Investing

Before the Bell: Oil Inventories, Netflix Ups & Downs, and Waiting for CPI

Published:

Premarket action on Wednesday had the three major U.S. indexes trading higher. The Dow Jones industrials were up 0.17%, the S&P 500 up 0.24% and the Nasdaq 0.23% higher.

Ten of 11 market sectors closed higher on Tuesday, with communications services (1.29%) and consumer cyclicals (1.26%) rising the most. Consumer staples (−0.16%) posted the day’s only loss. The Dow closed up 0.56%, the S&P 500 up 0.7% and the Nasdaq up 1.01% on Tuesday.

Trading volume was lighter Tuesday. New York Stock Exchange winners led losers by 2,219 to 877, while Nasdaq advancers led decliners by about 3.5 to 1. Among S&P 500 stocks, Warner Bros. Discovery Inc. (NASDAQ: WBD) added 8.2% after Goldman Sachs named the company its favorite media pick. Does this upturn now justify CEO David Zaslav’s massive salary? Since the merger of Warner Bros. and Discovery closed last April, the stock is still down by about 52%. Dish Network Corp. (NASDAQ: DISH) dropped by about 6.3%, after its top wireless executive, Stephen Bye, announced his departure to become president of a division of tech publisher Ziff-Davis.

Federal Reserve Chair Jerome Powell’s speech in Stockholm had essentially no impact on Tuesday morning trading. Buyers finally showed up in the afternoon, with small-cap growth stocks outperforming the rest of the market.

The only economic data point due Wednesday is the weekly report on petroleum inventories. Tuesday night, the American Petroleum Institute reported that crude oil inventories unexpectedly rose by nearly 15 million barrels last week. Industry analysts surveyed by The Wall Street Journal expect crude inventories to fall by 600,000 barrels in the government report due out after markets open.

Trading should be light again Wednesday as traders keep their powder dry for Thursday’s report on the consumer price index (CPI) for December. Economists are looking for CPI to be unchanged month over month and for core CPI to rise from an increase of 0.2% in November to up 0.3% in December.

Party City Holdco Inc. (NYSE: PRTY) is seeking a loan that would allow the company to file for debtor-in-possession bankruptcy within a few weeks, according to a Bloomberg report. The stock more than doubled in Tuesday trading to close at just over $0.45 per share.

Meme stock favorite GameStop Corp. (NYSE: GME) added about 8.5% to its share price on Tuesday. The company had no specific news, but then, when has it ever needed that?

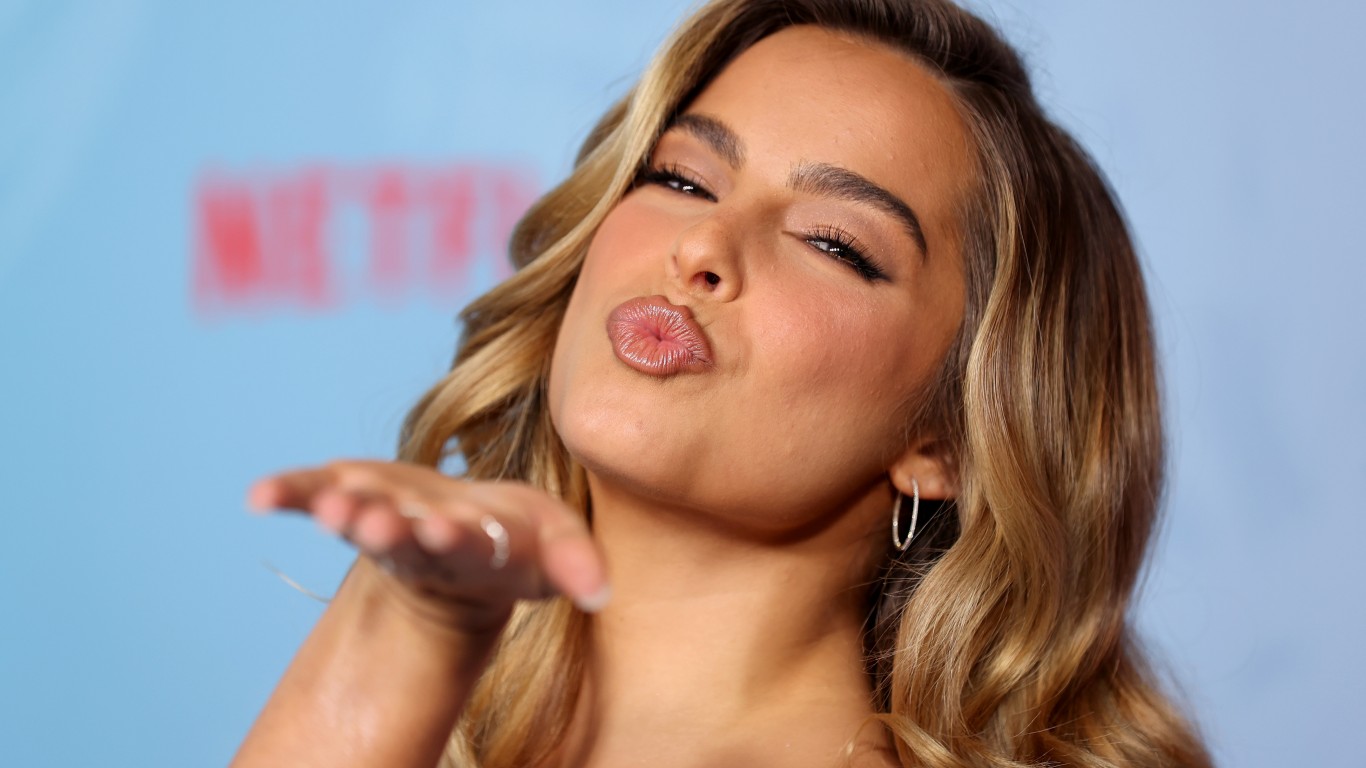

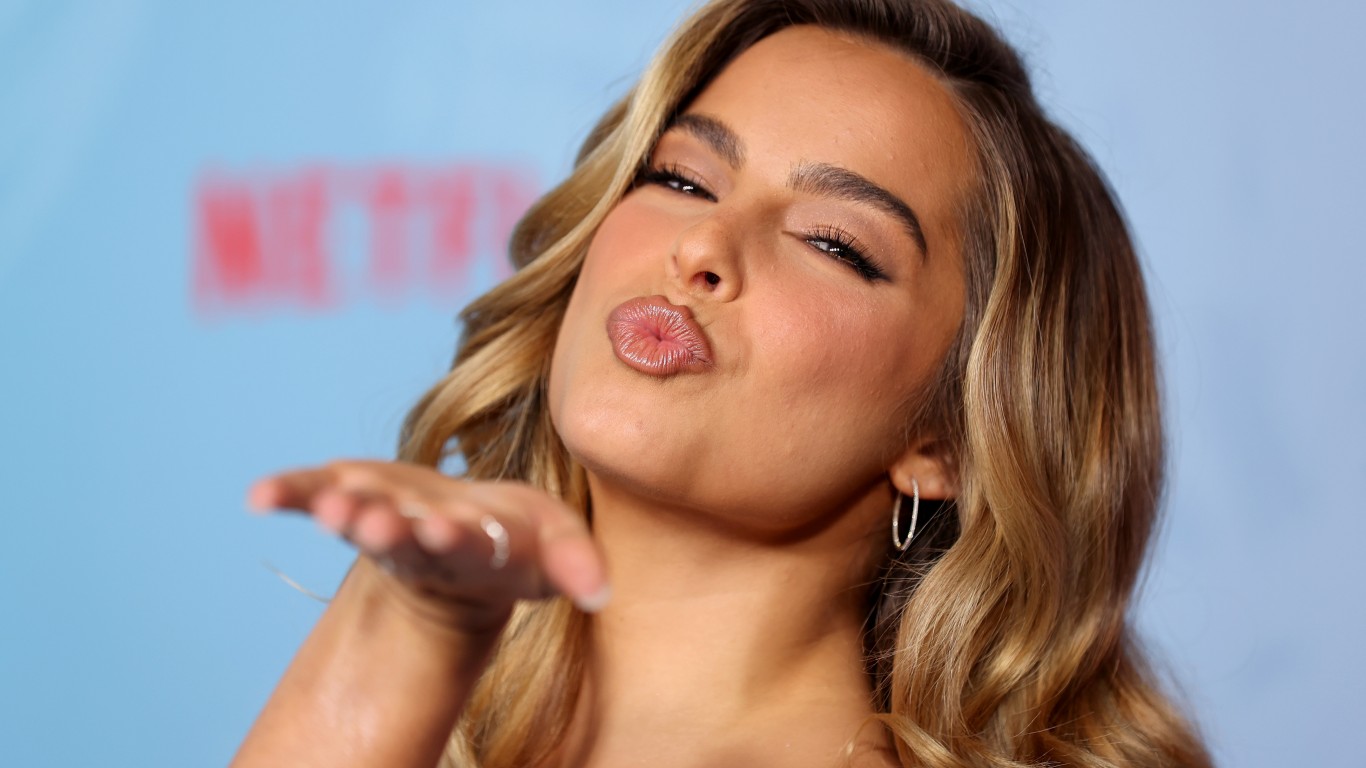

The weaker U.S. dollar has provided Goldman Sachs with all the evidence necessary to boost the firm’s estimates on Netflix Inc. (NASDAQ: NFLX). Goldman lifted its price target from $200 to $225 per share, noting that the dollar now trades down 7% compared with its value when Netflix last reported quarterly results. Goldman did not think the stronger dollar was enough to lift its Sell rating on the stock, however. Netflix shares closed up nearly 4% on Tuesday at $327.54.

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention.

Finding a financial advisor who puts your interest first can be the difference between a rich retirement and barely getting by, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors that serve your area in minutes. Each advisor has been carefully vetted, and must act in your best interests. Start your search now.

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.