Investing

More Buybacks on the Way, but Are Dividends Better for Shareholders?

Published:

Until the Inflation Reduction Act that was enacted last month, corporate stock repurchase announcements had fallen off a cliff in 2022. The new law subjects corporations to a 1% excise tax on stock buyback plans announced in 2023 and thereafter.

Companies have reacted predictably by announcing a wave of new buyback programs to get in under the existing regime. Johnson & Johnson (NYSE: JNJ) on Wednesday announced a $5 billion stock buyback plan that has no time limit and may be suspended or discontinued at any time. The company may buy back its stock in either an open market or privately negotiated transaction.

Independent oil and gas producer APA Corp. (NYSE: APA) added 40 million shares to an existing buyback program. APA repurchased 7 million shares at an average price of $42.59 in the June quarter and an additional 6.9 million shares in July at an average price of $33.87 per share. The company also doubled its annual dividend to $1.00 per common share.

Since the Inflation Reduction Act was signed, Home Depot has announced a buyback totaling $15 billion, Salesforce has said it will repurchase $10 billion of its shares, and Yum Brands plans to buy back $2 billion in its own stock. These are just the largest of the buybacks announced in the last two weeks of August. In the same period, General Motors reinstated its dividend and will resume its buyback program by bumping it from a remaining $3.3 billion to $5 billion.

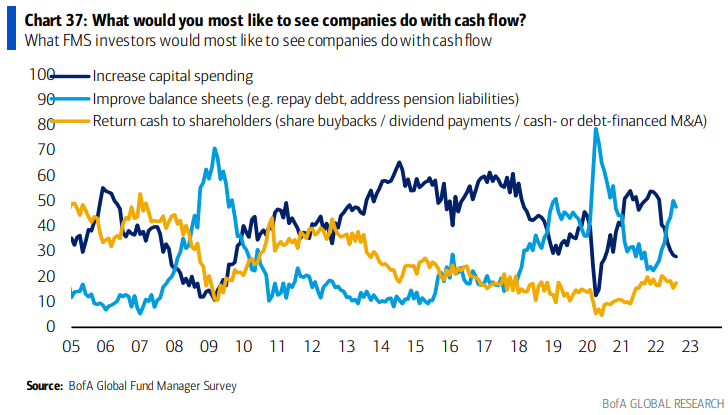

What do fund managers think companies should do with their cash piles? According to Bank of America Global Research’s August global fund manager survey, returning cash to shareholders through buybacks, higher dividends or a merger or acquisition places third in a three-horse race with improving the balance sheet (#1) and increasing capital spending (#2).

Given the size of corporate cash holdings, special dividends may also be added to the mix. London-listed Taylor Maritime, for example, has offered to acquire the 74% of dry bulk shipping firm Grindrod that it does not already own for $26 a share. That payment includes $21 per share in cash and a $5 per share special dividend.

Fund managers would like to see companies reduce leverage and take steps to address big liabilities like pension obligations because it raises profitability and that is easy to sell to investors. Raising capital spending is investing for growth, and that is complicated these days. Giving money back to shareholders in dividends or stock repurchases is straightforward.

24/7 Wall St.

24/7 Wall St.

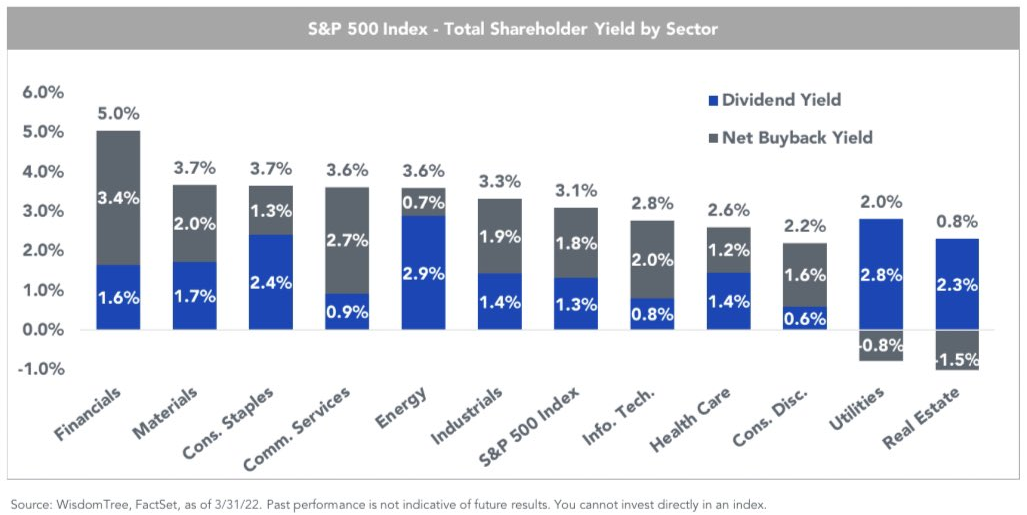

One way to look at it is that buyback yields are only realized when a stock is sold. Dividend yields pay investors for holding onto the shares. Corporate executives and directors generally receive at least some of their compensation in the form of stock options that benefit from buybacks but do not benefit from dividends.

If APA is typical of its sector, raising the dividend is more beneficial for current stockholders and less likely to be affected by the 1% buyback tax. Johnson & Johnson shareholders benefit about equally from buybacks or dividends. Financial and communications services stocks benefit most from buybacks and stand to be hit hardest by the new tax.

University of Massachusetts at Lowell economics professor William Lazonick told Marketplace, “Shareholder activists love stock buybacks because it’s a great way of taking money out of companies.”

Former Liz Claiborne (now Kate Spade) CEO William McComb defended buybacks, commenting that if a company has excess cash, then the firm should spread the wealth to shareholders in the most efficient way possible.

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.