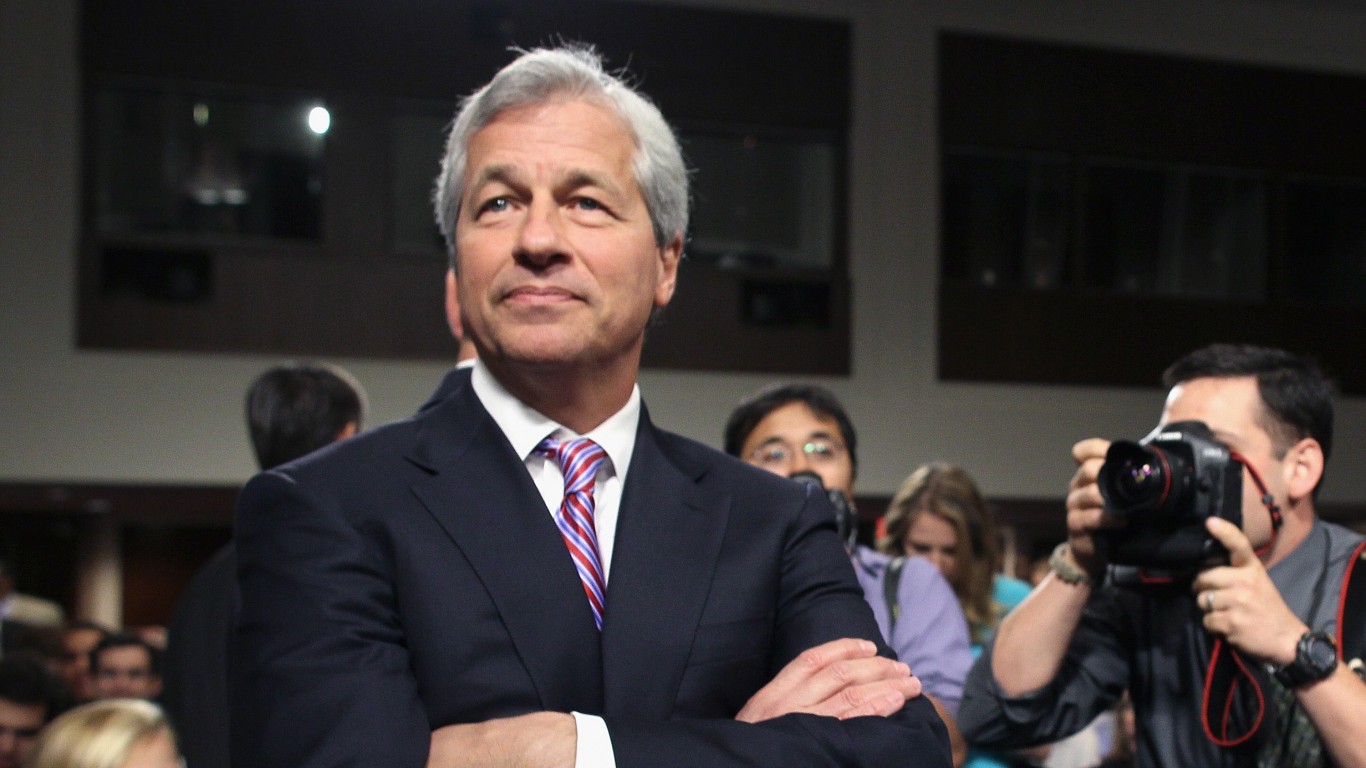

The largest (by market cap) of the big U.S. banks, JPMorgan Chase & Co. (NYSE: JPM) has seen a share price jump of 75% over the past 12 months. Just over 37% of the gain has come since the beginning of 2021. Perhaps the most anticipated data point will be the bank’s operating leverage, the ratio between the 12-month change in expenses and revenues. Analysts have forecast that several big banks, including JPMorgan, will report negative operating leverage in the third quarter.

CEO Jamie Dimon wasn’t especially concerned when the bank reported second-quarter results in July. During the conference call, Dimon commented: “We do not manage the company so we could tell analysts what the expense number is going to be.” JPMorgan is one of four big bank stocks we screened today that remain top dividend buys.

[in-text-ad]

Of 26 analysts covering the stock, 16 have a Buy or Strong Buy rating on the shares, while another seven rate the stock at Hold. At a trading price of around $170.20, the upside potential, based on the median price target of $175, is 2.8%. At the high price target of $200, the upside potential is 17.5%.

Analysts are expecting JPMorgan to report third-quarter revenue of $29.67 billion, which would be down about 2.7% sequentially and up 1.8% year over year. Adjusted EPS are forecast at $3.00, down 20.6% sequentially and 2.9% year over year. For the full fiscal year, current estimates call for EPS of $14.17, up 67%, on revenue of $122.2 billion, up 2.2%.

JPMorgan stock trades at 12.0 times expected 2021 EPS, 14.4 times estimated 2022 earnings and 13.2 times estimated 2023 earnings. The stock’s 52-week range is $95.24 to $171.51. The high was posted last Thursday. JPMorgan pays an annual dividend of $4.00 (yield of 2.35%).

Delta Air Lines

After a bumpy start to the year, Delta Air Lines Inc. (NYSE: DAL) took off in February and added 37% to its share price. By mid-August, the share price was back at that February level, and the stock is up nearly 15% since then. What that all adds up to is a share price gain of around 32% over the past 12 months and a decline of more than 25% since January of 2020. Getting back to pre-pandemic revenue and profit levels may not happen for Delta, or the other major airline, until late in 2022.

While half of 24 analysts rate the stock at Hold, there are nine Buy ratings and three Strong Buy ratings as well. The message: be patient. At a recent price of around $43.50, the upside potential, based on a median price target of $55, is $28.7%. At the high price target of $67, the upside potential is 54%.

For the third quarter, the consensus revenue forecast is $8.43 billion, up 18.4% sequentially and up 175% year over year. The airline is expected to post EPS of $0.17, the first time since the December quarter of 2019 that has happened. The stock posted a loss per share of $1.07 in the second quarter and $3.30 in the third quarter of 2020. For the full fiscal year, analysts are expecting a loss of $3.93 per share, compared to a year-ago loss of $10.76, on sales of $28.16 billion, up almost 65%.

Delta Air Lines stock trades at 10.8 times estimated 2022 earnings and 6.6 times estimated 2023 earnings. The stock’s 52-week range is $28.74 to $52.28. The company has suspended its dividend payment.

It’s Your Money, Your Future—Own It (sponsor)

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.