Investing

Miners Push For Ethereum Hard Fork as Sales of ETHW IOUs Continue

Published:

Last Updated:

The crypto community has been laser-focused on Ethereum’s upcoming Merge, which will transition the blockchain from proof-of-work to proof-of-stake. The transition is expected to occur this month, although there have been several tests in the years leading up to the Merge, which will go down as one of the most significant events in the history of cryptocurrency.

However, as the time of the Merge approaches, there is growing discussion about creating a hard fork of the Ethereum blockchain — continuing the proof-of-work chain in addition to the new proof-of-stake network.

There’s been talk of transitioning Ethereum from proof-of-work to proof-of-stake since at least early 2016. One of the primary reasons has been the significant energy required to complete a transaction on Ethereum. A single transaction on the blockchain consumes just as much energy as the average U.S. household in an entire week, resulting in the carbon footprint of watching more than 20,000 hours of YouTube.

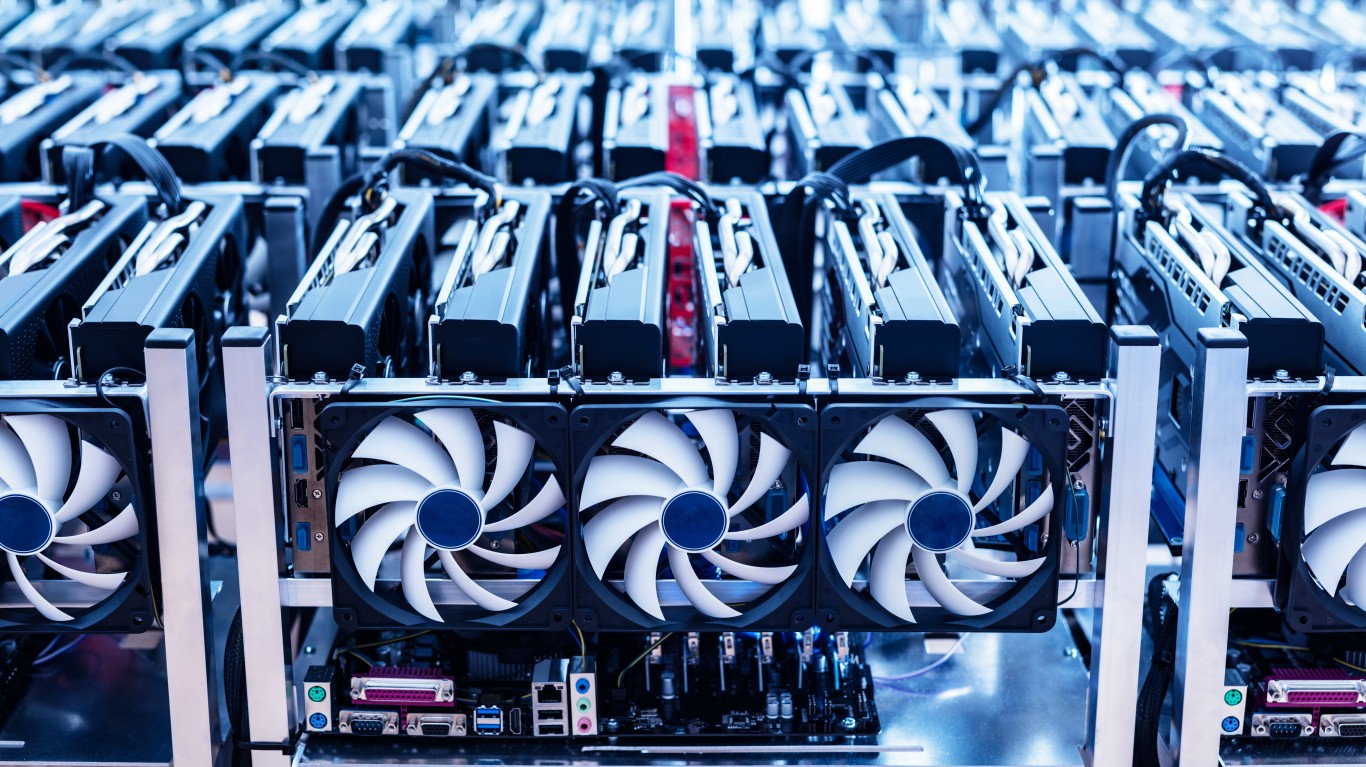

The large amount of energy required to complete transactions on proof-of-work blockchains has been one of the perennial arguments against cryptocurrencies, which is why there’s been a push toward proof-of-stake. Proof-of-work blockchains complete transactions via miners that solve complex mathematical problems, although mining is more about solving problems in exchange for newly minted tokens.

However, proof-of-stake blockchains utilize stakers who lock up their tokens to secure the network. Proof-of-stake protocols also significantly reduce the environmental impact of crypto mining and the resultant waste associated with proof-of-work blockchains.

Since it was created, Ethereum has been a proof-of-work protocol. However, after the Merge, miners who have been mining ether, the native token of the Ethereum network, will lose the ability to mint new ether tokens. Essentially, they’ll be put out of work and stuck with worthless mining rigs designed for ether because, after the Merge, ether will be created via staking rather than mining.

The Merge is called as such because it will be formed from the merging of the Ethereum blockchain with the Beacon Chain, also referred to as the consensus layer. The Ethereum Foundation describes the Beacon Chain as “an essential precursor to upcoming scaling upgrades” and “a ledger of accounts that conducts and coordinates the network of stakers.”

The foundation emphasized that the Beacon Chain doesn’t process transactions or handle smart contract interactions as the Ethereum network does. Instead, it’s a new consensus engine that will replace proof-of-work mining, upgrading Ethereum in the process. The Beacon Chain introduced proof-of-stake in its transition with Ethereum, creating a new way for users to keep the network secure. Although the Beacon Chain has already been live for some time, it has existed as a separate chain from the main Ethereum network since it began.

When the Merge takes place, Ethereum’s developers will take the proof-of-work algorithm currently at work on the Ethereum network and replace it with the proof-of-stake algorithm on the Beacon Chain, hence, the “Merge” name.

Proof-of-work protocols involve the use of nodes, which are computers that make up a massive network and compete with each other to solve complex math problems. The successful ones are rewarded with a new token for their efforts.

However, proof-of-stake protocols are more energy-efficient and environmentally friendly because they select nodes using an algorithm that prefers the nodes that hold more of the network’s currency. These nodes’ stakes are rewarded with new tokens.

After the Merge, Ethereum is expected to slash its energy consumption by about 99%. It should also speed up the pace of transaction completion significantly. However, not everyone is happy with the new arrangement.

Specifically, miners with sizable investments in Ethereum mining rigs will lose the ability to mint new ether tokens when those computers suddenly become obsolete. Ethereum miners generated over $620 million worth of ether just in July alone, so the disappearance of this income stream is quite significant.

As a result, a group of miners proposed last month to fork the Ethereum network to create a new form of ether that could still be mined, suggesting that the new token be tagged as ETHW. However, after initially capturing strong enthusiasm for the new token, the ETHW price tumbled, losing its momentum after only about a week of trading.

At this point, ETHW still doesn’t technically exist. The only way it ever will exist is if its supporters can successfully create a hard fork on the Ethereum network, splitting it into the proof-of-stake token that ether will become after the Merge and the continuation of the minable, proof-of-work token.

Some crypto exchanges expect the theoretical ETHW token to generate significant interest, so they’ve listed “IOU” versions of the token for trade, which is why prices have been attached to it despite the fact that it doesn’t exist yet.

Holders of those IOUs for ETHW tokens will see those IOUs convert to actual cryptocurrency if the ETHW fork is successful following the Merge. However, if the fork is unsuccessful, those IOU holders will see their tokens converted into the new proof-of-stake ether.

The tumbling price for those IOU ETHW tokens suggests that interest around the proof-of-work version of ether is insignificant and driven by miners hoping to continue minting new tokens and selling them. Ethereum’s core developer, Preston van Loon, says he doesn’t think ETHW will be sustainable. He thinks there won’t be enough buyers to absorb the constant selling pressure from miners, which will send the cryptocurrency to zero.

For now, the debate over whether to execute a hard fork of Ethereum at the time of the Merge continues. A hard fork occurs when a cryptocurrency splits into two different tokens.

Tron founder Justin Sun is one of the most prominent supporters of a hard fork at the Merge. He tweeted recently that his Tron-based stablecoin USDD will become the “first stablecoin in the EthereumPOW ecosystem.” Miner Chandler Guo is another high-profile supporter of a hard fork of Ethereum.

At the end of the day, holders of ether shouldn’t be affected by the Merge or the transition to proof-of-stake. Their ether should be worth the same both before and after the Merge, barring any significant selling or buying triggered by the event.

It remains to be seen whether the miners backing a hard fork will have their way or whether a new proof-of-work token will draw any investment from crypto enthusiasts after the Merge.

This article originally appeared on The Tokenist

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.