More than 1,500 companies are expected to report quarterly earnings this week. Of two in our watch list for Monday afternoon, one (Diamondback Energy) beat on both revenue and profits, while the other (NXP Semiconductors) missed on profits. Three companies we previewed that reported early Tuesday (BP, Pfizer and Under Armour) all beat on both the top and bottom lines.

Monday, we previewed three companies set to report results after markets close Tuesday (Activision Blizzard, Lyft and T-Mobile) and three more set to report results before markets open Wednesday (Cenovus Energy, Discovery and Norwegian Cruise Lines).

Earlier in the day, we previewed five firms set to report earnings after markets close Wednesday (Albemarle, Fisker, MGM Resorts, Qualcomm and Skillz).

Here’s a look at three companies scheduled to report results before markets open on Thursday.

Barrick

Over the past 12 months, the price of gold has dropped by about 6%. Barrick Gold Corp. (NYSE: GOLD) has seen its share price dive by about 29% over the same period.

Last month the company reported preliminary results indicating third-quarter gold sales of 1.07 million ounces and copper sales of 101 million pounds. Gold production totaled 1.09 million ounces and copper production totaled 100 million pounds. The average market price for gold in the quarter was $1,790 per ounce, while the average market price for copper was $4.25 per pound. Since then a slight increase in the share price has turned south. If fears of inflation continue to rise, gold prices are likely to rise with them. That, of course, is good for Barrick.

Analysts continue to be bullish on the stock, however, with 18 of 23 brokerages giving the shares a Buy or Strong Buy rating, and the rest have a Hold rating on the stock. At a recent price of around $18.40, the upside potential based on a median price target of $27 is about 47%. At the high price target of $35, the upside potential is 90%.

Third-quarter revenue is forecast at $287 billion, which would be down less than 1% sequentially and about 19% lower year over year. Adjusted earnings per share (EPS) are forecast at $0.23, down 20% sequentially and 44% lower year over year. For the full year, current estimates call for EPS of $1.16, up 0.8%, on sales of $12.11 billion, down 3.9%.

The stock trades at 15.8 times expected 2021 earnings, 14.8 times estimated 2022 earnings and 15.1 times estimated 2023 earnings. The stock’s 52-week range is $17.56 to $29.60. Barrick pays an annual dividend of $0.36 (yield of 1.95%).

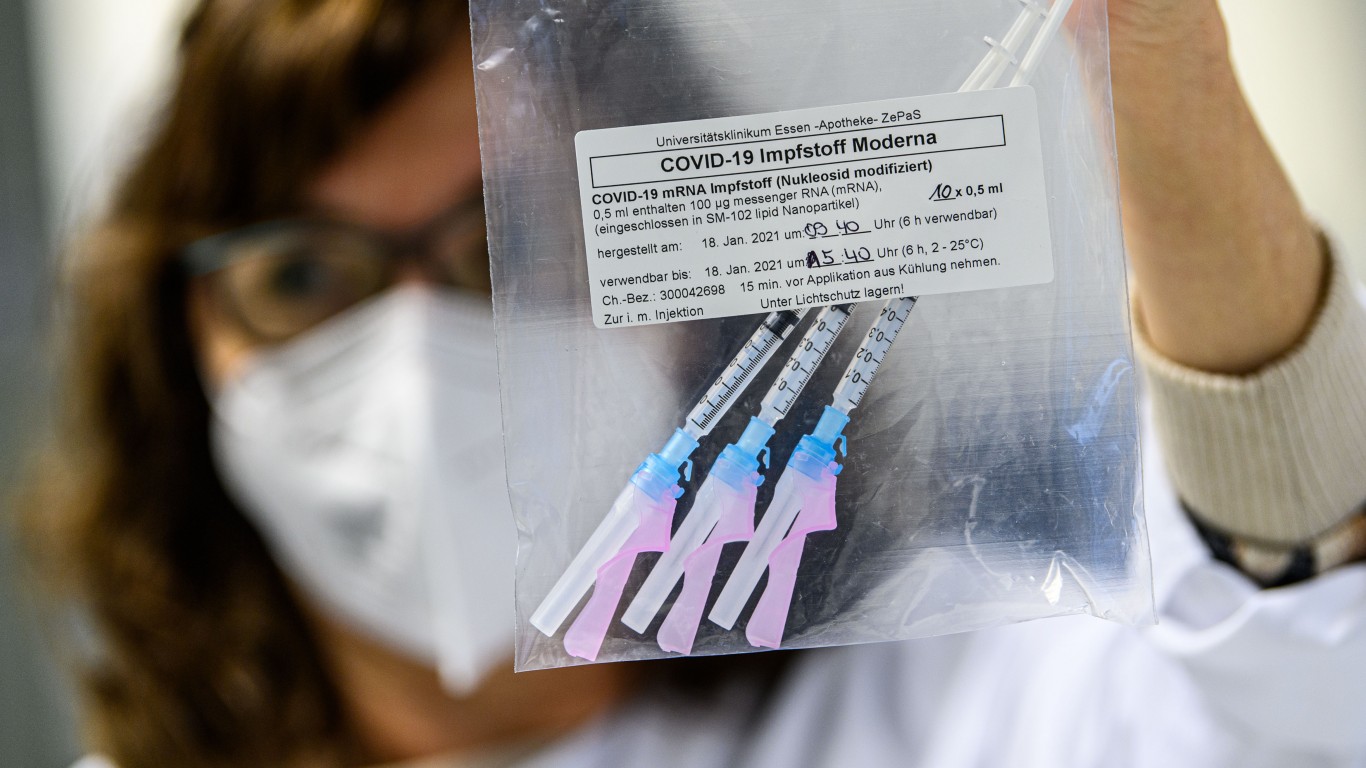

Moderna

Over the past 12 months, shares of COVID-19 vaccine maker Moderna Inc. (NASDAQ: MRNA) have added about 410% to their share price. Pfizer, the other early provider of a similar vaccine, has added about 40% to its share price over the same period. In the first quarter of last year, Moderna reported sales of about $8.4 million. For the full year, the company’s sales totaled $803.39 million. For 2021, sales are expected to rise by a factor of 25.

For a stock that has performed so well, analysts are mixed on its future. Of 17 brokerages covering the stock, seven have Buy or Strong Buy ratings, five have rated the stock a Sell or Strong Sell, and five have a Hold rating. At a price of around $344, the stock trades well above its median price target of $293.50. Based on a high price target of $475, upside potential on the stock is 38%.

Analysts expect Moderna to report third-quarter revenue of $6.29 billion, up 44% sequentially and higher than the $157.9 million in the year-ago quarter. Adjusted EPS are forecast at $9.42, up 46% sequentially and better than a loss per share of $0.59 a year ago. For the full year, EPS is expected to come in at $30.25, up from a loss per share of $1.25 last year, on sales of $20.37 billion, up from $803 million in 2020.

Moderna stock trades at 11.4 times expected 2021 EPS, 11.8 times estimated 2022 earnings and 27.4 times estimated 2023 earnings. The stock’s 52-week range is $66.59 to $497.49. Moderna does not pay a dividend.

Nikola

After coming public in June of last year, shares of electric semi maker Nikola Corp. (NASDAQ: NKLA) soared by 135% in less than a week. Since then, the stock has fallen by 82%. The company’s troubles included a harsh short seller report and replacing the founder and CEO, who was later indicted. Nikola has experienced enough drama in the past nine months to last most companies for at least that many years.

Fortunately, the recent uptick in interest in EV stocks has shined some light on Nikola too. The company’s first fully electric semis are due out before the end of the year, and its fuel cell electric hybrid is due in 2023. Production and revenue should be the company’s focus when it reports quarterly results.

Just eight analysts cover the stock, and six of those have given it a Hold rating. The other two rate the stock at Buy. At a price of around $12.80, the stock trades essentially at its median price target of $13. At the high price target of $25, the implied gain is 95%.

Analysts have no revenue forecast for the third quarter and expect Nikola to report a loss per share of $0.26. In the prior quarter, Nikola reported a loss of $0.20 per share. For the full year, the company is expected to lose $0.89 per share, more than the loss per share of $0.69 in 2020. Analysts also expect Nikola to report $4.77 million in revenue for the full fiscal year.

Nikola is not expected to report a profit in 2021, 2022 or 2023. The projected enterprise value-to-sales multiple for 2022 is 26.3 and for 2023 is 5.6. Forecast revenue for 2022 totals $18.8 million, and for 2023 it is $313 million. The stock’s 52-week range is $9.02 to $37.95. Nikola does not pay a dividend.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.