Investing

The Fed to the Rescue? Analysts Upgrade or Downgrade American Tower, Coinbase, Snowflake, Southwest and More

Published:

Markets were somewhat mixed on Thursday after what has been a rocky and truncated trading week. The Nasdaq was pushing higher by nearly 50 basis points, while the S&P 500 was flat and the Dow Jones was lower by 25 basis points.

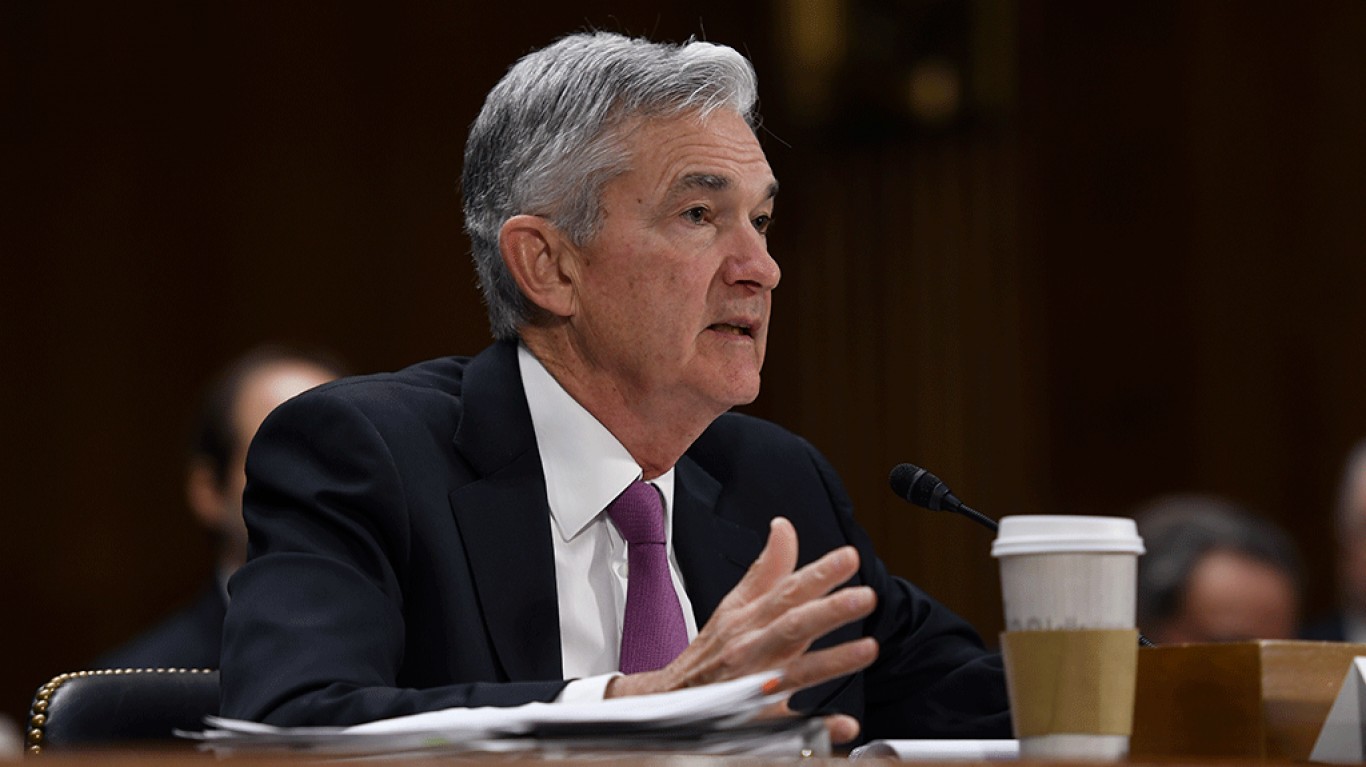

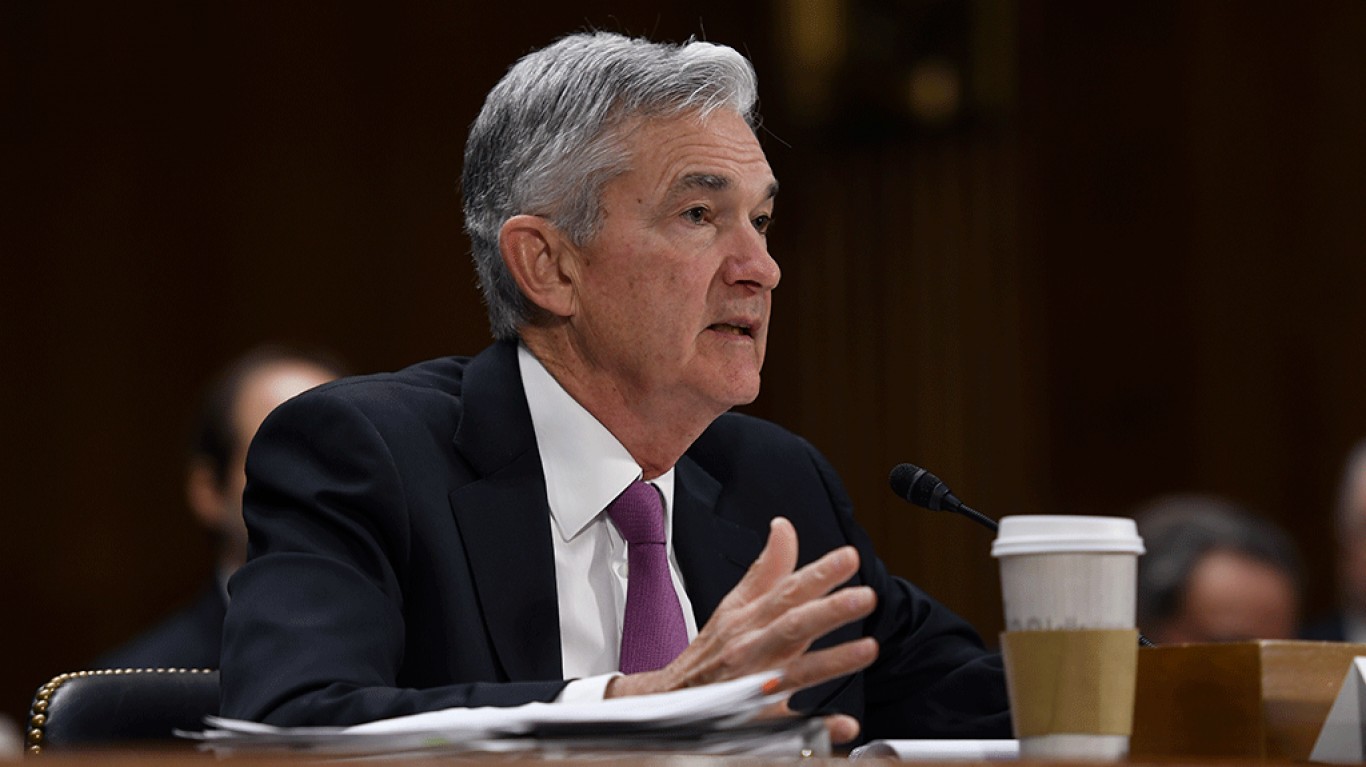

Fed Chair, Jerome Powell, appeared before the Senate Banking Committee for the second time this week discussing monetary policy and addressing concerns about inflation. While the US central bank is committed to reducing inflation, as per its dual mandate, there are still major concerns among economists.

Mohamed El-Erian, chief economic advisor at Allianz and regular contributor to CNBC, was quick to note that the Fed could very well push the US economy into recession with its actions. One of the first mistakes El-Erian pointed out was that the Fed was too late to acknowledge or act on inflation, letting it reach historic levels. The fact that the Fed labeled inflation as merely “transitory” less than one year ago is troubling, but hindsight is 20/20.

24/7 Wall St. is reviewing additional analyst calls seen on Thursday. We have included the latest call on each stock, as well as a recent trading history and the consensus targets among analysts. Note that analyst calls seen earlier in the day were on AutoZone, Best Buy, Dollar General, Lowes, Macy’s, and more.

American Tower Corp. (NYSE: AMT): Credit Suisse resumed coverage with an Outperform rating and a $313 price target. The stock traded near $256 on Thursday. The 52-week trading range is $220.00 to $303.72.

Coinbase Global, Inc. (NASDAQ: COIN): Redburn downgraded to a Neutral rating from Buy. The 52-week trading range is $40.83 to $368.90, and shares traded above $54 apiece on Thursday.

CRISPR Therapeutics AG (NASDAQ: CRSP): Evercore ISI downgraded to an In Line rating from Outperform and cut the price target to $60 from $66. The 52-week trading range is $42.51 to $169.76, and shares were trading near $63 on Thursday.

eBay Inc. (NASDAQ: EBAY): Morgan Stanley resumed coverage with an Underweight rating and a $36 price target. The 52-week trading range is $40.52 to $81.19, and shares traded above $42 apiece on Thursday.

Funko, Inc. (NASDAQ: FNKO): JPMorgan upgraded to an Overweight rating from Neutral and raised the price target to $28 from $25. The stock traded near $23 on Thursday, in a 52-week range of $15.28 to $24.19.

Leslie’s, Inc. (NASDAQ: LESL): Loop Capital downgraded to a Hold rating from Buy and cut the price target to $16 from $26. The 52-week range is $13.74 to $28.37. Shares traded near $15 apiece on Thursday.

Snowflake Inc. (NYSE: SNOW): JPMorgan upgraded to an Overweight rating from Neutral with a $165 price target. The stock traded near $139 on Thursday, in a 52-week range of $110.26 to $405.00.

Southwest Airlines Co. (NYSE: LUV): Raymond James upgraded to a Strong Buy rating from Outperform and cut the price target to $55 from $57. The shares traded near $35 on Thursday. The 52-week trading range is $34.36 to $56.33.

The Travlers Companies, Inc. (NYSE: TRV): Wolfe Research downgraded to a Peer Perform rating from Outperform and cut the price target to $156 from $185. The 52-week trading range is $145.40 to $187.98. Shares were changing hands at around $159 on Thursday.

Let’s face it: If your money is just sitting in a checking account, you’re losing value every single day. With most checking accounts offering little to no interest, the cash you worked so hard to save is gradually being eroded by inflation.

However, by moving that money into a high-yield savings account, you can put your cash to work, growing steadily with little to no effort on your part. In just a few clicks, you can set up a high-yield savings account and start earning interest immediately.

There are plenty of reputable banks and online platforms that offer competitive rates, and many of them come with zero fees and no minimum balance requirements. Click here to see if you’re earning the best possible rate on your money!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.