The three major U.S. equity indexes closed mixed Thursday. The Dow Jones industrials added 0.46%, and the S&P 500 rose by 0.3% while the Nasdaq slipped by 0.26%. Eight of 11 sectors ended the day with small gains, led by health care (1.6%) and utilities (1.4%). Energy closed down 2.5%.

The Bureau of Labor Statistics releases its nonfarm payrolls report for August Friday morning. New jobs increased by 3150,000, well below the 526,000 jobs added in July. Headline unemployment rose from 3.5% to 3.7%. Investors are stoked. All three major indexes traded higher shortly after Friday’s opening bell.

After markets closed Thursday, Lululemon reported results that beat estimates on both the top and bottom lines. Revenue rose by nearly 29% year over year, and the company issued upside guidance for the current quarter and the full fiscal year. Shares traded up more than 11% early Friday.

Broadcom also reported top-line and bottom-line beats, with revenue rising nearly 25% year over year. The chipmaker also raised its current-quarter guidance. The stock was up about 3% in early trading.

U.S. markets are closed Monday for the Labor Day holiday. We have had a look at what to expect when Coupa Software, GitLab and Uipath report after the close on Tuesday. Here are previews of two companies set to report results first thing Wednesday morning.

Academy Sports

Sporting gear retailer Academy Sports and Outdoors Inc. (NASDAQ: ASO) has seen its share price dip by about 2.7% over the past 12 months. From its peak (and all-time high) in mid-November, the stock is down about 10.5%. The stock has added 57% since posting a 52-week low in late May. The company has beaten analysts’ estimates for profits and revenues in every quarter since its late 2020 initial public offering.

Of 12 brokerages covering the firm, 11 have a Buy or Strong Buy rating and the other rates the stock at Hold. At a recent price of around $43.25 a share, the upside potential based on a median price target of $53.50 is 23.7%. At the high price target of $72.00, the upside potential is about 66.5%.

Analysts expect Academy Sports to report second-quarter fiscal 2023 revenue of $1.71 billion, which would be up 16.3% sequentially but down 4.5% year over year. Adjusted earnings per share (EPS) are forecast at $2.10, up 21.2% sequentially and 10.3% lower year over year. For the full fiscal year ending next January, estimates call for EPS of $6.96, down 8.4%, and revenue of $6.59 billion, down 2.7%.

The stock trades at 6.2 times expected 2023 EPS, 5.8 times estimated 2024 earnings of $7.52 and 5.1 times estimated 2025 earnings of $8.51 per share. The stock’s 52-week range is $25.10 to $51.08. Academy Sports pays a forward annual dividend of $0.30 (yield of 0.67%). Total shareholder return for the past year was negative 2.3%.

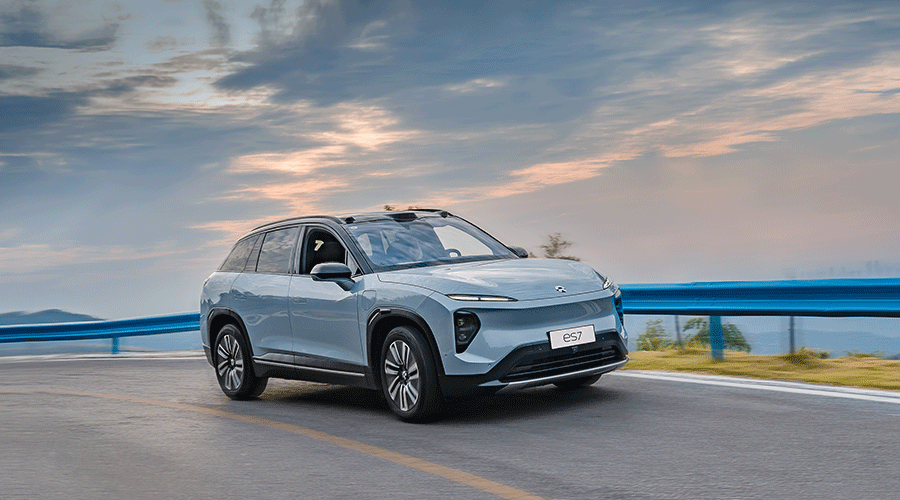

Nio

China-based EV maker Nio Inc. (NYSE: NIO) has dropped about 52% from its share price over the past 12 months. Since dipping to a 52-week low in mid-May, the stock has added 43.4%.

Nio delivered a total of 10,677 vehicles in August and has delivered 71,556 for the first eight months of 2022, representing a year-over-year increase of 28.3%. Continued lockdowns in some of China’s largest cities have hammered car sales. The only reason sales are better this year is that last year was truly awful. Things could get worse as the yuan weakens against the dollar.

There are 26 analyst ratings on Nio’s stock, and 24 are Buy or Strong Buy ratings. At a share price of around $18.80, the upside potential based on a median price target of $29.48 is about 56.8%. At the high target of $64.92, the upside potential is 245%.

For the first quarter of fiscal 2022, the consensus estimates call for revenue of $1.42 billion, down 9.4% sequentially and up 8.4% year over year. Nio is expected to post an adjusted loss per share of $0.18, worse than the $0.12 per-share loss in the prior quarter and much worse than the year-ago loss of $0.03 per share. For the full year, the company is expected to report a per-share loss of $0.54, worse than the $0.30 loss in 2021, on sales of $8.74 billion, up about 53.7%.

Analysts estimate that Nio will trade at a multiple of 76.1 times earnings in 2024. Until then, it is not expected to post a profit. The enterprise value-to-sales multiple is expected to be 3.1 in 2022 and 1.8 in 2023. The stock’s 52-week range is $11.67 to $44.27. The company does not pay a dividend, and the total shareholder return for the past year is negative 51.9%.

It’s Your Money, Your Future—Own It (sponsor)

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.