Three companies we previously previewed reported results late Wednesday or early Thursday. One of those, Lennar, missed both earnings and revenue estimates, while the other two both beat on revenues and one, Adobe, met earnings estimates and the other, Jabil, beat its earnings forecast. Both Lennar and Adobe stock traded lower early Thursday morning while Jabil traded up.

[in-text-ad]

Wednesday, we previewed earnings due out after markets close Thursday and before they open on Friday: Darden Restaurants, FedEx, Rivian and Winnebago.

Here’s a look at one company that hasn’t announced an earnings date yet, but could report Friday or early next week, along with two companies that have confirmed earnings reports for Monday morning.

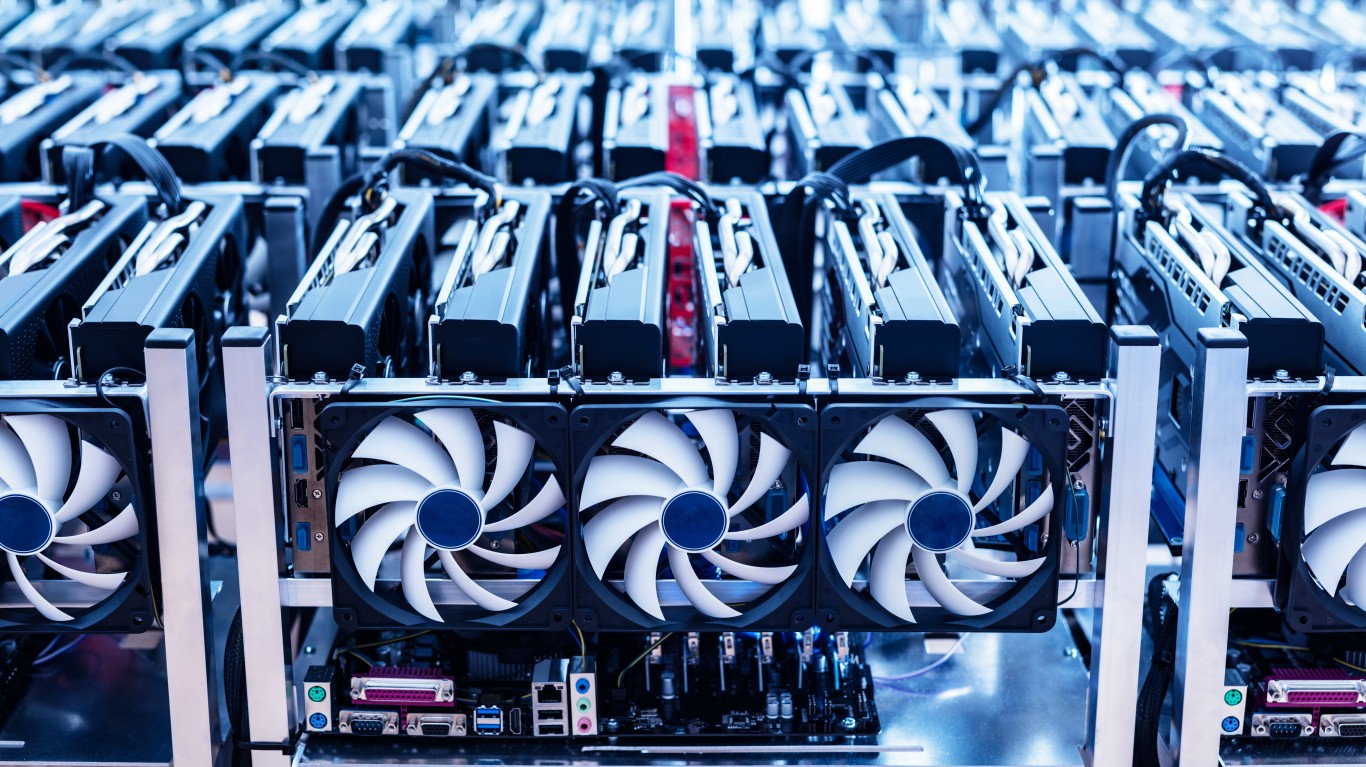

Bit Digital

Bitcoin miner Bit Digital Inc. (NASDAQ: BTBT) has not announced a date for its earnings report, but several sources expect to hear from the company either on Friday or sometime next week. The stock has added about 16% over the past 12 months, including a spike to a share price gain of around 375% in early January. In mid-November, Bit Digital filed an update on production and mining operations for its September (third) quarter indicating that the company earned 248.36 bitcoin, a sequential decline to its transfer of all its China-based mining to North America.

Only one analyst covers the firm, giving Bit Digital a Strong Buy rating. At a recent price of around $7 a share, the upside potential to the analyst’s price target of $14 is 100%.

Bit Digital is forecast to report third-quarter revenue of $19.6 million and adjusted earnings per share (EPS) of $0.14. For the 2021 fiscal year, the analyst expects EPS of $1.25 on sales of $121.7 million. Data for prior years was not available.

Bit Digital’s share price to earnings multiple for fiscal 2021 is 5.6. For fiscal 2023, the multiple to estimated EPS of $0.75 is 9.4. The stock’s 52-week range is $3.97 to $33.00. The company does not pay a dividend. Total shareholder return for the past year was 38.8%.

Blade Air

Blade Air Mobility Inc. (NASDAQ: BLDE) is a first mover in what some call the urban air mobility category. This includes helicopter taxi services and human organ flight services. What’s most interesting about Blade is its commitment to introduce electric vertical takeoff and landing aircraft (eVTOLs) by the middle of this decade.

As of mid-September, two ARK Invest ETFs (Autonomous Technology & Robotics and Space Exploration & Innovation) owned a total of around 5.93 million shares of Blade Air stock. As of Wednesday’s close, the two funds had increased their stake in the company by more than 1 million shares. The company is set to report fourth-quarter and full fiscal year results after markets open on Monday.

All five analysts covering the stock have rated the shares a Buy or Strong Buy. At a share price of around $9.10, the upside potential based on a median price target of $15 is about 65%. At the high price target of $16, the upside potential is almost 76%. Blade Air completed a SPAC merger and came public on May 10. Since then, the stock is up more than 18%.

Fourth-quarter revenue is forecast at $13.75 million, which would be up 6.2% sequentially. The estimated loss per share for the quarter is $0.12, compared to a year-ago loss per share of $0.01. For the 2021 fiscal year that ended in September, the company is currently forecast to post a loss per share of $0.64 on sales of $43.72 million, a year-over-year revenue increase of almost 87%.

Blade Air is expected to post a loss in 2022 and 2023 as well. Based on average estimated sales of $70.17 million in fiscal 2022, the company’s price to enterprise value multiple is 6.9. For the 2023 fiscal year, the multiple is 2.3 and is based on an average revenue estimate of $132.72 million. Blade Air does not pay a dividend. Total shareholder return for the past year is a negative 12%.

[in-text-ad]

Carnival

Cruise line operator Carnival Corp. & PLC (NYSE: CCL) traded up 45% in early June, just ahead of the spread of the Delta variant of COVID-19. Since then, the stock is down 43% and, for the full year, the shares have posted a loss of 17.5%. The rapid spread of the Omicron variant has sliced 14% from the share price just this week.

CEO Arnold Donald told Yahoo News Wednesday that none of his ships have had “incidents of significant propagation of COVID on board even when there were the isolated individual cases.” Donald also said demand for cruises has been “robust.” Carnival will report results first thing on Monday.

Analysts tilt toward a favorable view of Carnival, with eight of 19 analysts giving the shares a Buy or Strong Buy rating and another eight assigning a Hold rating. At a share price of around $17.80, the upside potential based on a median price target of $26.75 is about 50%. At the high target of $41, the upside potential is 130%.

For the company’s fourth quarter of fiscal 2021, analysts have forecast revenue of $1.55 billion, up 184% sequentially and 98% year over year. The adjusted loss per share is forecast at $1.46, better than the prior quarter loss of $1.75 and much better than last year’s quarterly loss of $2.06 per share. For the full fiscal year that ended in November, Carnival is expected to post a per-share loss of $6.83, compared with last year’s loss of $7.47 per share. Revenue is forecast to reach $2.16 billion, down 61% year over year. Carnival posted revenue of $4.79 billion in the quarter that ended last February, just before the COVID-19 pandemic effectively shut down cruise operations.

In addition to the fiscal 2021 loss, Carnival is expected to post a loss per share of $0.18 in its 2022 fiscal year before posting EPS of $1.93 in fiscal 2023. The stock’s 52-week range is $16.32 to $31.52. The company does not pay a dividend. Total shareholder return for the past year is a negative 18.5%.

Take Charge of Your Retirement: Find the Right Financial Advisor For You in Minutes (Sponsor)

Retirement planning doesn’t have to feel overwhelming. The key is finding professional guidance—and we’ve made it easier than ever for you to connect with the right financial advisor for your unique needs.

Here’s how it works:

1️ Answer a Few Simple Questions

Tell us a bit about your goals and preferences—it only takes a few minutes!

2️ Get Your Top Advisor Matches

This tool matches you with qualified advisors who specialize in helping people like you achieve financial success.

3️ Choose Your Best Fit

Review their profiles, schedule an introductory meeting, and select the advisor who feels right for you.

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.