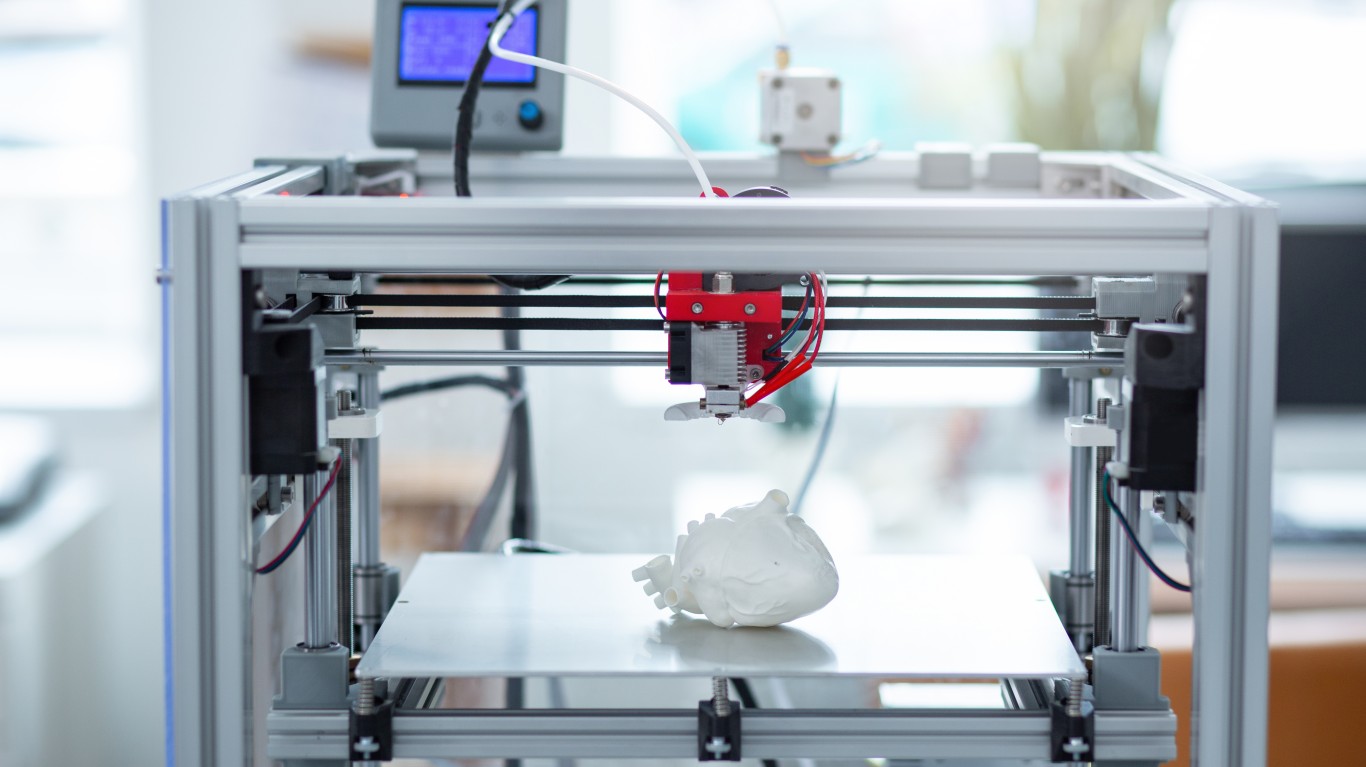

One ARK Invest exchange-traded fund run by ETF star Cathie Wood bought over 111,000 shares of 3D Systems Corp. (NYSE: DDD) shares on Tuesday, as the prices of this fund gained over 2% in Tuesday’s session. The ETF is down a fair amount in the past year.

[in-text-ad]

It was ARK Autonomous Technology & Robotics ETF (NYSEARCA: ARKQ) that bought 111,300 shares of the 3D printer company. At Tuesday’s closing price, this would have valued this purchase at roughly $2.3 million. This is only a small fraction of the total holdings. The fund is down 13% over the past 52 weeks.

Check out all the ARK Invest purchases for Tuesday:

| Fund | Ticker | Name | Shares |

|---|---|---|---|

| ARKF | SQ | BLOCK | 57,109 |

| ARKG | EXAS | EXACT SCIENCES | 300 |

| ARKG | PACB | PACIFIC BIOSCIENCES OF CALIFORNIA | 19,000 |

| ARKK | PACB | PACIFIC BIOSCIENCES OF CALIFORNIA | 61,500 |

| ARKQ | VUZI | VUZIX | 142 |

| ARKQ | MKFG | MARKFORGED | 4,045 |

| ARKQ | DDD | 3D SYSTEMS | 111,300 |

| ARKQ | AVAV | AEROVIRONMENT | 16,700 |

| ARKW | VUZI | VUZIX | 2,867 |

| ARKW | U | UNITY SOFTWARE | 66,491 |

| ARKW | TWLO | TWILIO | 36,751 |

| ARKW | SQ | BLOCK | 58,727 |

| ARKW | DKNG | DRAFTKINGS | 266,064 |

| ARKW | COIN | COINBASE GLOBAL | 54,114 |

| ARKW | CND | CONCORD ACQUISITION | 168,700 |

| ARKX | PLTR | PALANTIR TECHNOLOGIES | 67,125 |

Catherine Wood, the CEO and CIO of ARK Investment Management, is a minority and nonvoting shareholder of 24/7 Wall St., owner of a673b.bigscoots-temp.com.

Are You Ahead, or Behind on Retirement? (sponsor)

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention.

Finding a financial advisor who puts your interest first can be the difference between a rich retirement and barely getting by, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors that serve your area in minutes. Each advisor has been carefully vetted, and must act in your best interests. Start your search now.

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.