BofA Securities is one of the bigger names on Wall Street and is constantly releasing calls on dozens of stocks across its coverage universe. One reason that BofA has become such a respected name on the street is the accuracy and consistency of its reports. Here, 24/7 Wall Street is taking a look at a few analyst calls that BofA released on Wednesday morning.

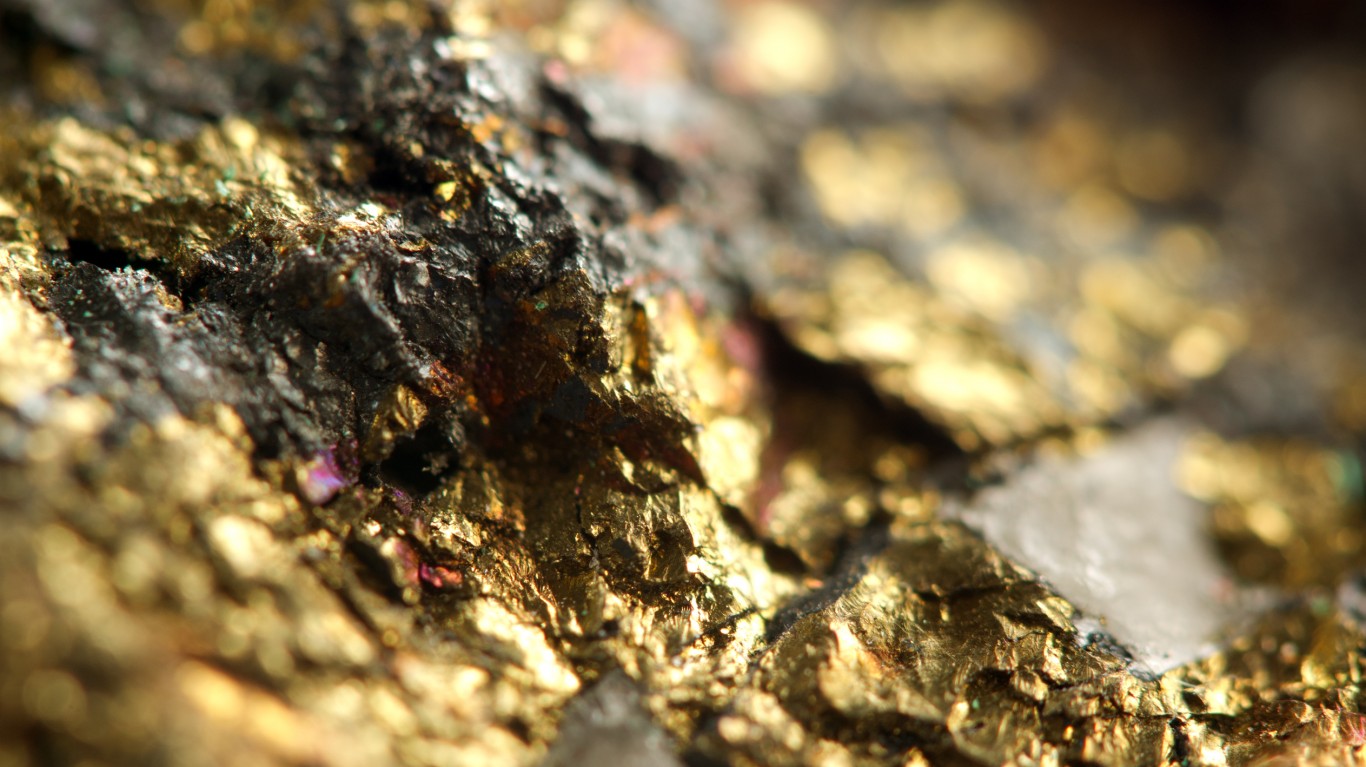

With the broad markets fluctuating a lot over the past month, investors are looking for safe investment opportunities. The situation with Russia has caused some destabilization within international markets, and we have seen oil and gold prices run up as a result. Outside of these industries, BofA Securities has some ideas of its own.

24/7 Wall St. is taking a closer look at these companies, their updates and what BofA Securities is saying about them on Wednesday morning.

Wynn Resorts Ltd. (NASDAQ: WYNN): BofA reiterated a Neutral rating and raised the price objective to $100 from $90, implying upside of about 4% from the most recent closing price of $96.26. Overall, the brokerage firm said that results ex-Macau were slightly better than expected driven by continued strong high-end demand. The real estate sale was a surprise as Wynn has historically been more cautious on sale-leasebacks, but the pricing is hard to argue with, and it is highly accretive upfront.

Wynn stock was last seen down 2% around $94, in a 52-week range of $76.03 to $143.88. The consensus analyst price target is $103.96.

Roblox Corp. (NYSE: RBLX) was reiterated with a Buy rating and an $84 price objective, implying upside of 14% from the most recent closing price of $73.30. BofA Securities is putting this stock as a leader in the emerging Metaverse category. The brokerage firm noted that at the dawn of social media, in the mid-2000s, few could have predicted how much time people eventually would spend on what was then an emerging media company. The Metaverse category is in its early adoption cycle, and Roblox stands to be a category leader. BofA believes that the company is concretely demonstrating for consumers, developers and merchants what the term means.

Roblox stock was last seen down over 24%, at roughly $55, in a 52-week range of $53.63 to $141.60. The consensus price target is $106.15.

ViacomCBS Inc. (NASDAQ: VIAC) was on the bearish side of BofA Securities. The firm downgraded it to Neutral from Buy and cut the price target to $39 from $53, implying upside of 8% from the most recent closing price of $35.99. The firm said that the prior bullish thesis was based on the company being a potential attractive target in the midst of a wave of industry consolidation. While BofA sees the position as unchanged, the firm does not see a potential sale as imminent.

ViacomCBS stock was trading down roughly 21% at just over $28, in a 52-week range of $28.01 to $101.97. The consensus price target is $46.48.

Virgin Galactic Holdings, Inc. (NYSE: SPCE): BofA gave more of an update on this stock than an actual call. The last call that BofA Securities made on Virgin Galactic was in mid-January, reiterating a Neutral rating with a $10 price target. As per this update, the company announced that it would be opening ticket sales to the public Wednesday.

Reservations are being offered at $450,000, with an initial deposit of $150,000. Along with reserving a ticket to space, the purchase provides passengers with access to “money-can’t-buy experiences, events, trips and space-readiness activities” ahead of the suborbital flight.

Virgin Galactic stock was last seen down over 6% around $10, in a 52-week range of $7.58 to $57.51. The consensus price target is $21.55.

Are You Still Paying With a Debit Card?

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.