Investing

5 Very Safe Dividend Kings to Buy Now in Case the Potential Coming Sell-Off Is Devastating

Published:

The recent election proved that while there may be a switch in the leadership in the U.S. House of Representatives, and the Senate may remain tied at 50-50, the issues facing the economy will still be the same. While inflation has been tamped down some, the reality is that prices are still trending at the highest levels in 40 years, and consumers are being stretched very thin. One thing is for sure. If the election plays out the way it looks like it will, the beloved gridlock could be on the way.

The negative reaction to the election results and current inflation data could make things especially difficult as we head toward the end of the year. While seasonality is generally positive during the annual year-end run, this year could be different. We might be set up for a final massive sell-off. What makes sense now is safe, dividend-paying stocks.

We often have written about the opportunities that the Dividend Aristocrats offer for long-term investors. These are the companies that meet the guidelines for inclusion and have raised their dividends every year for 25 years. In 2022, 66 stocks made the cut and remain top picks across Wall Street.

For those seeking even greater dividend dependability, investors may be drawn to the Dividend Kings. These 44 companies have raised their payouts to shareholders a stunning 50 consecutive years or more. We screened the list looking for safe stocks that are Buy rated on Wall Street and found five that look like great ideas now. It is important to remember that no single analyst report should be used as a sole basis for any buying or selling decision.

This Dividend King is way off the radar for many, but it is among the safest plays now. Black Hills Corp. (NYSE: BKH) operates as an electric and natural gas utility company in the United States.

The Electric Utilities segment generates, transmits and distributes electricity to approximately 218,000 electric utility customers in Colorado, Montana, South Dakota and Wyoming. It owns and operates 1,481.5 megawatts of generation capacity and 8,892 miles of electric transmission and distribution lines.

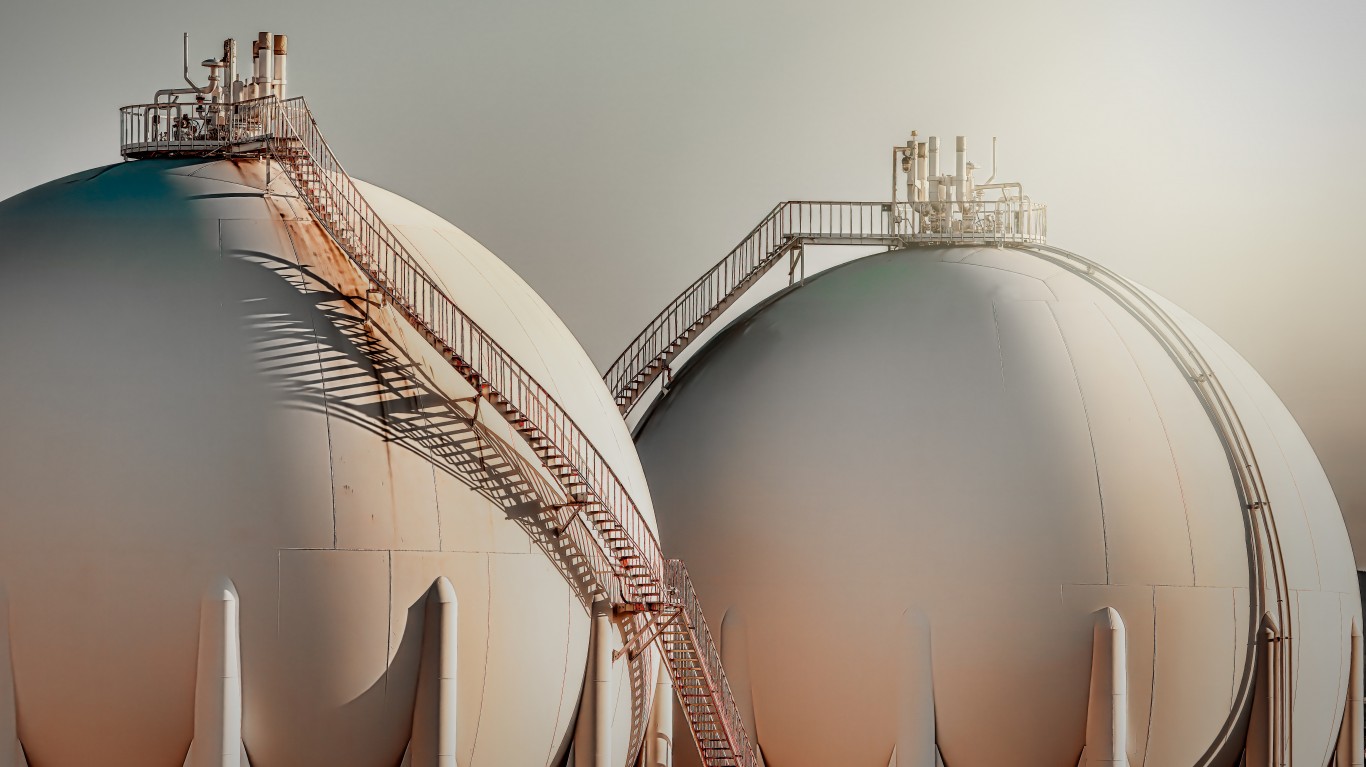

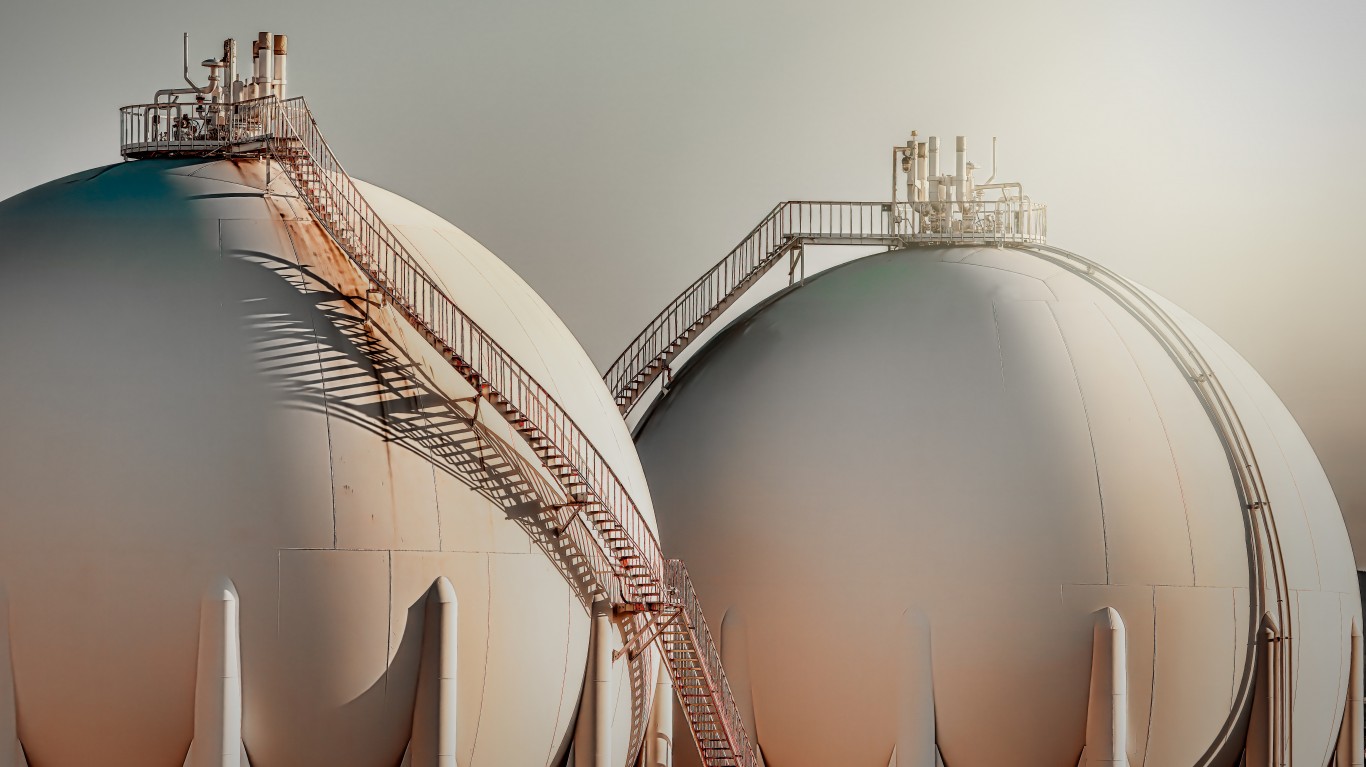

The Gas Utilities segment distributes natural gas to approximately 1,094,000 natural gas utility customers in Arkansas, Colorado, Iowa, Kansas, Nebraska and Wyoming. It owns and operates 4,732 miles of intrastate gas transmission pipelines, 41,644 miles of gas distribution mains and service lines, six natural gas storage sites and approximately 50,000 horsepower of compression and 515 miles of gathering lines.

Shareholders receive a 3.97% dividend. Sidoti has an $80 target price on Black Hills stock. The consensus target is $75.00, and shares closed on Wednesday at $64.19.

This remains a top Buffet holding, as he owns 400 million shares. Coca-Cola Co. (NYSE: KO) is the world’s largest beverage company, refreshing consumers with more than 500 sparkling and still brands. It has an incredibly strong worldwide brand, with 40% overseas sales.

The company’s portfolio features 20 billion-dollar brands including Diet Coke, Fanta, Sprite, Coca-Cola Zero, vitaminwater, Powerade, Minute Maid, Simply, Georgia and Del Valle. Globally, it is the number one provider of sparkling beverages, ready-to-drink coffees and juices and juice drinks.

Through the world’s largest beverage distribution system, consumers in more than 200 countries enjoy Coca-Cola beverages at a rate of more than 1.9 billion servings a day. Also remember that the company also owns 16.7% of Monster Beverage, which continues to deliver big numbers.

Coca-Cola stock investors receive a 2.72% dividend. UBS’s $68 target price is less than the $69.02 consensus target, but Wednesday’s close was at $58.77.

During even difficult times, people still have to buy groceries, and this stock is a pure play in the consumer defensive arena. Hormel Foods Corp. (NYSE: HRL) develops, processes and distributes various meat, nuts and other food products to retail, food service, deli and commercial customers in the United States and internationally.

The company provides various perishable products, including fresh meats, frozen items, refrigerated meal solutions, sausages, hams, guacamoles and bacons, as well as such shelf-stable products as canned luncheon meats, nut butters, snack nuts, chilies, microwaveable meals, hashes, stews, tortillas, salsas and tortilla chips.

It also engages in the processing, marketing and sale of branded and unbranded pork, beef, poultry and turkey products. It offers nutritional food products and supplements, desserts and drink mixes, and industrial gelatin products. Its brands include Skippy, Spam, Hormel, Natural Choice, Applegate, Justin’s, Jennie-O, Café H, Herdez, Black Label, Sadler’s, Columbus, Gatherings, Wholly, Columbus, Planters, Planters Cheez Balls and Corn Nuts.

The dividend yield here is 2.19%. The $53 Argus price target is well above the $46.22 consensus target. Hormel Foods stock closed at $47.14 on Wednesday.

This consumer staples leader is another safe bet for nervous investors. Kimberly-Clark Corp. (NYSE: KMB) manufactures and markets personal care and consumer tissue products worldwide. It operates through the following three segments.

The Personal Care segment offers disposable diapers, swim pants, training and youth pants, baby wipes, feminine and incontinence care products, and other related products under the Huggies, Pull-Ups, Little Swimmers, GoodNites, DryNites, Sweety, Kotex, U by Kotex, Intimus, Depend, Plenitud, Softex, Poise and other brands.

The Consumer Tissue segment provides facial and bathroom tissues, paper towels, napkins and related products under the Kleenex, Scott, Cottonelle, Viva, Andrex, Scottex, Neve and other brands.

Kimberly-Clark’s K-C Professional segment offers wipers, tissues, towels, apparel, soaps and sanitizers under the Kleenex, Scott, WypAll, Kimtech and KleenGuard brands.

The company sells its household use products directly to supermarkets, mass merchandisers, drugstores, warehouse clubs, variety and department stores, and other retail outlets, as well as through other distributors and e-commerce. It sells away-from-home use products directly to manufacturing, lodging, office building, food service and public facilities, as well as through distributors and e-commerce.

Investors receive a 3.73% dividend. Jefferies has set a $146 target price, while the consensus target for Kimberly Clark stock is $125.62. Wednesday’s final trade was reported at $123.83.

This is another off-the-radar utility stock that is a good choice for worried conservative investors looking for income and safety. Northwest Natural Holding Co. (NYSE: NWN), through its subsidiary Northwest Natural Gas, provides regulated natural gas distribution services to residential, commercial, industrial and transportation customers in Oregon and southwest Washington.

The company also operates 5.7 billion cubic feet of the Mist gas storage facility contracted to other utilities and third-party marketers. It offers natural gas asset management services and operates an appliance retail center. In addition, it engages in gas storage, water, non-regulated renewable natural gas and other investments and activities.

The company provides natural gas service through approximately 786,000 meters in Oregon and southwest Washington, as well as water services to a total of approximately 80,000 people through approximately 33,000 water and wastewater connections in the Pacific Northwest and Texas.

The dividend yield is 4.36%. Maxim’s $62 target price compares with a $53.29 consensus target and the most recent close at $45.40 a share.

Any company that has paid shareholders dividends for 50 years or more is the epitome of safe and dependable. These outstanding stocks also have support from top Wall Street analysts, making them good ideas for nervous investors. In these turbulent times, “better safe than sorry” are words to live by for sure, especially given the multitude of events and situations threatening a stock market that ran way past its intrinsic value some time ago.

Retirement planning doesn’t have to feel overwhelming. The key is finding professional guidance—and we’ve made it easier than ever for you to connect with the right financial advisor for your unique needs.

Here’s how it works:

1️ Answer a Few Simple Questions

Tell us a bit about your goals and preferences—it only takes a few minutes!

2️ Get Your Top Advisor Matches

This tool matches you with qualified advisors who specialize in helping people like you achieve financial success.

3️ Choose Your Best Fit

Review their profiles, schedule an introductory meeting, and select the advisor who feels right for you.

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.