While the number of earnings reports due out next week is likely to be far fewer than we have seen over the past few weeks, there are some that typically attract a lot of interest. Many retailers will be reporting results next week, beginning with two Dow Jones industrial average stocks coming up Tuesday morning. Among tech stocks, another Dow stock, a red-hot chipmaker and China’s largest e-commerce company.

We already have previewed three companies scheduled to report quarterly results before markets open on Monday: Oatly, Tyson Foods and Warner Music.

Here’s a look at three companies on deck for earnings after markets close Monday afternoon.

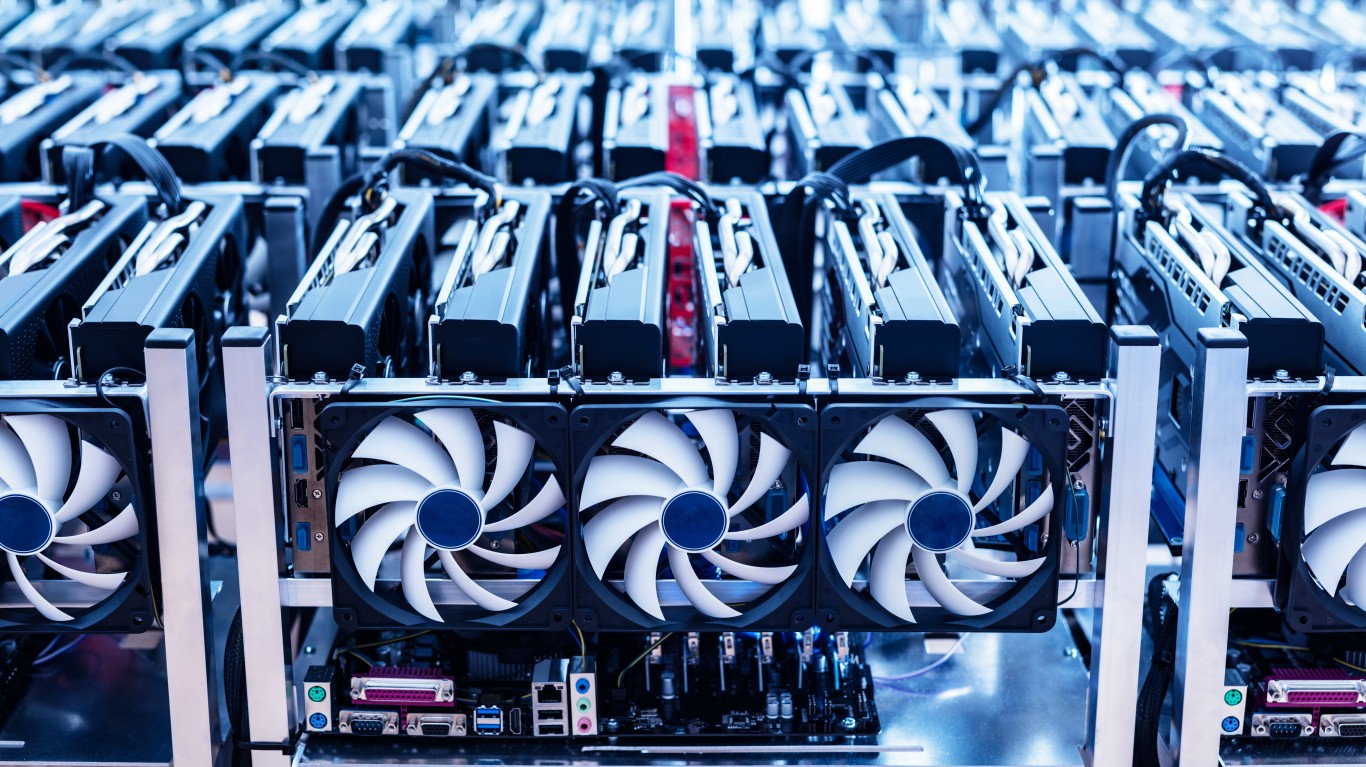

Bitfarms

Cryptomining firms have continued to crop up as the price of Bitcoin and other cryptocurrencies rise. Bitfarms Ltd. (NASDAQ: BITF) came public in late June this year and the stock price has doubled since then. Most of that increase has come in the past two weeks after Bitfarms announced a month-over-month increase of 12.5% in bitcoin mining production.

Even though the stock trades about 7.5 million shares daily, only one analyst covers the company. And that one has a Strong Buy rating on the stock and a price target of $8.00. At a current price of $7.89, the stock’s upside potential is just 1.4%.

Third-quarter revenue is forecast at $52 million, which would be up 27% sequentially. Bitfarms is expected to post adjusted earnings per share (EPS) of $0.20, compared to the prior quarter loss of $0.06. For full fiscal 2021, the company is expected to EPS of $0.46 on revenue of $163.8 million.

The stock trades at a multiple of 17.3 to expected 2021 EPS and 10.9 times estimated 2022 earnings. The stock’s 52-week range is $0.40 to $10.00. Bitfarms does not pay a dividend.

IonQ

After an undistinguished October 1 initial public offering that saw the share price drop by more than 11%, IonQ Inc. (NASDAQ: IONQ) has added more than 75% to its share price in a little over a month. The company’s trapped-ion quantum computers are already available to customers of Amazon Braket, Microsoft Azure and Google Cloud. At the time of the IPO, the company also said it had tripled its bookings target from $5 million to $15 million for fiscal 2021.

Both of the analysts covering the stock have Buy ratings. The shares currently trade at around $19.20, above the median price target of $18. At the high target of $20, the upside potential is about 4.2%.

Third-quarter revenue is forecast at $250,000 and IonQ is expected to post an adjusted loss per share of $0.08. For the full year, the net loss is forecast at $0.48 on revenue of $1.3 million.

IonQ is not expected to post a profit in 2021, 2022 or 2023. By 2023, the enterprise value-to-sales multiple is expected to be 246.9. The stock’s 52-week range is $7.07 to $23.14. The company does not pay a dividend.

Lucid

Lucid Group Inc. (NASDAQ: LCID) began trading publicly in late July and instantly became the fourth most valuable electric vehicle maker in the world. It had moved up to third place by this week, but Rivian’s IPO has pushed Lucid back into fourth. Until late last month, the stock traded no better than flat to the IPO price. Then Lucid delivered its first cars to paying customers and the stock is up nearly 70%. What the company has to say about its future will matter more than the numbers it reports Monday.

Only three analysts cover the stock, with two giving it a Buy rating and the other rating the shares at Sell. At a current price of around $43.10, the stock has far outpaced its median price target of $28. Based on the high target of $60, the upside potential is 39%.

Analysts expect the company to report third-quarter revenue of $1.25 million and an adjusted loss of $0.25 per share. For the full year, the loss per share for two quarters is forecast at $0.61 on sales of $76.14 million.

Lucid is not expected to report a profit in 2021, 2022 or 2023. The company’s enterprise value-to-sales ratio for 2022 is estimated at 43.4, and for 2023 it is 18.4. The stock’s 52-week range is $9.67 to $64.86. Lucid does not pay a dividend.

The #1 Thing to Do Before You Claim Social Security (Sponsor)

Choosing the right (or wrong) time to claim Social Security can dramatically change your retirement. So, before making one of the biggest decisions of your financial life, it’s a smart idea to get an extra set of eyes on your complete financial situation.

A financial advisor can help you decide the right Social Security option for you and your family. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Click here to match with up to 3 financial pros who would be excited to help you optimize your Social Security outcomes.

Have questions about retirement or personal finance? Email us at [email protected]!

By emailing your questions to 24/7 Wall St., you agree to have them published anonymously on a673b.bigscoots-temp.com.

By submitting your story, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.