Investing

Midday Meme Stock Report for 12/28: GameStop, Hut 8, IonQ, Naked Group

Published:

During Tuesday’s premarket trading session, it looked like the day would be building better on Monday’s solid gains. In the noon hour, the Nasdaq traded in the red, the S&P 500 was barely in the green and only the Dow Jones industrial average had improved on its premarket level. The utilities and industrials sectors were both up 0.7% to lead the pack, while health care, energy and technology all traded in the red.

Crude oil was still higher than Monday’s settlement but had pulled back since to around $76.10 a barrel. Bitcoin continued its downward trajectory, trading down about 5.3% at around $48.30. The 10-year/two-year Treasury note spread remained at 0.72%.

The slide in Bitcoin weighed on our cryptocurrency mining watch list. Every one of the stocks traded in the red, with Hut 8 Mining Corp. (NASDAQ: HUT) still the biggest loser. At the end of November, Hut 8 reported that it held 5,242 bitcoin in reserve. A $2,000 swing in Bitcoin value is a big deal for the company, representing around 9% or so of its total market cap. Other crypto miners posting double-digit share price declines in the noon hour Tuesday were Marathon Digital and Bit Farms.

With a gain of just over 1%, GameStop Corp. (NYSE: GME) was among the small number of meme stocks on our list that had posted gains Tuesday. The company had no specific news, but it did put up a banner on the homepage of its NFT website encouraging applicants to sign up to be a creator on the GameStop NFT Marketplace.

Shares of Naked Brand Group Ltd. (NASDAQ: NAKD) traded down by nearly 10% on no specific news. The company’s acquisition of electric van maker Cenntro is supposed to close this week, but some investors may be skeptical. Monday, Cenntro announced that it manufactured and shipped 628 of its Logistar 200 electric delivery vehicles to the European market and confirmed its guidance to deliver at least 20,000 vehicles next year.

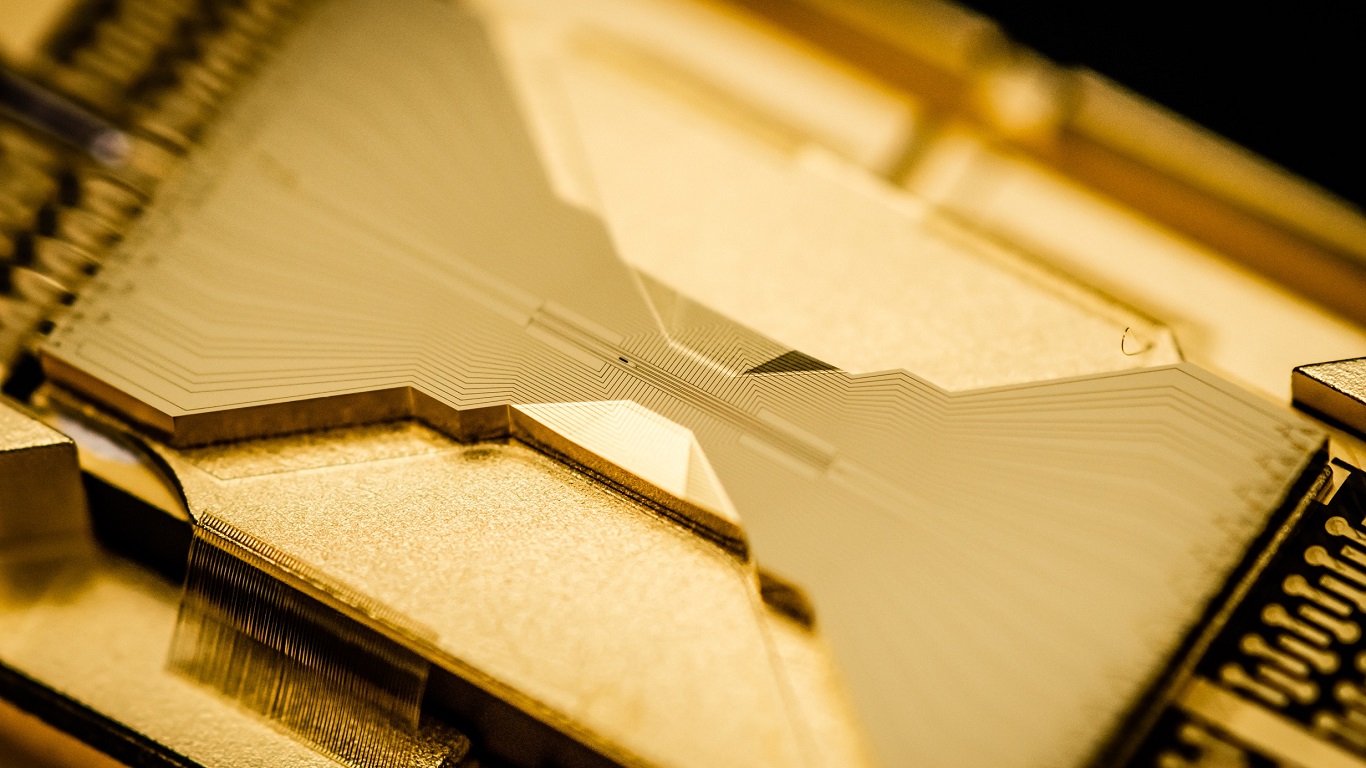

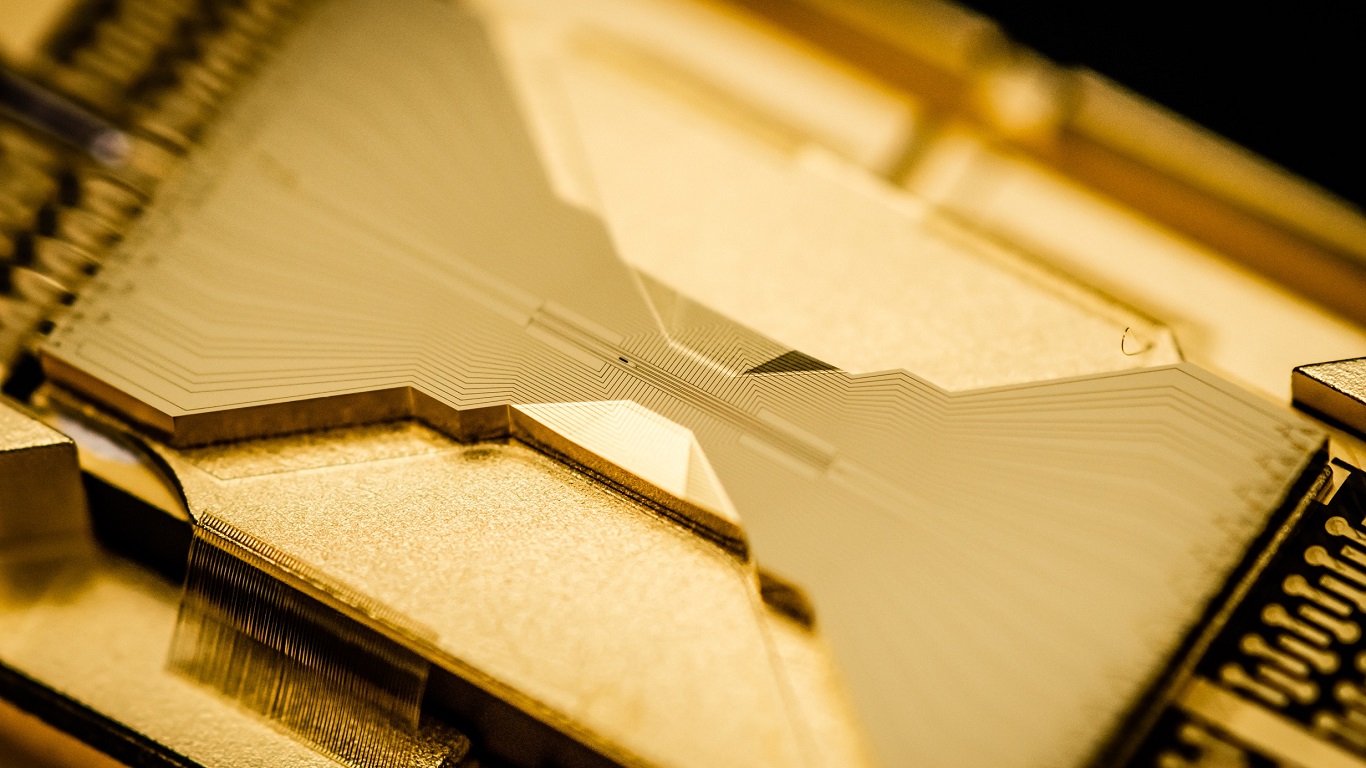

Quantum computer maker IonQ Inc. (NYSE: IONQ) traded down about 7% in the noon hour Tuesday. The company two weeks ago registered 4 million common shares to one of its IPO sponsors and 7.5 million common shares to cover warrants issuable when warrants associated with the IPO are exercised. The stock actually traded about $0.75 a share higher than it did after the filing.

Shares of Hut 8 traded down more than 13% as the noon hour ended Tuesday, at $7.65 in a 52-week range of $2.63 to $16.57. The average daily trading volume is around 11.7 million shares, and nearly 6.2 million had already traded on Tuesday.

GameStop stock traded up nearly 1% to $149.73, in a 52-week range of $17.08 to $483.00. The average daily trading volume is around 2.4 million shares, and fewer than a million had traded thus far on the day.

Shares of IonQ traded down 7.2%, at $16.99 in a 52-week range of $7.07 to $35.90. The average daily trading volume is about 6.8 million shares, and almost 3 million had traded thus far.

Naked Brands stock traded down more than 9% to $5.00, in a 52-week range of $2.85 to $51.00. The average daily volume is about 4.1 million shares, and more than 5.1 million had changed hands already.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.