Investing

Meme Stock Movers for 12/23: American Virtual Cloud, Bit Digital, Naked Brands, Tesla

Published:

U.S. equities indexes closed solidly higher on Wednesday, and all three major indexes traded up in Thursday’s by about a quarter-point. All 11 sectors closed higher as well, led by consumer cyclicals (up 1.8%) and technology (up 1.3%). Thursday morning’s report on new claims for unemployment benefits came in slightly higher than forecast at 1.86 million new claims, but down slightly week over week from 1.87 million. The Federal Reserve’s favorite inflation measure, the core personal consumption expenditures (PCE) index, came in at 4.7% for November, up from 4.2% in October and above the forecast of 4.5%. The inflation report cooled, but did not crush, the premarket gains.

Crude oil added another dollar since our midday report on Wednesday to trade at around $73.10 a barrel. Bitcoin cannot seem to break through the $49,000 barrier, where it has been stuck for most of the past couple of days. The yield on 10-year Treasury notes was up about one basis point, and the spread to the two-year note is around 0.78%, unchanged from Wednesday.

American Virtual Cloud Technologies Inc. (NASDAQ: AVCT) was Wednesday’s big winner from among the companies on our meme stock watch list. Shares rose more than 34% to boost the stock’s price increase since December 3 to 163%. We outlined what appears to be going on with the stock in our morning report Wednesday. Shares traded down about 12% in Thursday’s premarket.

The meme stock posting Wednesday’s biggest loss was Naked Brand Group Inc. (NASDAQ: NAKD). Shares dropped 13.5%, and the cumulative loss since Monday is about 17%. The company’s 1-for-15 reverse stock split took effect Monday. It is part of the process that will result in Naked’s acquisition of electric vehicle maker Cenntro and a pivot from lingerie sales to EV manufacturing and sales. The stock was down by another 1.8% in Thursday’s premarket.

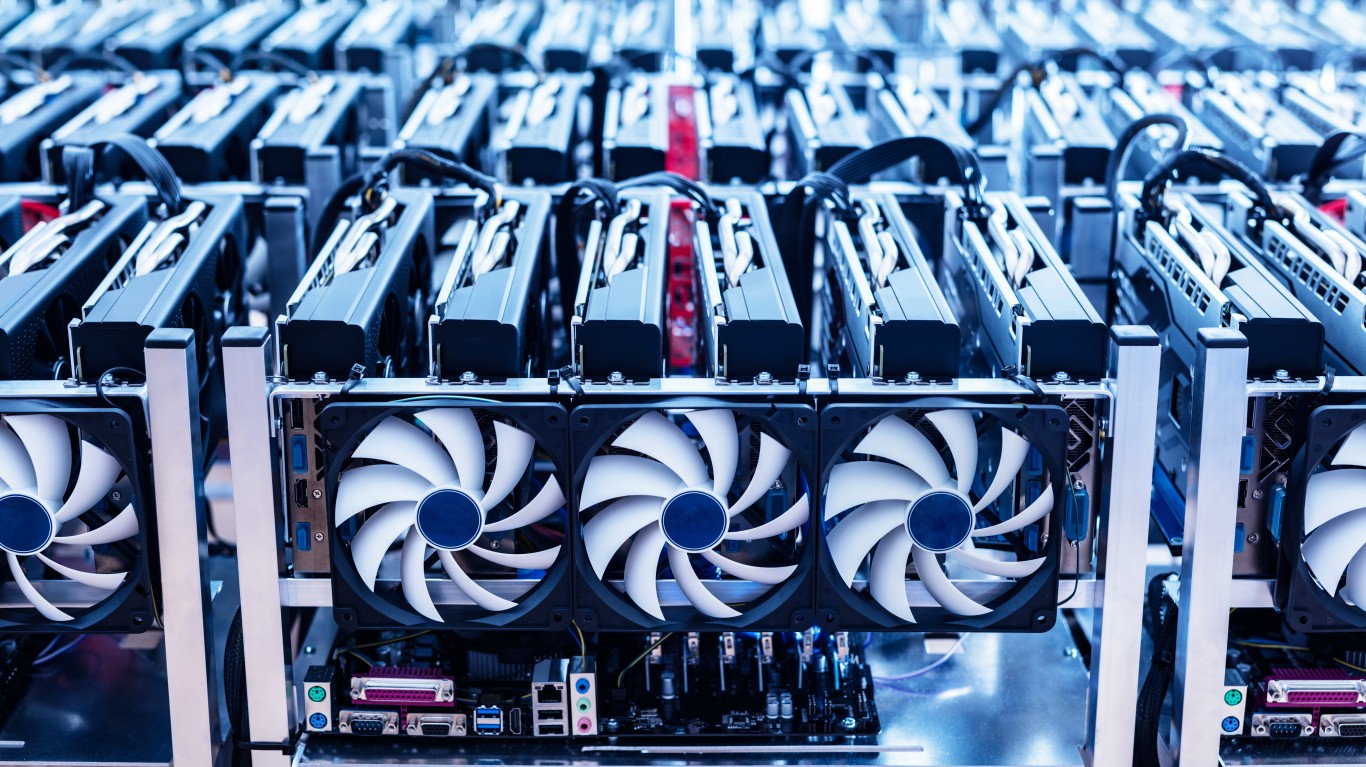

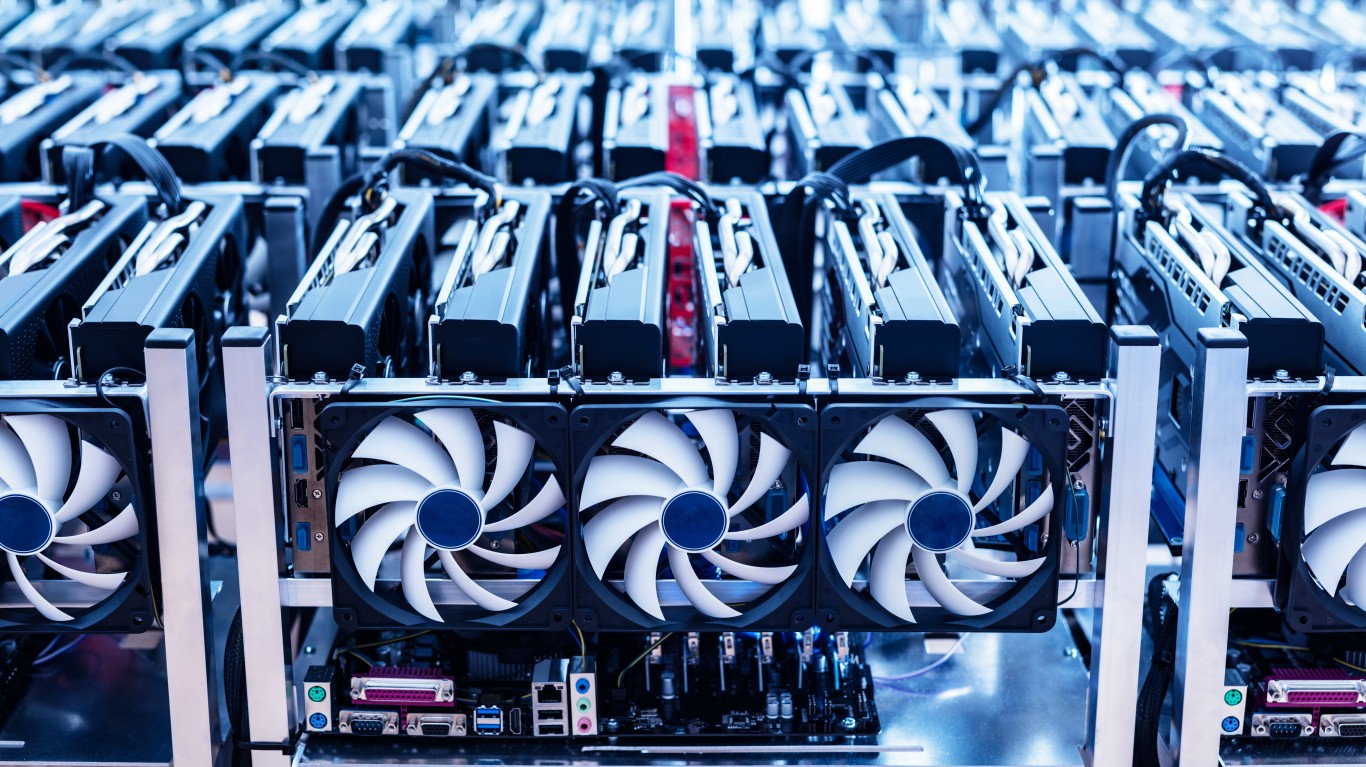

Bitcoin miner Bit Digital Inc. (NASDAQ: BTBT) filed its third-quarter earnings report with the Securities and Exchange Commission Thursday morning. The company reported revenue of $10.4 million, compared to an analyst’s forecast of $19.6 million. Bit Digital also reported a net loss of $20.15 million, of which about $16.1 million was related to share-based compensation for the company’s directors, management and consultants. As of Wednesday’s close, Bit Digital’s stock had lost about 50% of its value, and shares traded down about 1.6% in Thursday’s premarket.

Tesla Inc. (NASDAQ: TSLA) added about 7.5% to its share price Wednesday to close at nearly $1,009. The stock traded up less than 1% in Thursday’s premarket. It appears that CEO Elon Musk has not quite “sold enough” of his Tesla stock, as he said Tuesday that he had done. According to Barron’s, Musk sold 1.9 million more shares on Tuesday and Wednesday, bringing his total sales to some 14.8 million shares. And Barron’s thinks he has another 4 million or so options expiring next week and that is likely to generate sales of another 1.8 million of the shares Musk already owns.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.