It is no secret that rising prices for crude oil have lifted the share prices of U.S. oil producers. Not as obvious, perhaps, is that shares of Canada’s top crude producers have all outperformed their U.S. competitors over the past 12 months.

Goldman Sachs analysts Neil Mehta, Carly Davenport and Nicolette Slusser earlier this month raised the price targets on five Canadian oil companies, three of which have been given a Buy rating by the analysts.

Overall, Goldman Sachs sees the price difference (spread) between U.S. benchmark West Texas Intermediate (WTI) and Western Canada Select (WCS) tightening. In the first quarter of the year, the WTI-WCS spread was about $13 a barrel. In early June, the spread had widened to $19 a barrel, reflecting “the widening of high sulfur fuel oil crack spreads, which tends to have a depressing impact on Canadian oil prices relative to Brent.”

In other words, when demand for crude is not stressed, high-sulfur crude from the oil sands is not price competitive; when demand is high, the spread closes.

Despite continuing protests, the TMX pipeline from Edmonton to Vancouver is expected to be operational in the third quarter of next year, according to the Goldman Sachs analysts. Combined with the Line 3 expansion from Alberta to northern Wisconsin, Goldman Sachs expects the spread to average $15 a barrel this year and $14 in 2023.

Goldman expects costs for Canada’s producers to rise next, given that crude prices will remain elevated as well. Higher pricing also leads to a conclusion that sustaining capital spending also will rise: ” Overall, while we do see higher cost pressures impacting margins, we believe these dynamics are largely embedded within our estimates, and we still expect significant cash generation at our crude deck….” The analysts forecast Brent crude (the international benchmark) at $135 a barrel in the second half of this year and $125 a barrel in 2023, dropping to $90 a barrel Brent in 2024.

The five companies included in the firm’s review, plus ConocoPhillips’s Canadian operations, have banded together to create a group called the Pathways Alliance with the goal of reducing greenhouse gas emissions by 22 million metric tons by 2030 on the way to net-zero emissions by 2050. According to the analysts, “some investors have become more constructive on the path forward and contribution the companies can make to driving emissions lower in Canada.”

Suncor Energy

The top Goldman Sachs pick from the Canadian oil producers is Suncor Energy Inc. (NYSE: SU). The company is the largest producer in the oil sands region, and it produced more than 700 million barrels of oil equivalent per day in 2021. Goldman Sachs raised its earnings per share (EPS) estimates by 12.2% for 2022, 10.9% for 2023,and 1.9% in 2024. Suncor doubled its dividend payment in October and repurchased 5.5% of its outstanding common shares in 2021.

The analysts noted that Suncor’s share price has risen 153% since January of 2021 compared to a Canadian peer average of 283% in the same period:

Among our Canadian Oils coverage, we see the most upside to SU on a total return basis, with a 23% total return on our 12-month US$51 price target relative to the Canada average total return of 18%. We expect improved business turnaround will be key to closing the performance gap.

Key risks to Goldman’s estimates remain commodity prices, refining margins, and operational execution. The analysts rate the stock a Buy and raised its price target from $43.00 to $51.00. Suncor’s dividend yield is about 3.25% and its total return over the past 12 months is about 57%.

Canadian Natural Resources

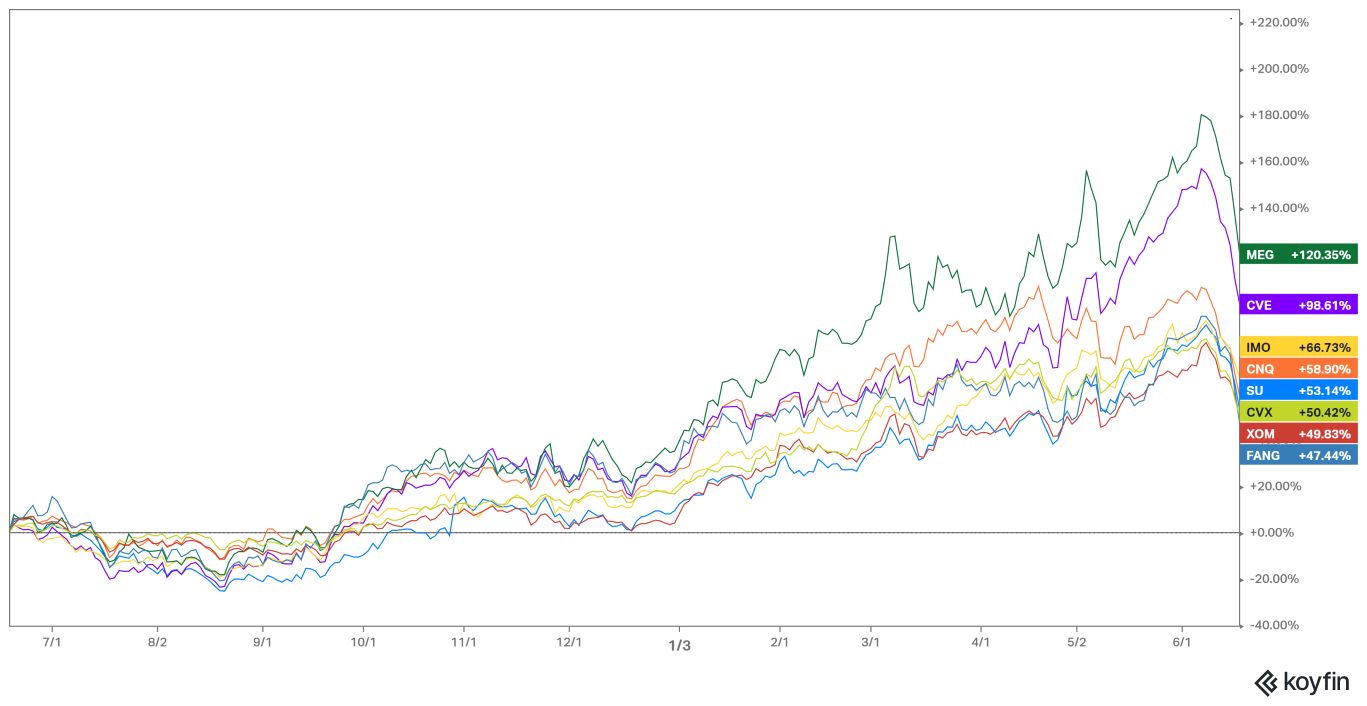

Canadian Natural Resources Ltd. (NYSE: CNQ) also trades under the same ticker symbol in Toronto. The Goldman Sachs analysts have maintained their Neutral rating on the shares and raised their price target from $72 to $80. As is the case for all these stocks, the higher price target reflects higher commodity prices and revised earnings estimates. As the following chart shows, all five of these Canadian stocks outperformed both U.S. super majors, Exxon Mobil and Chevron, as well as Diamondback Energy, a top-rated independent U.S. producer:

Goldman Sachs raised its earnings estimates on Canadian Natural Resources by 12.2% this year and 14.6% in 2023, before slipping by 2.2% in 2024. The price target and EPS changes reflect updated commodity price assumptions, tweaks to production costs and buyback assumptions. Key risks include lower commodity prices, higher capital spending and operational execution.

Imperial Oil

Imperial Oil, a subsidiary of Exxon Mobil, trades separately in Toronto under the ticker IMO. Goldman Sachs has a Buy rating on the stock and just raised its price target from C$79 to C$87. The analysts also raised their EPS estimates by 10.6% in 2022 and by 5.0% in 2023, and lowered their estimate by 5.5% for 2024. The price target and EPS changes reflect updated commodity price assumptions, tweaks to production costs and royalty rates and buyback assumptions. Key risks are falling commodity prices, declining refining margins and operational execution.

Cenovus Energy

Cenovus Energy Inc. (NYSE: CVE) is an integrated energy company that completed a merger in March of 2021 with Husky Energy and set an all-time high stock price earlier this month. The analysts have a Buy rating on the stock and just raised the 12-month price target from $24 to $29. They raised their EPS estimates for 2022 and 2023 by 8.9% and 7.2%, respectively. Cenovus’s EPS are projected to decline by about 8.4% in 2024.

The price target and EPS estimates reflect updated commodity price assumptions, tweaks to production costs and buyback assumptions. Key risks are lower commodity prices, lower refining margins and operational execution.

MEG Energy

The final Canadian oil company in the firm’s review is MEG Energy, which trades in Toronto under the ticker symbol MEG and over the counter in the United States (MEGEF). The company has about 2 billion barrels of proved plus probable bitumen reserves at its Christina Lake project. Goldman Sachs maintained a Neutral rating on the shares while raising the price target from C$21 to C$25. The analysts also raised the EPS estimates by 12.1% for 2022 and 13.3% for 2023, while lowering the 2024 price target by 2.6%.

The price target and EPS estimates reflect updated commodity price assumptions, tweaks to production costs and buyback assumptions. Key risks, as always, include falling commodity prices, higher capital spending and operational execution.

Want to Retire Early? Start Here (Sponsor)

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.