Last Friday, investors got their first look at how the country’s biggest banks fared in the fourth quarter of 2021. Judging by their reactions, Wells Fargo deserved a share price boost and JPMorgan deserved to get punished. Citigroup and BlackRock closed lower on Friday, but they avoided the punishment JPMorgan received.

Following Monday’s Dr. Martin Luther King Jr. holiday, Goldman Sachs and Truist reported results before markets opened Tuesday. Truist beat on both the top and bottom lines, while Goldman missed the consensus earnings estimate.

More financial sector results are coming up this Wednesday and the rest of this week, as well as reports from consumer product, industrial, and transportation firms. Before markets open Wednesday, we will hear results from Bank of America, Morgan Stanley, Procter & Gamble and UnitedHealth. It will be a busy week.

We also have previewed four companies set to report after markets close on Wednesday: Alcoa, Discover Financial, Kinder Morgan and United Airlines.

Here are three earnings reports due out before markets open on Thursday.

American Airlines

Over the past 12 months, American Airlines Group Inc. (NASDAQ: AAL) has been the top-performing U.S. airline, and the only one to have a double-digit share price gain. Last week the company said its fourth-quarter revenue would be 19% below its 2019 revenue for the same quarter. That represents an improvement of one percentage point over American’s November estimate. More bad weather and a possible interruption of some flights due to safety concerns resulting from new 5G bandwidth rules could be near-term issues for American and other carriers.

Analysts are cautious on American. Of 22 brokerages covering the stock, 11 have a Hold rating and six more have Sell or Strong Sell ratings. At a recent price of around $18.50 a share, the implied upside based on a median price target of $20 is about 8.1%. At the high target of $28, the upside potential is more than 51%.

Fourth-quarter revenue is forecast at $9.38 billion, which would be up 4.6% sequentially and 133% higher year over year. American is expected to post a loss per share of $1.48, worse than the $0.95 loss per share in the prior quarter and much improved over last year’s third-quarter loss of $3.86 per share. For the full year, the company is expected to post a loss of $8.36 compared to the year-ago loss of $19.66 on revenue of $29.83 billion, up 72%.

The stock trades at 7.1 times estimated 2023 earnings of $2.62. The airline is expected to post a loss of $0.35 per share in fiscal 2022. The stock’s 52-week range is $15.02 to $26.09. American does not pay a dividend. The stock’s total return for the past 12 months was 16.9%.

Baker Hughes

Over the past 12 months, shares of oilfield services firm Baker Hughes Co. (NASDAQ: BKR) have added about 23%. Since posting a 52-week low in mid-April, however, the shares are up 42%, including a couple of big dips. Rising oil prices have begun to breathe some life into the drilling business, but new drilling will be constrained by promises to return more cash to shareholders, rising interest rates and a determination by producers not to topple the golden calf of higher prices.

Analysts remain solidly bullish on Baker Hughes stock, with 22 of 30 putting a Buy or Strong Buy rating on the shares. The rest rated the stock at Hold. At a share price of around $27.20, the upside potential based on a median price target of $30 is 10.3%. At the high price target of $48, the implied upside is 76.5%.

The consensus fourth-quarter revenue estimate is $5.5 billion, up almost 8% sequentially and flat year over year. Adjusted earnings per share (EPS) are forecast to rise sequentially by 79% to $0.29. That is a year-over-year improvement from a loss of $0.07. For the full year, analysts are forecasting EPS up 2,160% to $0.68 on sales of $20.53 billion, down less than 1%.

Baker Hughes stock trades at 40.1 times expected 2021 EPS, 22.2 times estimated 2022 earnings of $1.23 and 16.6 times estimated 2023 earnings of $1.63. The stock’s 52-week range is $13.08 to $27.84, and the high was posted earlier in the morning. Baker Hughes pays an annual dividend of $0.72 (yield of 2.62%). Total shareholder return for the past year was 22.5%.

Union Pacific

Transportation and logistics have been a huge issue for the past several months, as demand for goods has outpaced supply. Shipping and trucking companies, as well as railroads like Union Pacific Corp. (NYSE: UNP), take some of the heat for rising inflation, even if that is not entirely fair.

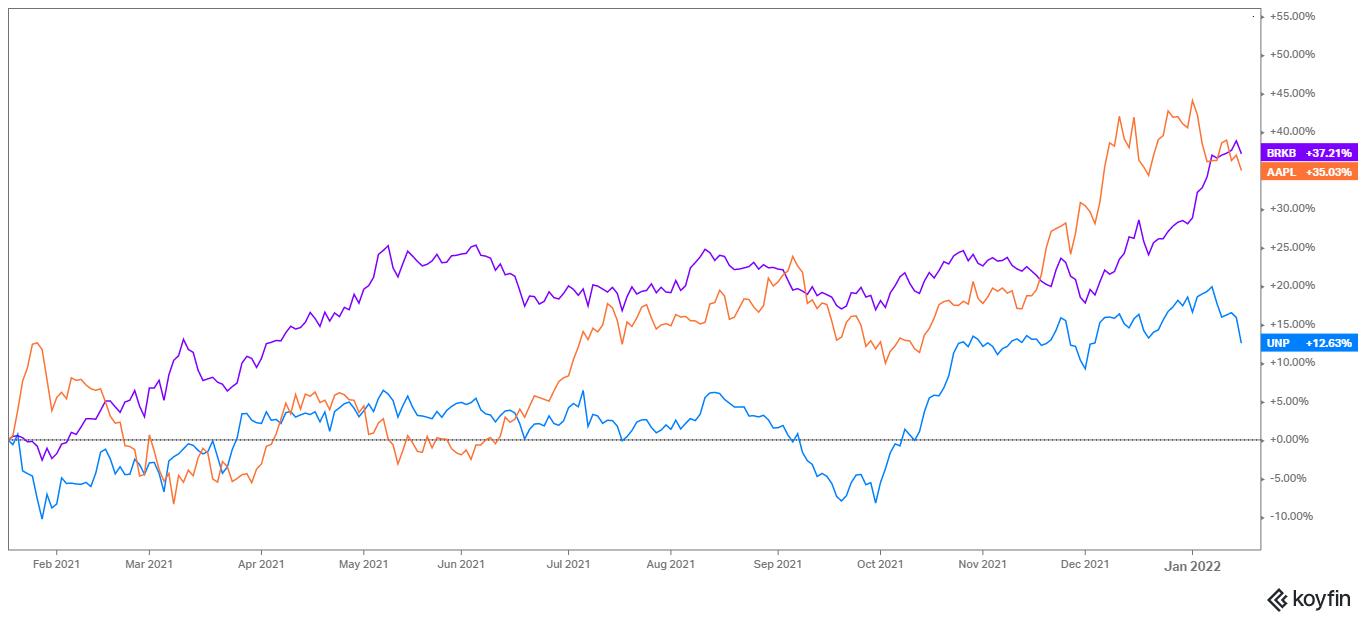

Shares of Union Pacific have gained about 12.7% over the past 12 months, even including a 13.5% drop between mid-August and early October. Here is a Koyfin chart comparing Union Pacific’s stock price (the blue line) with Berkshire Hathaway’s (the purple line), owner of Burlington Northern Santa Fe, and Apple (orange line), Berkshire’s largest holding. Excluding Apple, Berkshire looks a lot like Union Pacific.

There are 30 analysts covering Union Pacific stock, and 23 have a Buy or Strong Buy rating on the shares while another six rate them at Hold. The bulls continue running on transportation stocks it seems. At a share price of around $240, the upside potential based on a median price target of $269 is 12%. At the high price target of $300, the implied upside is 20%.

The consensus fourth-quarter revenue estimate is $5.61 billion, up less than 1% sequentially and up about 9.1% year over year. Adjusted EPS are forecast to rise sequentially by 1.8% to $2.62, representing a rise of 11% year over year. For the full year, analysts are forecasting EPS up almost 21% to $9.90 on sales of $21.66 billion, up by nearly 11%.

The stock trades at 24.3 times expected 2021 EPS, 21.1 times estimated 2022 earnings of $11.37 and 19.0 times estimated 2023 earnings of $12.60. The stock’s 52-week range is $193.14 to $256.11. Union Pacific pays an annual dividend of $4.72 (yield of 1.92%). Total shareholder return for the past year was 12.9%.

It’s Your Money, Your Future—Own It (sponsor)

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.