Investing

CleanSpark Bounces More Than 27% This Week as The Miner Upgrades Guidance After Hitting Target Early

Published:

Shares of bitcoin miner CleanSpark (US:CLSK) has risen 27.6% in trading on this week as the company announced that it had achieved its 2022 year-end hash rate target of 5 EH/s more than two months ahead of schedule.

Despite this recent bounce, CLSK’s share price has been declining from a 2022 high achieved in April and remains -61% lower. The primary reason for the share price weakness has been a falling Bitcoin price which is linked to the level of revenue generation.

The miner has grown its bitcoin mining hashrate (EH/s) rate by more than 150% over the year from 1.9 EH/s at the end of 2021 to 5 EH/s currently.

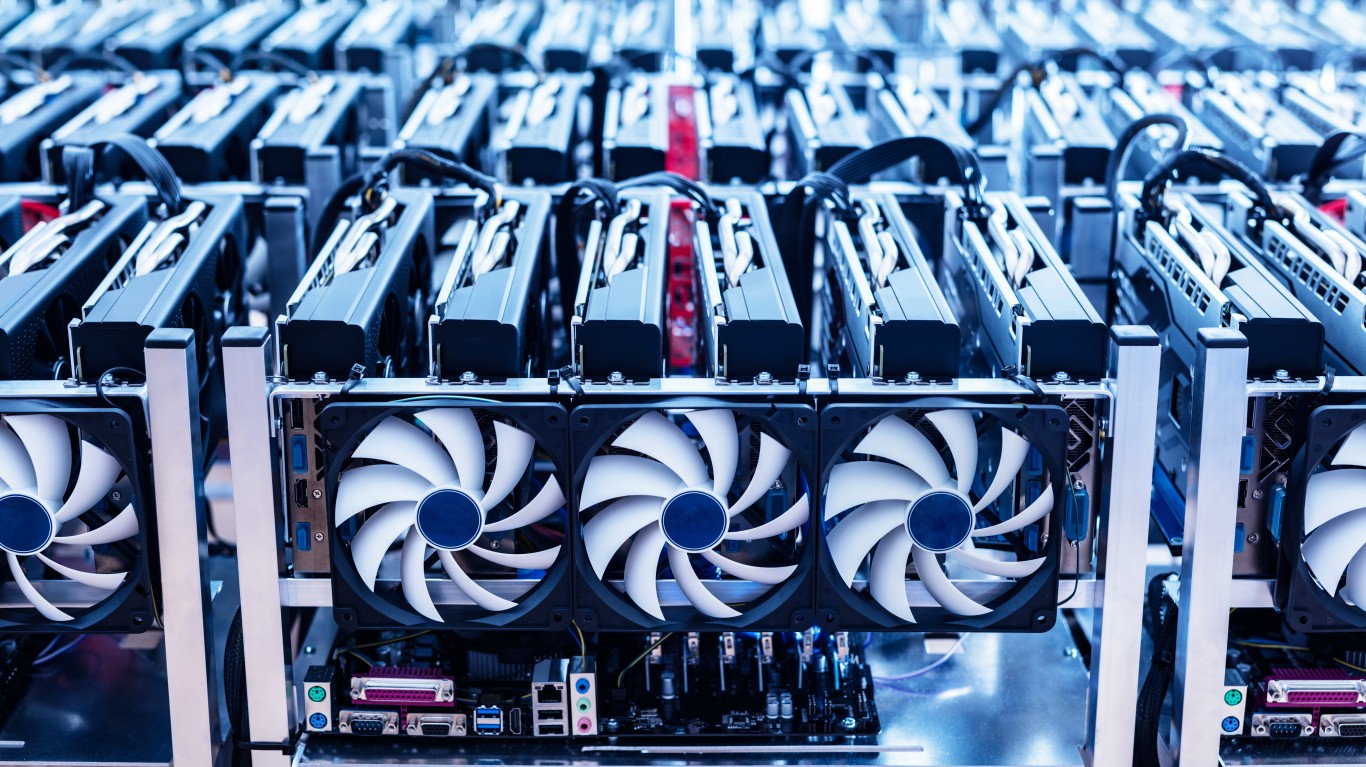

A company’s hashrate is the computing power available for processing transactions and securing the bitcoin blockchain, is one of the most critical metrics for evaluating public bitcoin mining companies. It determines how much bitcoin a company mines.

As the company achieved its guidance more than two months ahead of schedule, management decided to upgrade full-year minining rate guidance by 10% to 5.5 EH/s.

In 2023, CleanSpark has guided the market that it is targeting a bitcoin mining rate of 22.4 EH/s which will make it one of the largest Bitcoin mines globally.

The global bitcoin mining rate at the end of 2022 is expected to be around 260-270 EH/s and likely growing to 300 EH/s over 2023.

CleanSpark could effectively grow market share towards 10% of the total global processing hash rates.

CleanSpark’s CEO Zach Bradford accompanied the press with statements highlighting “In a period where the sector is experiencing referrals in forward-looking expectations, we are bucking the trend”

Bradford did note that the Washington and new Sandersville facility helped the company achieve its growth target but pointed out that CLSK’s “operational prowess and efficiency gains” were the main driver of the achievement.

During CleanSpark’s last mining update in September, the company mined 448 Bitcoins representing 13% growth over the previous month. For the full year, CLSK has mined 3,090 Bitcoins and still holds 594 on the balance sheet after selling the rest to fund its operations.

The balance of bitcoin held on the balance sheet is worth about $12 million at current spot prices of around $20.2K per $1 USD.

BTC sales during September generated $7.5 million of income for the company.

CleanSpark currently has four owned and operated facilities with approximately 50,000 operational mining machines and has a daily production high of 19.2 bitcoin.

CleanSpark also reported to investors in early October that it completed the acquisition of the Sandersville facility from Mawsons Infrastructure Group (US:MIGI) for $42.5 million in cash. The acquisition included about 6,500 miners.

One benefit of the falling CLSK share price over 2022 has been the significant uptick in institutional interest for the stock. This can be explained by Fintel’s institutional ownership score of 81.35 which ranks the company in the top 5% when screened against 32,564 other stocks.

CleanSpark has 220 institutions on the register that collectively now own 15.8 million shares on the register. Some of these institutions include Geode Capital, Mirae Asset Global Investments and State Street Corp.

CLSK is just one of many Crypto miners that have fallen significantly over 2022 with the BTC price. Some of these companies with their 2022 year to date return are:

This article originally appeared on Fintel

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.