Investing

Why Analysts Are Hiking Targets on These Trillion-Dollar Tech Names

Published:

Although markets turned lower to start out this truncated trading week, a couple of analysts took this opportunity to hike their targets on a couple of trillion-dollar names. Markets are currently combatting concerns over rising interest rates and what this would mean for the tech sector more broadly, but this may just be a speed bump for big names in the field.

Here, 24/7 Wall St. looks at two big names on every investor’s list, what analysts are saying about them going forward and what 2022 could hold for them. Keep in mind that both of these giants are reporting earnings next week.

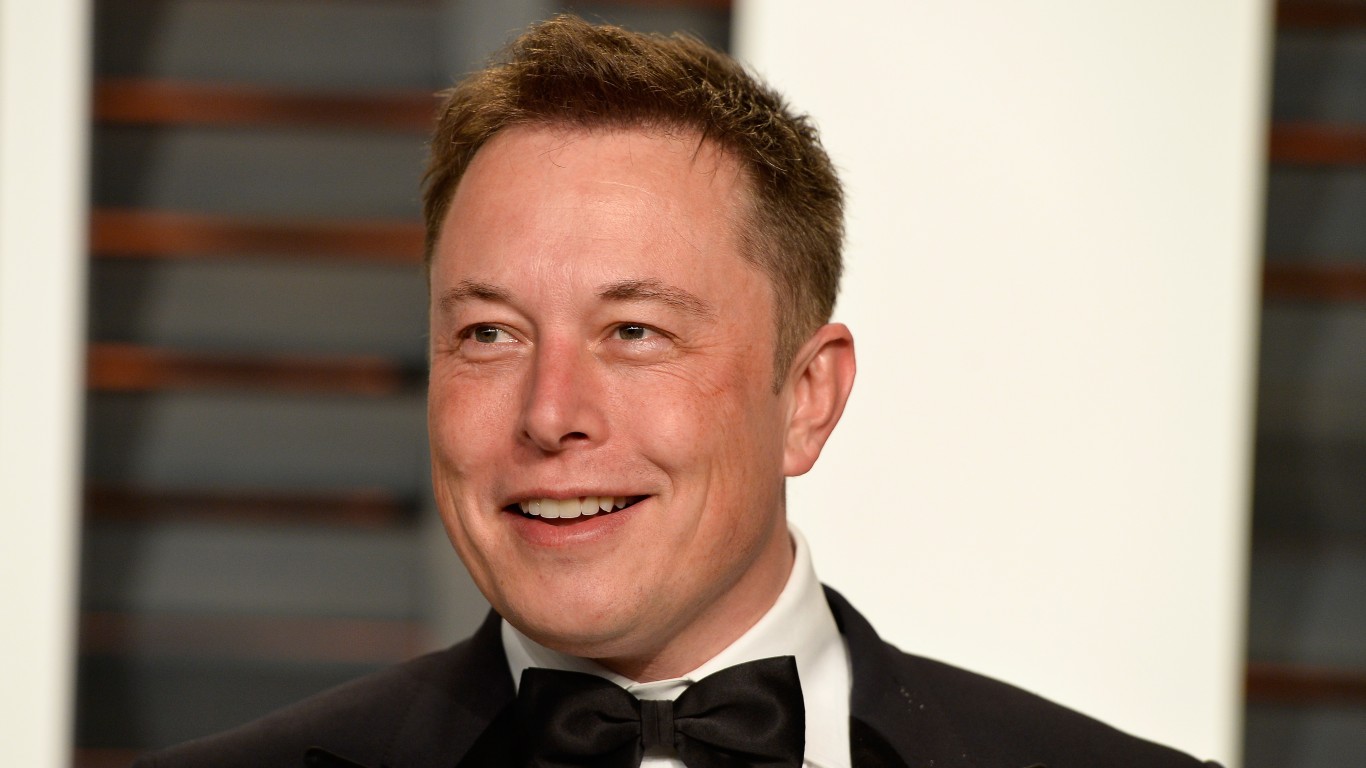

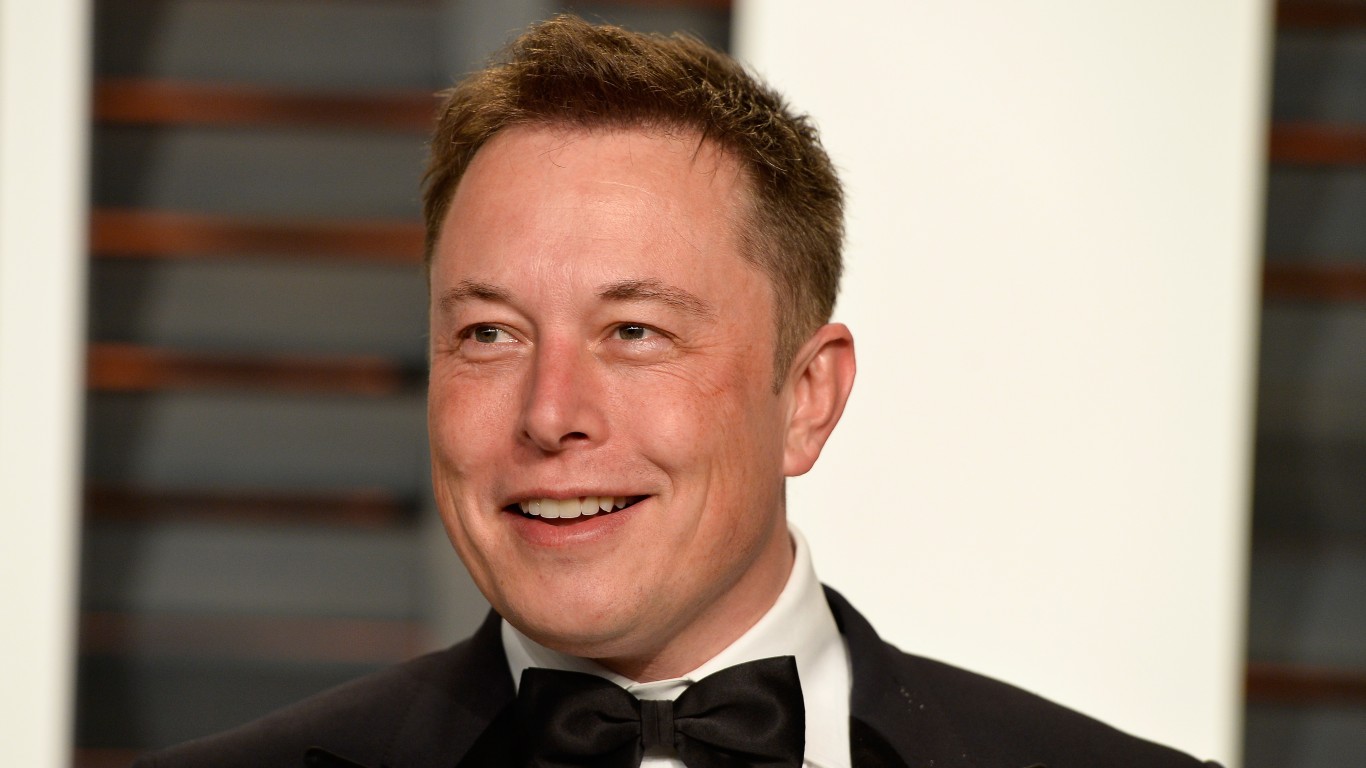

Tesla Inc. (NASDAQ: TSLA) is Elon Musk’s vehicle for providing the world with a greener future through electric vehicles (EVs) and advanced battery technology. With new production facilities opening around the world in Shanghai, Austin and Berlin, Tesla is expanding its footprint, and many are growing more bullish on the stock after a stellar 2021.

Credit Suisse’s Dan Levy is coming around to the stock and reiterated a Neutral rating for Tesla but raised its price target to $1,025 from $830, an increase of 23.5%. However, this update still implies downside of 2.3% from the most recent closing price of $1,049.61.

The brokerage firm noted that there are four major themes in 2022 that could unlock further growth for the EV-giant: capacity expansion; expectations Tesla will continue its strong gross margin trajectory from 2021, with volume ramp, China mix and price increases driving gross margin; updated product roadmap; and batteries. Note that batteries are likely the key constraint for Tesla’s production.

Tesla stock was last seen trading down over 2% around $1,025 just after Tuesday’s opening bell. The stock has a 52-week range of $539.49 to $1,243.49 and a consensus price target of $927.67.

Apple Inc. (NASDAQ: AAPL) is currently the world’s largest public company by market cap, coming in at $2.79 trillion. Apple’s earnings report is just around the corner, and analysts and investors alike are looking forward to what the iPhone giant has to say. For the most part, analysts are fairly positive on the future of Apple.

Deutsche Bank reiterated a Buy rating on Apple stock and raised its price target to $200 from $175, an increase of 14.3%. This new target implies upside of 15.6% from the most recent closing price of $173.07.

Overall, Deutsche Bank believes the Wall Street estimate for the 2022 calendar year revenue growth of 5% is too low. Instead, the firm suggests an estimate of 9%. Accordingly, the firm believes there should be an upward bias to estimates throughout the year.

In the near term, Deutsche Bank sees supply chain constraints as being a headwind to revenue. However, the firm believes the supply chain has improved at a faster pace than expected, with iPhone wait times shortening to a few days.

Apple stock was last seen down about 1% at $171, in a 52-week range of $116,21 to $182.94. Analysts have a consensus price target of $179.87 for the stock.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.