Another week of earnings season is coming to a close with some interesting reports due out late Thursday or early Friday morning. As usual, there are no reports scheduled for Friday afternoon, and none are scheduled for Monday, President’s Day, when U.S. markets are closed.

Reports issued late Wednesday included a number of surprise misses, including from Roblox, ViacomCBS and Wynn Resorts.

After markets close Wednesday afternoon, four reports of general interest are due: Albemarle, Applied Materials, Cisco Systems and Pioneer Natural Resources. We also have previewed two reports, Palantir and Walmart, due before markets open on Thursday.

Here is a look at the three firms scheduled to report results after markets close Thursday or before they open again on Friday.

Deere

Heavy equipment maker Deere & Co. (NYSE: DE) has posted a share price gain of more than 25% over the past 12 months. When the stock’s current 12-month low rolls off the board next week, the share price gain will rise to more than 30%. Shares reached an all-time high just a week ago and Deere’s prospects remain solid with the coming release of an autonomous tractor that does not need a driver and can run over a predetermined route as long as there are only a few obstacles to dodge. The company reports results before markets open Friday.

Analysts remain bullish on the stock, with 14 of 24 giving the shares a rating of Buy or Strong Buy and eight more rating the stock at Hold. At the recent price of around $388.30 a share, the upside potential based on a median price target of $425 is about 9.5%. At the high price target of $485, the upside potential is about 24.9%.

For the company’s first quarter of fiscal 2022 that ended in January, analysts expect Deere to report revenue of $8.28 billion, which would be down 19.4% sequentially and 2.9% lower year over year. Adjusted earnings per share (EPS) are expected to come in at $2.24, down 45.5% sequentially and down by 42% year over year. For the full fiscal year, EPS is forecast at $22.21, up 17%, on sales of $47.15 billion, up about 18.7%.

The stock trades at17.5 times expected 2022 EPS, 15.4 times estimated 2023 earnings of $24.24 and 14.4 times estimated 2024 earnings of $26.96 per share. Deere’s 52-week range is $298.54 to $700.34. The company pays an annual dividend of $3.61 (yield of 1.08%). Total shareholder return for the past year was 23.56%.

Livent

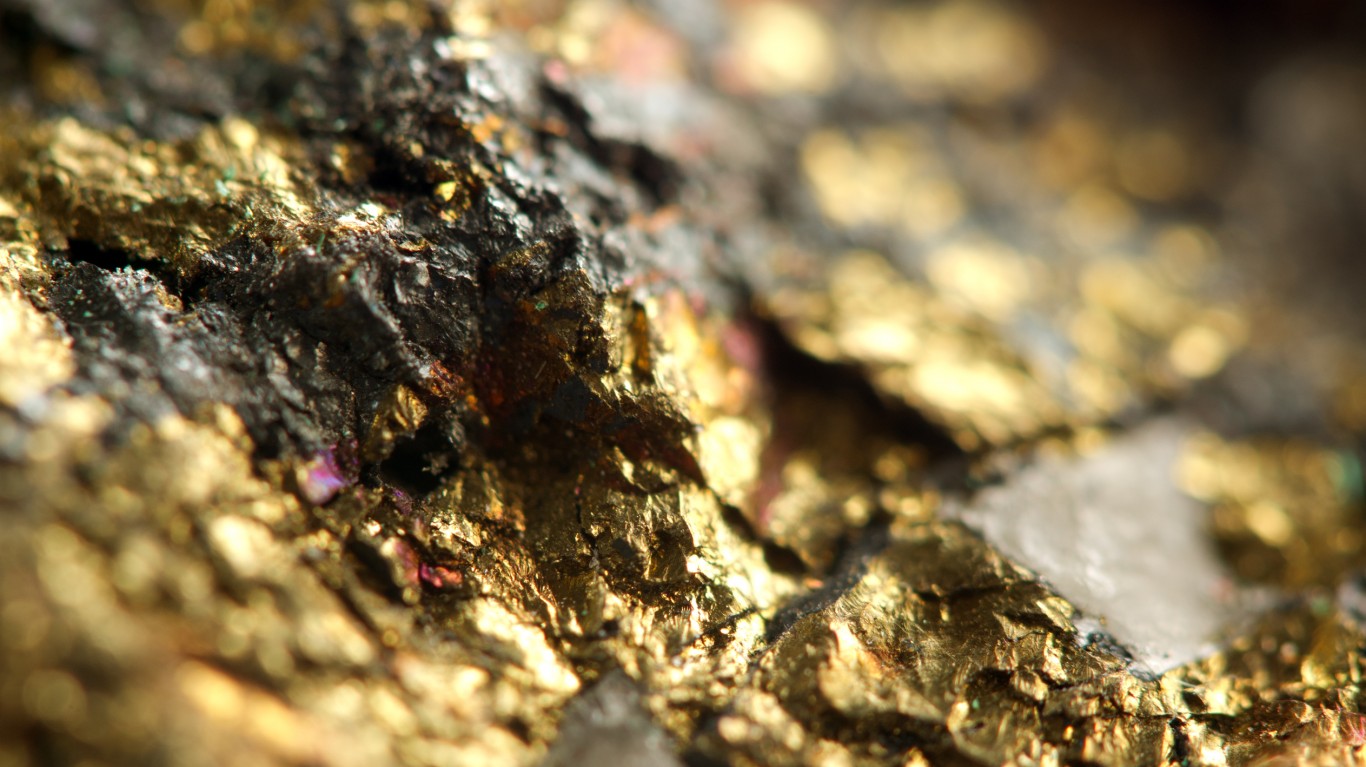

Lithium producer Livent Corp. (NYSE: LTHM) has seen its share price rise by more than 10% over the past 12 months. Over the past two years, however, the stock is up by about 133%, and the shares posted their all-time high last November. The stock has dropped by around 25% since then. As we noted in our preview of Albemarle, another lithium producer that will report results after Wednesday’s closing bell, prices for battery-grade lithium are around $62,000 per metric ton, about double where they were a year ago. Livent reports earnings after markets close Thursday.

Of 14 analysts covering the stock, eight have a Hold rating on the shares, while another five rate the stock as a Buy or Strong Buy. At a share price of around $24.75, the implied upside based on a median price target of $28.50 is 15.2%. At the high price target of $40, the implied upside is 61.6%.

Fourth-quarter revenue is forecast at $106.48 million, up 2.8% sequentially and 29.5% year over year. Adjusted EPS are forecast at $0.07, up 136.9% sequentially and up from a loss of $0.02 per share year over year. For the full 2021 fiscal year, EPS are forecast at $0.16, up from a loss last year of $0.05 per share, on revenue of $403.97 million, up 40.2%.

Livent stock trades at 153.1 times expected 2021 EPS, 49.8 times estimated 2022 earnings of $0.50 and 38.1 times estimated 2023 earnings of $0.65 per share. The stock’s 52-week range is $14.73 to $33.04. Livent does not pay a dividend. Total shareholder return for the past year was 8.65%.

Sunrun

Residential solar energy installer Sunrun Inc. (NASDAQ: RUN) has had a tough year. Shares have dropped about 66% over the past 12 months, including a 58% decline since mid-November. Solar stocks react sharply to geopolitical issues, interest rate increases and the prices of oil and natural gas. And the reactions come across the board from panel makers like JK Solar, component makers like Enphase and installers. The company reports results after markets close Thursday.

Of 21 analysts covering the stock, 18 have a Buy or Strong Buy rating on the shares and two more rate the stock at Hold. At a share price of around $24.50, the upside potential based on a median price target of $54 is 120%. At the high price target of $91, the upside potential is 271%.

Fourth-quarter revenue is forecast at $408.96 million, down 6.8% sequentially but up 27% year over year. Analysts are forecasting an adjusted loss of $0.15 per share, much worse than the $0.11 per share profit in the prior quarter but much better than the per-share loss of $0.76 in the year-ago quarter. For full fiscal 2021, Sunrun is expected to post an adjusted loss per share of $0.35, less than half its $0.85 loss per share in 2020. Revenue of $1.58 billion is 71.3% higher than in 2020.

Sunrun stock trades at an estimated sales to enterprise value multiple of 7.8 times in 2021, an estimated 6.8 times multiple for 2022 and an estimated 6.1 times 2023 sales. The company does not pay a dividend. Total shareholder return for the past year was negative 68.5%.

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.