The number of companies reporting quarterly earnings this week has swelled to more than 1,000 as more companies confirm their plans. Of the four firms we recently previewed, two (Coinbase and Plug Power) missed both earnings and revenue estimates, while Nio beat the consensus revenue estimate but missed on profits. 23andMe delayed its report to Wednesday afternoon.

After markets close on Wednesday, Affirm, Disney, Progenity and SoFi are also expected to report quarterly results. Two more companies (ArcelorMittal and Hut 8) are on deck for Thursday morning.

Here are previews of five reports due out after markets close on Thursday.

Blink

Shares of electric vehicle charging station maker and distributor Blink Charging Co. (NASDAQ: BLNK) surged in late January to a 12-month gain of more than 500%. That surge has been cut in half, and the stock currently trades up about 250% compared with its year-ago price. The share jumped 24% between last Friday’s and Monday’s close thanks to the now-passed federal infrastructure bill. The bill includes some $7.5 billion to add 500,000 EV charging stations to the country’s charging network.

Investors have liked the stock for the past year, but Tuesday brought some second thoughts, apparently, as shares gave back about half of Monday’s gain.

Analysts remain bullish on the stock. Only seven brokerages cover the company, and four rate the shares a Hold while three more have either a Buy or Strong Buy rating. At a recent price of around $34.00 a share, the stock trades above its median price target of $33.50. At the high target of $40, the potential upside is 19%.

Third-quarter revenue is forecast at $4.72 million, which would be up 8.4% sequentially and nearly 420% higher year over year. On a GAAP basis, the estimated loss per share is $0.27 for the quarter, better than the loss of $0.32 per share in the prior quarter, but more than the year-ago loss of $0.12 per share. For fiscal 2021, analysts expect Blink to post a loss per share of $1.05, compared to last year’s loss of $0.59 per share, on revenue of $16.36 million, up 162%.

Blink is not expected to post a profit in 2021, 2022 or 2023. The enterprise value-to-sales multiple is expected to be 78.4 in 2021. Based on estimated earnings for 2023 and 2024, multiples are 46.4 and 24.5, respectively. The stock’s 52-week range is $9.21 to $64.50. Blink does not pay a dividend.

Lordstown Motors

EV maker Lordstown Motors Corp. (NASDAQ: RIDE) has had a rough year. Since posting a 52-week high in mid-February, the stock has dropped by nearly 80%. A short-seller report was followed by a delivery delay for its first vehicle, the Endurance pickup.

With competitor Rivian coming public Wednesday at an IPO price of $78 a share, Rivian’s market cap is likely to be at least 10 times larger than Lordstown’s. And Rivian expects to deliver 1,000 of its R1T pickups to customers by the end of the year. Lordstown did sell its Ohio factory to Foxconn in October for a bargain price of $230 million. Foxconn is gearing up to offer EV assembly plants, much like its iPhone assembly plants in the Far East. What will happen to Lordstown is anyone’s guess.

Of eight analysts covering the stock, six have Sell or Strong Sell ratings. There are one Hold and one Buy rating as well. At a price of around $5.70, Lordstown stock trades above the median price target of $5.00. At the high target of $10, the upside potential is 43%.

Analysts do not expect Lordstown to post any revenue in the third quarter. They also expect a reported loss per share of $0.59, a bit better than the prior quarter’s loss per share of $0.61. For the full year, estimates call for a loss per share of $2.52 (last year’s loss was $1.04 per share) and sales of $3.34 million (there were no sales reported in 2020).

Lordstown is not expected to post a profit in 2021, 2022 or 2023. The enterprise value-to-sales multiple is expected to be 202.4 in 2021. Based on estimated earnings for 2022 and 2023, multiples are 0.8 and 0.6, respectively. The stock’s 52-week range is $4.64 to $31.57. Lordstown does not pay a dividend.

Phunware

Not many people had heard of Phunware Inc. (NASDAQ: PHUN) until late October when the company was linked with former President Donald Trump’s proposed SPAC merger with Digital World Acquisition. Phunware’s share price jumped from around $1 to more than $24 in just two days. The stock traded at around $4 Wednesday morning.

The ephemeral Trump boost has given way to a focus on cryptocurrency trading. Before the link with Trump was announced, the stock traded about 1.5 million to 2.0 million shares daily on average. On October 22, nearly 650 million shares traded hands. While the daily average is now around 26 million, it’s dropping with the share price and the apparent pivot to crypto.

All four analysts covering the stock rate it a Buy or Strong Buy. At the price of around $4.00, the stock trades above its median price target of $1.88. At the high price target of $4.50, the upside potential is 12.5%.

Third-quarter revenue is forecast at $2.27 million, up 58% sequentially but down 27% year over year. Analysts are expecting a loss per share of $0.05, better than the prior quarter’s loss of $0.08 per share and the year-ago loss of $0.10 per share. For the full year, Phunware is expected to report a loss per share of $0.38, a penny worse than a year ago, on sales of $8.24 million, down nearly 18%.

Phunware is not expected to post a profit in 2021 or 2022. The enterprise value-to-sales multiple is expected to be 44.8 in 2021. Based on estimated earnings for 2022 and 2023, multiples are 23.3 and 16.5, respectively. The stock’s 52-week range is $0.60 to $24.04. The company does not pay a dividend.

Sundial

Sundial Growers Inc. (NASDAQ: SNDL) is one of the most heavily traded meme stocks around. More than 85 million shares change hands daily, largely due to the below $1.00 price.

Like all cannabis companies, Sundial is holding on until U.S. legislation removes the dangerous drug label that constrains the U.S. market. Even if federal legalization does come, the industry faces stiff price competition from illegal suppliers and high tax payments from federal, state and local taxes that see cannabis boost to revenue. In spite of all this, Sundial’s share price is up more than 50% over the past 12 months, thanks entirely to an early February spike in meme stock prices.

Of six analysts covering the firm, four have a Hold rating on the stock, and the other two rate the stock at Strong Sell. At a price of around $0.70, the upside potential based on a median price target of $0.80 is 14.3%. The high price target is $0.81, lifting the upside potential to 15.7%.

Sundial is expected to post third-quarter revenue of $13.27 million, up 80% sequentially and 3% higher year over year. Analysts expect the company to break even for the quarter, after posting a loss per share of $0.02 in the prior quarter. For the full year, the company is expected to post a loss per share of $0.08 on sales of $45.25 million, lower by about $2.6 million year over year.

Sundial is not expected to post a profit in 2021, 2022 or 2023. The enterprise value-to-sales multiple is expected to be 14.2 in 2021. Based on estimated earnings for 2022 and 2023, multiples are 9.2 and 7.4, respectively. The stock’s 52-week range is $0.24 to $3.96. Sundial does not pay a dividend.

24/7 Wall St.

24/7 Wall St.Despite Massive Market Melt-Up, 4 Buy-Rated Stocks With Huge Dividends Are Still Cheap

TMC

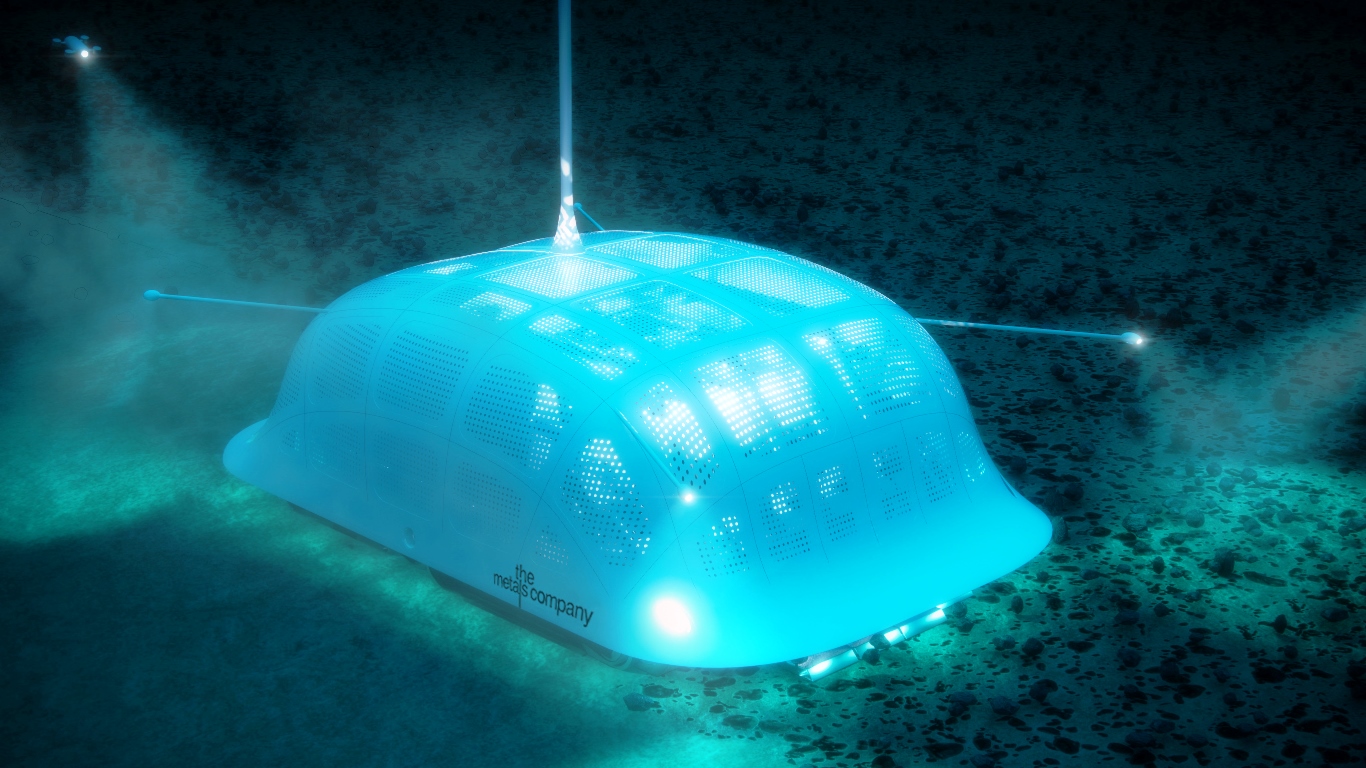

TMC the metals company Inc. (NASDAQ: TMC) came public in early September following a SPAC merger. TMC plans to mine an undersea deposit of metals, including cobalt, copper, and manganese that can be collected from the ocean floor with little to no environmental impact. All the metals are contained in what are known as polymetallic nodules and are in high demand for use in lithium-ion batteries.

The initial exuberance that led to a 25% share price gain gave way to a decline that started about two weeks later that has resulted in a share price decline of almost 69% since the IPO.

The only analyst covering the stock has a Buy rating. At $3.20 per share, the upside to a price target of $20 is about 525%.

There are no quarterly or full-year estimates for profits or revenues, nor are there any multiples based on those estimates. TMC stock’s 52-week trading range is $2.84 to $15.39. More than 9 million shares are traded daily, and the company’s market cap is around $720 million.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.