Investing

5 'Strong Buy' Natural Gas Dividend Stocks to Buy as Spot Prices Soar

Published:

Unless you have been asleep for the past year, you have seen the incredible price increases in energy commodities. Oil is at the highest level since 2014, while natural gas has surged to its highest levels in more than 13 years. Though reasons for the massive and spiraling surge in prices are many, from government regulations and policy changes to the conflict in Ukraine, one thing is for sure. Demand for both oil and gas products will continue to soar, especially if supply from Russia is embargoed.

We decided to screen our 24/7 Wall St. energy research database looking for companies that were heavily weighted to natural gas, and we found five large-cap stocks that are ideal for growth stock investors looking to capitalize on the solid pricing and demand environment.

It is important to remember that no single analyst report should be used as a sole basis for any buying or selling decision.

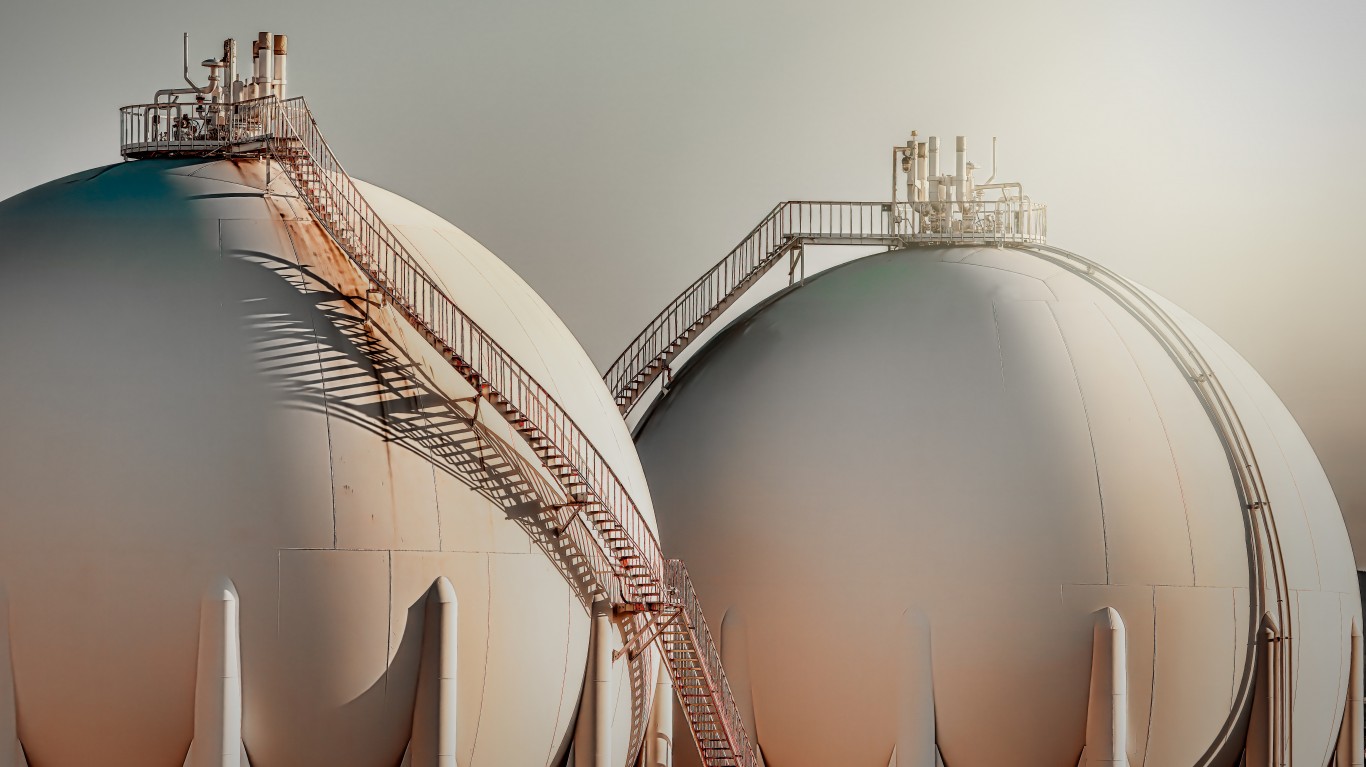

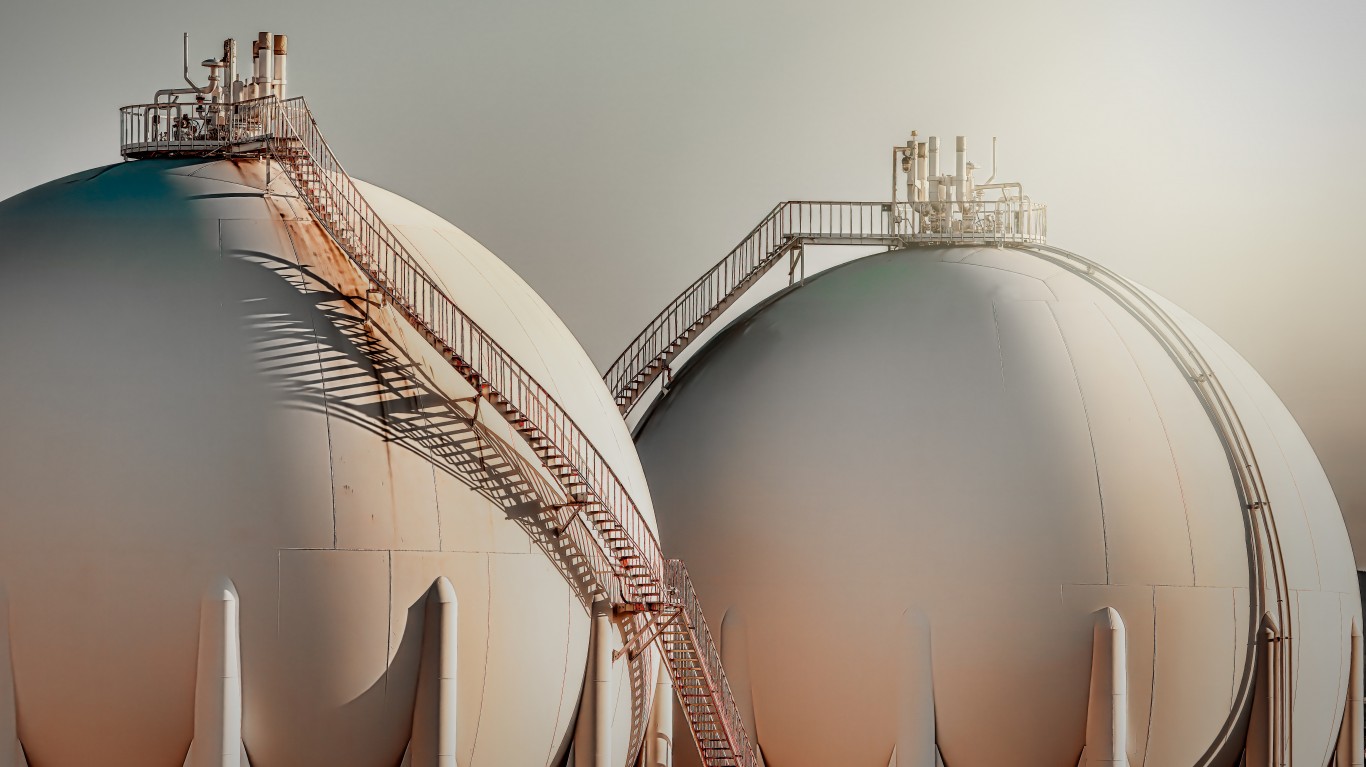

This top liquefied natural gas (LNG) play has made a huge move off the October 2020 lows. Cheniere Energy Inc. (NYSEAMERICAN: LNG) is an energy company primarily engaged in LNG-related businesses. The company operates through two segments.

Cheniere’s LNG terminal segment consists of the Sabine Pass and Corpus Christi LNG terminals. Its LNG and natural gas marketing segment consists of LNG and natural gas marketing activities by Cheniere Marketing.

Cheniere Marketing is developing a portfolio of long- and medium-term sale and purchase agreements with professional staff based in the United States, the United Kingdom, Singapore, and Chile. The company conducts its business through its subsidiaries, including the development, construction, and operation of its LNG terminal business and the development and operation of its LNG and natural gas marketing business.

Cheniere Energy stock investors receive a 0.95% dividend. Barclays has a $160 price target, which is higher than the $148.35 consensus target. The shares closed on Tuesday at $139.13.

This company was formed by the closing of the $17 billion merger of Cabot Oil & Gas and Cimarex Energy in 2021. Coterra Energy Inc. (NASDAQ: CTRA) is an independent oil and gas company engaged in the development, exploration and production of oil, natural gas and NGLs in the United States. It primarily focuses on the Marcellus Shale, with approximately 177,000 net acres in the dry gas window of the play located in Susquehanna County, Pennsylvania.

The company also holds Permian Basin properties with approximately 306,000 net acres and Anadarko Basin properties located in Oklahoma with approximately 182,000 net acres. In addition, it operates natural gas and saltwater disposal gathering systems in Texas. The company sells its natural gas to industrial customers, local distribution companies, oil and gas marketers, major energy companies, pipeline companies and power generation facilities.

As of December 31, 2021, it had proved reserves of approximately 2,892,582 thousand barrels of oil equivalent, which include 189,429 thousand barrels of oil and other liquid hydrocarbons, 14,895 billion cubic feet of natural gas and 220,615 thousand barrels of natural gas liquids.

Shareholders receive a 1.97% dividend. The Mizuho target price on Coterra Energy stock is a Wall Street high $44. The consensus target of $31.75 is closer to Tuesday’s close at $30.47 per share.

This company is expected to have a stunning percentage of its production come in as natural gas. EQT Corp. (NYSE: EQT) operates as a natural gas production company in the United States. It also produces natural gas liquids (NGLs) and crude oil. As of December 31, 2020, it had 19.8 trillion cubic feet of proved natural gas, NGLs and crude oil reserves across approximately 1.8 million gross acres.

With more than 125 years of experience, EQT continues to be a leader in the use of advanced horizontal drilling technology. This technology is designed to minimize the potential impact of drilling-related activities and reduce the overall environmental footprint.

Investors receive a 1.11% dividend. The $58 Tudor Pickering Holt price target is well above the $38.55 consensus target. EQT stock closed down over 3% on Tuesday at $43.97.

This is one of the largest natural gas infrastructure companies in the world. Kinder Morgan Inc. (NYSE: KMI) operates through the following segments.

The Natural Gas Pipelines segment owns and operates interstate and intrastate natural gas pipelines and underground storage systems; natural gas gathering systems and natural gas processing and treating facilities; NGLs fractionation facilities and transportation systems; and LNG liquefaction and storage facilities.

The Products Pipelines segment owns and operates refined petroleum products and crude oil and condensate pipelines, as well as associated product terminals and petroleum pipeline transmix facilities.

The Terminals segment owns or operates liquids and bulk terminals that store and handle various commodities, including gasoline, diesel fuel, chemicals, ethanol, metals and petroleum coke. It also owns tankers.

The CO2 segment produces, transports and markets CO2 to recover and produce crude oil from mature oil fields, and it owns interests in or operates oil fields and gasoline processing plants, as well as operates a crude oil pipeline system in West Texas. It owns and operates approximately 83,000 miles of pipelines and 144 terminals.

Shareholders receive a 5.51% dividend. Mizuho analysts have set a $21 target price. That compares with a $17.95 consensus target for Kinder Morgan stock and Tuesday’s closing print of $19.60.

This off-the-radar name has seen strong movement since last fall and has undeniable positive prospects. Ovintiv Inc. (NYSE: OVV) engages in the exploration, development, production and marketing of natural gas, oil, and NGLs in the United States and Canada.

The company’s principal assets are in the Permian in West Texas, Anadarko in west-central Oklahoma and Montney in northeast British Columbia and northwest Alberta. Its other upstream assets are in the Eagle Ford in south Texas, Bakken in North Dakota, Uinta in central Utah, Duvernay in west central Alberta, Horn River in northeast British Columbia, and Wheatland in southern Alberta. The company was formerly known as Encana.

Shareholders receive a 1.49% dividend. The Ovintiv stock price target at Capital One Financial is $82. The consensus target was last seen at $61.16. Shares closed at $54.76 on Tuesday.

These five top energy picks are perhaps off the radar for some investors, but they offer outstanding growth potential and reasonable entry points as compared to some other companies in the sector. It may make sense to buy partial positions now and see if prices don’t back up some, as we could see some selling when earnings are delivered for the first quarter.

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Have questions about retirement or personal finance? Email us at [email protected]!

By emailing your questions to 24/7 Wall St., you agree to have them published anonymously on a673b.bigscoots-temp.com.

By submitting your story, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.