Investing

Earnings Previews: Halliburton, Johnson & Johnson, Philip Morris, Procter & Gamble, Steel Dynamics

Published:

Last Updated:

The first week of the September-quarter earnings season is now in the books. At a glance, of 24 companies we followed that reported quarterly results this week, only two missed profit estimates and only three missed revenue forecasts. That’s a high-quality start.

Next week starts off with just a couple of interesting quarterly reports due: grocery store operator Albertsons and financial services company State Street.

[in-text-ad]

After Monday’s closing bell, we shall hear from a bellwether steelmaker, and Tuesday morning includes reports from two Dow Jones industrial average components, an oil patch biggie and a tobacco company.

On August 13, Steel Dynamics Inc. (NASDAQ: STLD) posted an all-time high share price of nearly $75. Over the past 12 months, that represents a share price gain of almost 130%. Since then, the shares have dropped by more than 15% but still show an overall 12-month gain of around 92%. That gain, however, trailed Cleveland-Cliffs (196%), U.S. Steel (170%), Arcelor Mittal (134%) and Nucor (112%).

One might conclude that it has been a pretty good year for steel. Much of the gain, of course, was due to the expected wind-down of the COVID-19 pandemic and a giant infrastructure spending bill emanating from the U.S. government. Neither has quite materialized, but rising hopes have lifted all the steel stocks from three-month lows over the past couple of weeks. Steel Dynamics reports third-quarter results after markets close Monday.

Analysts are bullish on the stock with nine of 11 rating the shares a Buy or Strong Buy and the other two assigning a Hold rating. At a recent price of around $62.20, the upside potential based on a median price target of $75 is 20.6%. At the high price target of $104, the upside potential is 67.2%.

The consensus third-quarter revenue estimate is $5.1 billion, which would be up 14% sequentially and more than double year over year. Adjusted earnings per share (EPS) are tabbed to come in at $4.89, up nearly 44% sequentially and nearly 10 times higher than a year ago. For the full fiscal year, Steel Dynamics is expected to report EPS of $15.84, up more than 450%, on sales of $18.04 billion, up 88%.

The stock trades at 3.9 times expected 2021 EPS, 6.0 times estimated 2022 earnings and 10.1 times estimated 2023 earnings. The stock’s 52-week range is $30.26 to $74.37, and Steel Dynamics pays an annual dividend of $1.04 (yield of 1.69%).

Oilfield services firm Halliburton Co. (NYSE: HAL) will report third-quarter results before markets open on Tuesday. Although the company’s share price has had some big swings over the past 12 months, the stock has doubled in that time.

[in-text-ad]

Rising crude oil prices typically imply more drilling and that’s good news for Halliburton and its peers. It remains to be seen, however, if this time is going to be different. Many exploration and production companies have committed to returning capital to shareholders and that curbs their ability to drill more without piling on more debt. If a new wave of drilling does come about, it is unlikely to result in the number of new oil and gas wells that were drilled between late June of 2009 and October of 2011, when more than 1,000 new rigs began working.

Of 29 analysts covering the company, 18 rate the shares a Buy or Strong Buy and nine have Hold ratings on the stock. At a price of around $25.50, the upside potential based on a median price target of $27.50 is 7.8%. At the high target of $38, the implied gain is 49%.

Third-quarter revenue is forecast to come in at $3.91 billion, up 5.5% sequentially and 31.2% year over year. Adjusted EPS are forecast at $0.28, up 6.8% sequentially and 155% year over year. For full fiscal 2021, analysts are forecasting EPS of $1.05, up 61.3%, on sales of $15.14 billion, up 4.8%.

Halliburton stock trades at 23.4 times expected 2021 EPS, 15.2 times estimated 2022 earnings and 11.9 times estimated 2023 earnings. The stock’s 52-week range is $10.99 to $25.50, and the company pays an annual dividend of $0.18 (yield of 0.73%).

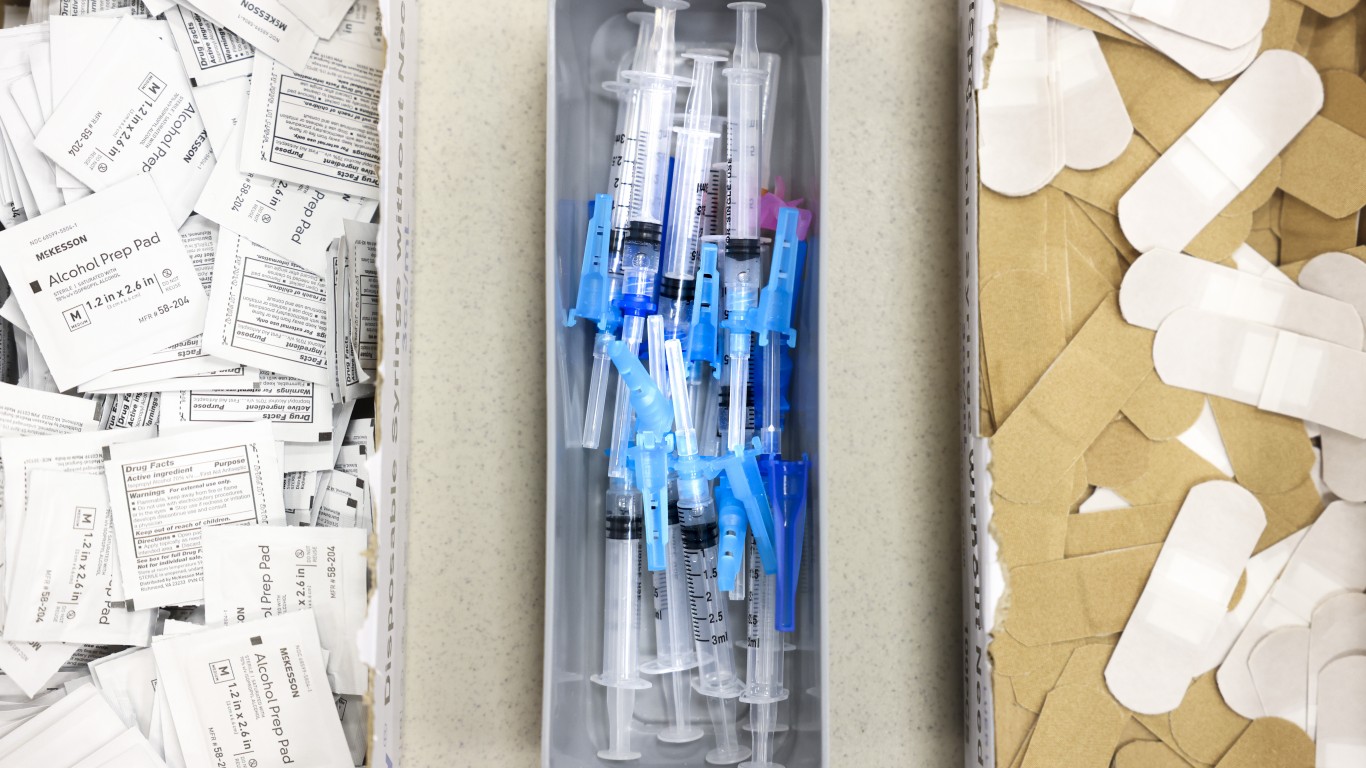

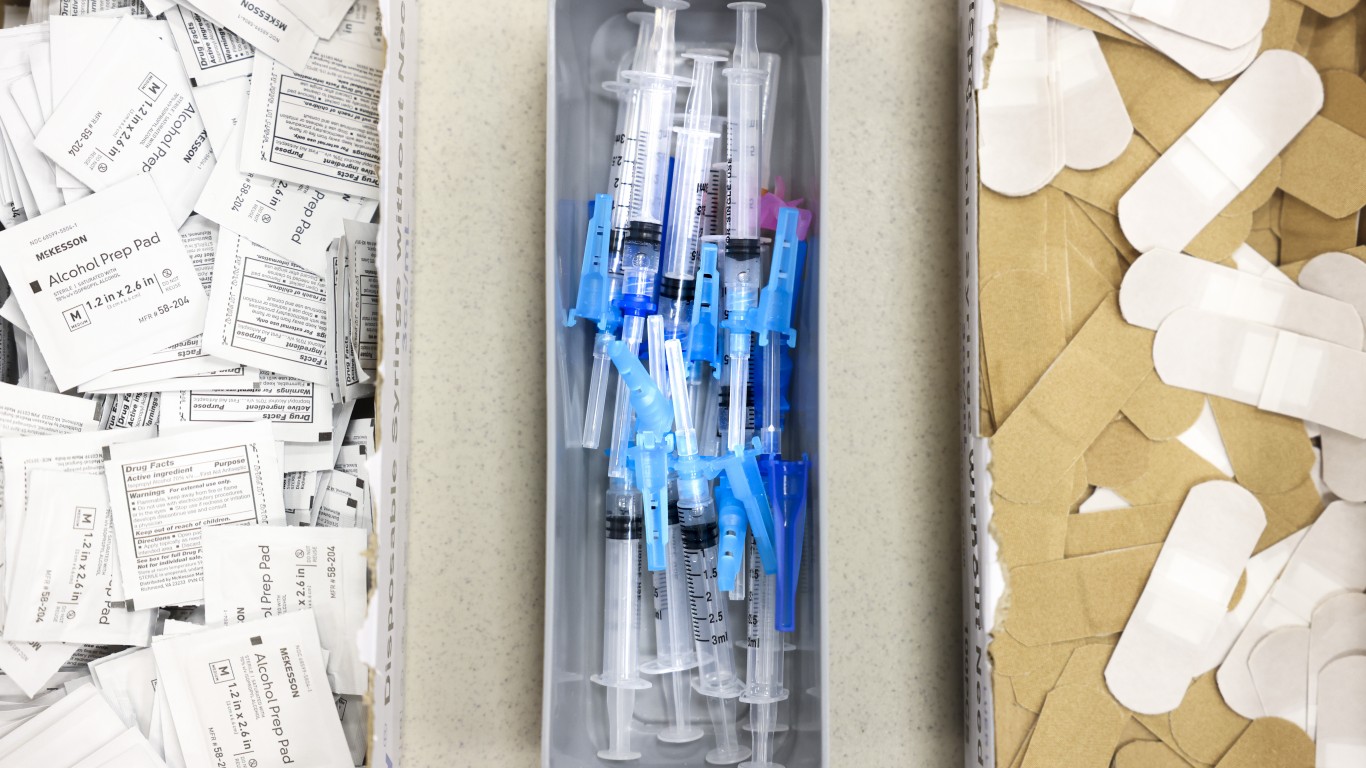

On Thursday, Johnson & Johnson (NYSE: JNJ) announced that a subsidiary it established to hold its liabilities related to billions in liabilities for its talc products was filing for Chapter 11 bankruptcy protection. According to the filing, Johnson & Johnson will set up a $2 billion fund to pay claims demanding as much as $10 billion in payments. The company has paid out some $3.5 billion in claims for the contaminated talc it was selling.

The company also expects the U.S. Food and Drug Administration on Friday to approve a booster shot for its COVID-19 vaccine. Its pharmaceuticals revenue rose by 17% in the second quarter due to the vaccine. The Dow company reports third-quarter results before markets open Tuesday.

Of 18 brokerages covering the company, 10 have Buy or Strong Buy ratings on the stock and the rest rate the shares at Hold. At a trading price of around $160.60, the upside potential based on a median price target is 16.4%. At the high target of $215, the upside potential is nearly 34%.

Third-quarter revenue is forecast at $23.74 billion, up 1.8% sequentially and up 12.6% year over year. Adjusted EPS are expected to come in at $2.36, down 5% sequentially and up 7.2% year over year. For full fiscal 2021, analysts are looking for EPS of $9.65, up 20.1%, on sales of $93.98 billion, up 13.8%.

Shares trade at 16.5 times expected 2021 EPS, 15.3 times estimated 2022 earnings and 14.4 times estimated 2023 earnings. The stock’s 52-week range is $133.65 to $179.92. The company pays an annual dividend of $4.24 (yield of 2.66%).

The maker and distributor of Marlboro cigarettes outside the United States, Philip Morris International Inc. (NYSE: PM) has added about 33% to its share price over the past 12 months. Shares dropped 9.5% in September but have recovered about half that loss in the first two weeks of October. The company reports quarterly results before markets open Tuesday.

[in-text-ad]

Earlier this week, the stock got a positive jolt from FDA approval of a rival’s e-cigarette. Philip Morris’s parent company, Altria, owns a 35% stake in e-cigarette maker Juul that cost the company $12.8 billion in 2018, and on which Altria had written off $11.2 billion by last October. Philip Morris and its peers will continue to see share price gains as long as they can raise prices on their products and generate dividends.

Sentiment on the company is decidedly bullish, with 15 of 20 analysts rating the stock a Buy or Strong Buy and the other five rating the shares a Hold. At a price of around $99.30, the upside potential based on a median price target of $110 is about 10.8%. At the high price target of $130, the upside potential is nearly 31%.

Third-quarter revenue is forecast at $7.93 billion, up 4.4% sequentially and 6.4% year over year. Adjusted EPS are forecast to come in at $156, down a penny sequentially and up about 11% year over year. For full fiscal 2021, Philip Morris is expected to report EPS of $6.09, up nearly 18%, on sales of $31.17 billion, up 8.7%.

The stock trades at 16.0 times expected 2021 EPS, 14.6 times estimated 2022 earnings and 13.2 times estimated 2023 earnings. The stock’s 52-week range is $68.91 to $106.51, and Philip Morris pays an annual dividend of $5.00 (yield of 5.06%).

Dow stock Procter & Gamble Co. (NYSE: PG) has posted a share price gain of less than 3% over the past 12 months, including a drop of 14% in early March. Since that disaster, shares have added more than 19%. Since January of 2020, the stock is up about 22.5%, reflecting market share growth that lifted revenue and profits.

Now, the company faces the same supply chain woes as other firms and the question is can P&G raise its prices to consumers to maintain its profitability. The company reports first-quarter 2022 results before markets open on Tuesday.

Of 21 analysts covering the stock, 11 rate the shares a Buy or Strong Buy and nine more have Hold ratings. At a price of around $144.30, the implied gain based on a median price target of $159 is 10.2%. At the high price target of $167, the implied gain is 15.7%.

Analysts anticipate P&G will report first-quarter fiscal 2022 revenue of $19.83 billion, up 4.7% sequentially and 2.6% year over year. Adjusted EPS are pegged at $1.58, up 40% sequentially and up 3% year over year. For the full fiscal year, current estimates call for EPS of $5.93, up 4.8%, on sales of $78.9 billion, up 3.7%.

Shares trade at 24 times expected 2022 EPS, 22.4 times estimated 2023 earnings and 21 times estimated 2024 earnings. The stock’s 52-week range is $121.54 to $147.23. P&G pays an annual dividend of $3.48 (yield of 2.45%).

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention.

Finding a financial advisor who puts your interest first can be the difference between a rich retirement and barely getting by, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors that serve your area in minutes. Each advisor has been carefully vetted, and must act in your best interests. Start your search now.

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.