All three major U.S. stock indexes gained at least 1% on Monday, led by the S&P 500, which set both new all-time intraday and closing highs. All three were trading up Tuesday morning as well, with the Nasdaq leading the way with a gain of 0.5%. The Dow Jones industrials and the S&P 500 were up by around half that much.

Crude oil added about a dollar to its share price and traded up about 1.5% at $76.70 a barrel early Tuesday. Bitcoin, alas, traded down about 3.8% in the morning at around $49,050. The cryptocurrency closed at nearly $51,000 on Monday. Yields on 10-year and two-year Treasury notes were around 1.49% and 0.75%, respectively, Tuesday morning. That’s slightly wider than Monday’s spread of 0.72%.

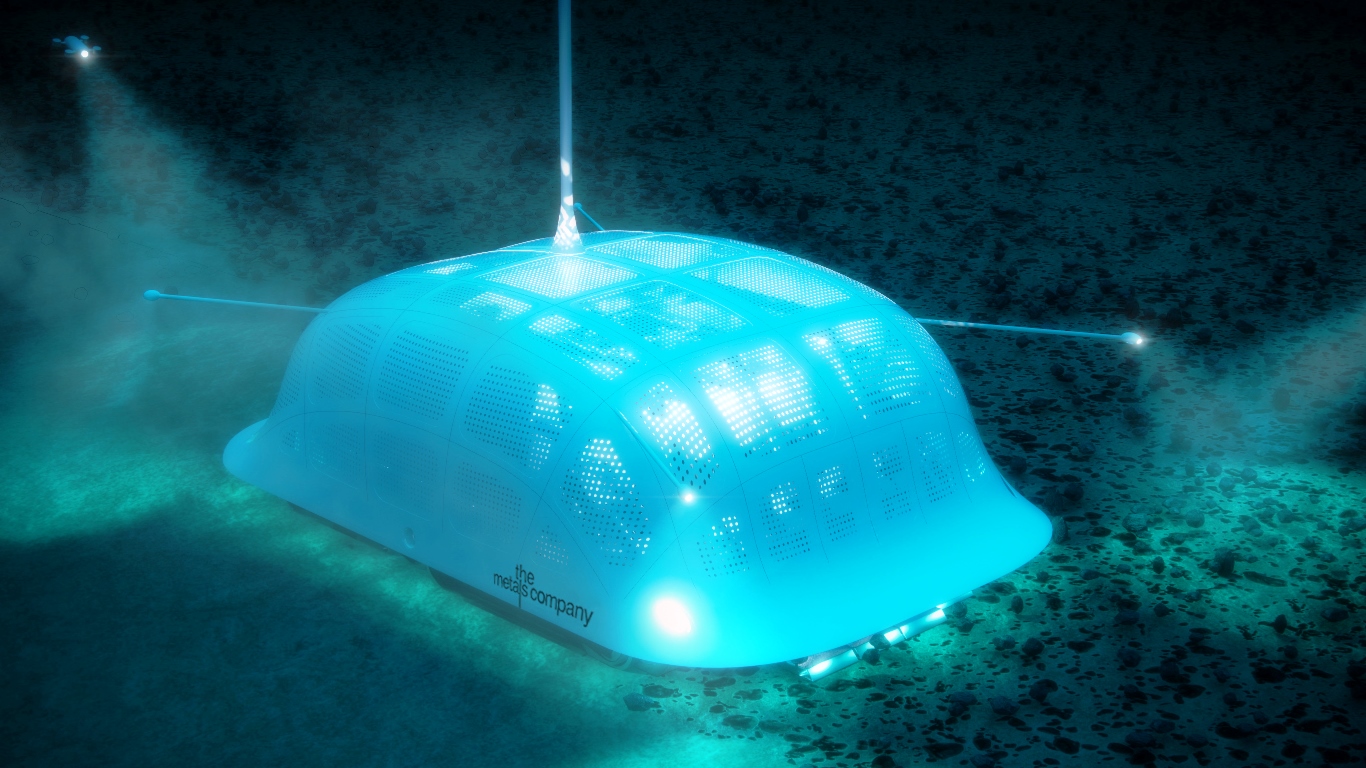

Looking at our meme stock watch list, we see losers outnumbered winners on Monday. TMC the metals company Inc. (NASDAQ: TMC) closed down nearly 10% on Monday and was unchanged Tuesday morning. The company had no specific news, but it did get some bad press. In the January 3 and 10, 2022, issue of The New Yorker, Elizabeth Kolbert writes about the pushback against the company’s plan to harvest polymetallic nodules from the ocean floor.

In early October, the company outlined a pilot program to mine an undersea deposit of metals that TMC claims can be collected from the ocean floor with little to no environmental impact. Target metals include cobalt, copper and manganese, and all are in high demand for use in lithium-ion batteries for electric vehicles.

Here’s how Kolberet summarizes the opposition:

Marine scientists argue, though, that the potential costs of deep-ocean mining outweigh the benefits. They point out that the ocean floor is so difficult to access that most of its inhabitants are probably still unknown, and their significance to the functioning of the oceans is ill-understood. In the meantime, seabed mining, which would take place in complete darkness, thousands of feet under water, will, they say, be almost impossible to monitor.

Cryptocurrency miner Hut 8 Mining Corp. (NASDAQ: HUT) traded down by about 5% in Tuesday’s premarket on no specific news. Many other crypto-mining companies also traded down by around 4%, likely due to the sharp drop in Bitcoin prices.

EV maker Rivian Automotive Inc. (NASDAQ: RIVN) added about 10.6% to its share price on Monday on no specific news. A good start to the Santa Claus rally may be responsible for the solid gain, as investors seek to wring out some end-of-the-year profits. The stock traded down by less than 1% in Tuesday’s premarket session.

Tesla Inc. (NASDAQ: TSLA) added about 2.5% to its share price Tuesday and traded up another 1.7% at around $1,112.70 early Tuesday. Wedbush analyst Dan Ives and his team wrote that the firm is maintaining its Outperform rating on Tesla with a base price target of $1,400 and a bull-case price target of $1,800. The key to Wedbush’s bull case is China, where the firm expects Tesla to deliver 40% of its vehicles next year. According to Barron’s, Ives noted that China is “worth $400 a share to Tesla next year.”

Travel Cards Are Getting Too Good To Ignore (sponsored)

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.