The packaged software industry includes companies that offer multiple software programs bundled together to make a complete set. Microsoft Office, for example, is a packaged software as it includes many other applications, such as Microsoft Excel, Microsoft Word and others.

The demand for packaged software is on the rise primarily due to growing IT investment in the retail industry. Let’s take a look at the 10 best-performing packaged software companies in 2022 (so far).

Ten Best-Performing Packaged Software Companies In 2022

We have used the year-to-date return data of the packaged software stocks to rank the 10 best-performing packaged software companies in 2022.

-

Simulations Plus (5%)

Founded in 1996 and headquartered in Lancaster, Calif., this company offers modeling and simulation software, as well as consulting services. Simulations Plus Inc (NASDAQ:SLP) shares are up by almost 1% in the last three months and up over 26% in the last year.

As of this writing, Simulations Plus shares are trading at above $49 (52-week range of $106.48 to $162.36), giving it a market capitalization of more than $980 million.

-

Qualys (5%)

Founded in 1999 and headquartered in Foster City, Calif., this company offers cloud security and compliance solutions. Qualys Inc (NASDAQ:QLYS) shares are up by over 14% in the last three months and up almost 30% in the last year.

As of this writing, Qualys shares are trading at above $142 (52-week range of $106.48 to $162.36), giving it a market capitalization of more than $5.40 billion.

-

Powerbridge Technologies (9%)

Founded in 1997 and headquartered in Zhuhai, China, this company develops SaaS solutions and Blockchain applications. Powerbridge Technologies Co Ltd (NASDAQ:PBTS) shares are down by over 11% in the last three months and down almost 49% in the last year.

As of this writing, Powerbridge Technologies shares are trading at above $0.50 (52-week range of $0.2518 to $2.2100), giving it a market capitalization of more than $50 million.

-

Citrix Systems (10%)

Founded in 1989 and headquartered in Fort Lauderdale, Fla., this company offers information technology solutions, including a digital workspace that unifies apps, data and services. Citrix Systems, Inc. (NASDAQ:CTXS) shares are up by almost 7% in the last three months but are down by over 3% in the last year.

As of this writing, Citrix Systems shares are trading at above $103 (52-week range of $78.07 to $108.84), giving it a market capitalization of more than $13 billion.

-

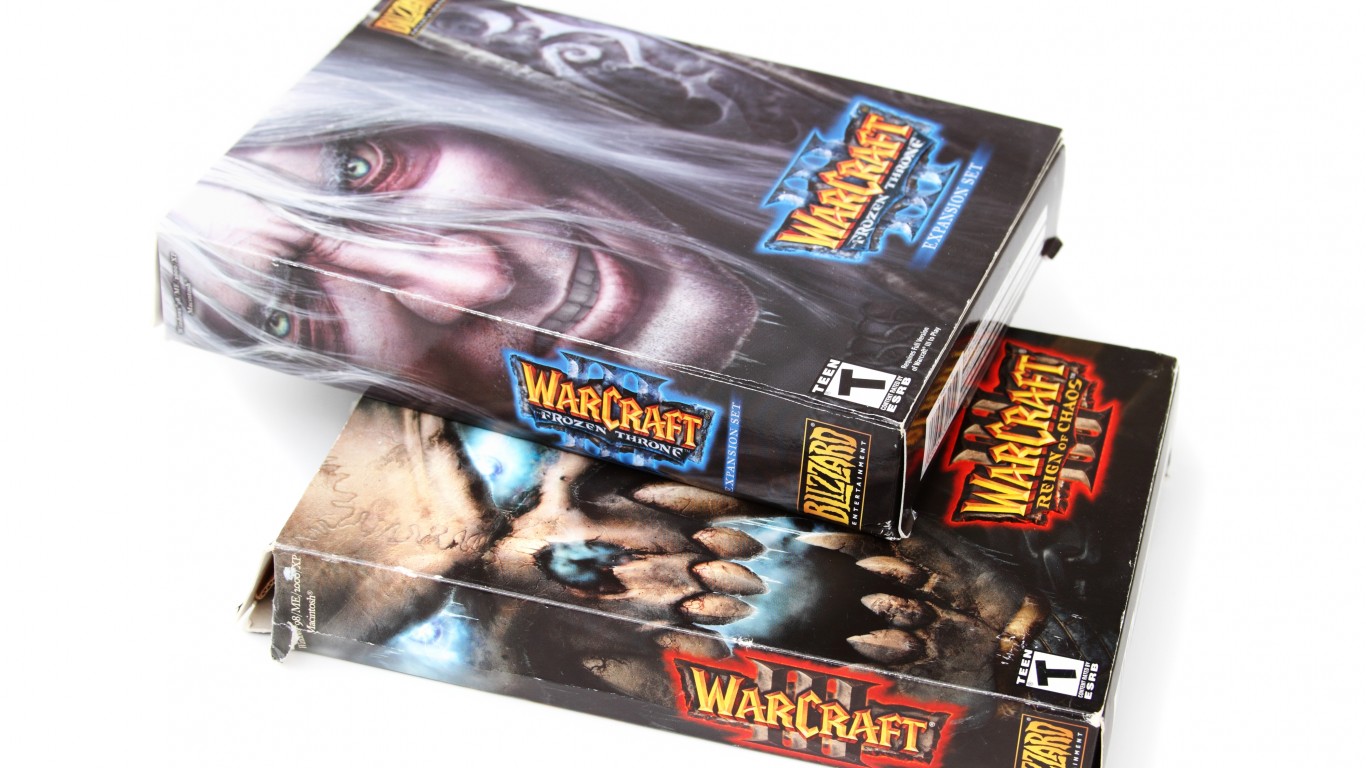

Activision Blizzard (13%)

Founded in 1979 and headquartered in Santa Monica, Calif., this company develops and publishes interactive entertainment content and services. Activision Blizzard, Inc. (NASDAQ:ATVI) shares are down by almost 4% in the last three months and down over 3% in the last year.

As of this writing, Activision Blizzard shares are trading at above $74 (52-week range of $56.40 to $86.90), giving it a market capitalization of more than $58 billion.

-

Change Healthcare (28%)

Founded in 2007 and headquartered in Nashville, Tenn., this company develops a healthcare technology platform to offer data and analytics-driven solutions. Change Healthcare Inc (NASDAQ:CHNG) shares are up by over 19% in the last three months and up over 31% in the last year.

As of this writing, Change Healthcare shares are trading at above $27 (52-week range of $18.97 to $27.59), giving it a market capitalization of more than $8.90 billion.

-

Sierra Wireless (74%)

Founded in 1993 and headquartered in Richmond, British Columbia, Canada, this company offers device-to-cloud and networking solutions, and operates through Embedded Broadband and Internet-of-Things Solutions (IoT) segments. Sierra Wireless, Inc. (NASDAQ:SWIR) shares are up by almost 31% in the last three months and up over 97% in the last year.

As of this writing, Sierra Wireless shares are trading at above $30 (52-week range of $13.44 and $30.97), giving it a market capitalization of more than $1 billion.

-

SurgePays (133%)

Founded in 2006 and headquartered in Bartlett, Tenn., it is a technology-driven company that has developed a supply chain software platform. Surgepays Inc (NASDAQ:SURG) shares are down by almost 3% in the last three months and down almost 22% in the last year.

As of this writing, SurgePays shares are trading at above $4.60 (52-week range of $1.7600 to $7.3000), giving it a market capitalization of more than $59 million.

-

Sunrise New Energy (168%)

Founded in 2014 and headquartered in Beijing, China, this company offers advisory services to small and medium enterprises via a peer-to-peer knowledge sharing and enterprise service platform. Sunrise New Energy Co Ltd (NASDAQ:EPOW) shares are up by over 57% in the last three months and up over 36% in the last year.

As of this writing, Sunrise New Energy shares are trading at above $2.40 (52-week range of $1.0500 to $6.4200), giving it a market capitalization of more than $68 million.

-

CYREN (242%)

Founded in 1991 and headquartered in Herzliya, Israel, this company provides cloud delivered Software-as-a-Service cybersecurity solutions. Cyren Ltd (NASDAQ:CYRN) shares are down by almost 51% in the last three months but are up by over 60% in the last year.

As of this writing, CYREN shares are trading at around $1 (52-week range of $0.1800 to $13.8700), giving it a market capitalization of more than $8 million.

This article originally appeared on ValueWalk

“The Next NVIDIA” Could Change Your Life

If you missed out on NVIDIA’s historic run, your chance to see life-changing profits from AI isn’t over.

The 24/7 Wall Street Analyst who first called NVIDIA’s AI-fueled rise in 2009 just published a brand-new research report named “The Next NVIDIA.”

Click here to download your FREE copy.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.