Stocks are trading lower shortly after Thursday’s opening bell. The report on December CPI came in better than expected, and equities reacted accordingly. The all-times index declined by 0.1% and came in at up 6.5% year over year. That is the smallest 12-month increase since October of 2021. The core index (excluding food and energy) rose 0.3% to post a 12-month increase of 5.7%.

That uptick faded, probably due to a decline in new claims for unemployment benefits from 206,000 in the prior week to 205,000 last week. Continuing claims also declined. The CPI report and the unemployment report add up to uncertainty regarding how the FOMC will act at its meeting on January 31. Share prices have been rising on the belief that the Federal Reserve might pause its big incremental rate hikes. After Thursday morning, traders are going into wait-and-see mode, waiting for more signals. Next week brings the producer price index (PPI), and we still have the first reading on fourth-quarter gross domestic product (GDP)coming the week after that, along with the personal consumption expenditures (PCE) index.

After U.S. markets closed on Wednesday, KBHome reported quarterly results that missed estimates on the top and bottom lines. The company’s guidance for the first quarter of 2023 is flat to down with last’s total of $1.4 billion. Homebuilding revenue for the 2022 fiscal year totaled $6.88 billion; KB Home is projected housing revenue of $5 billion to $6 billion in the new fiscal year. Shares traded down about 4.2% Thursday morning.

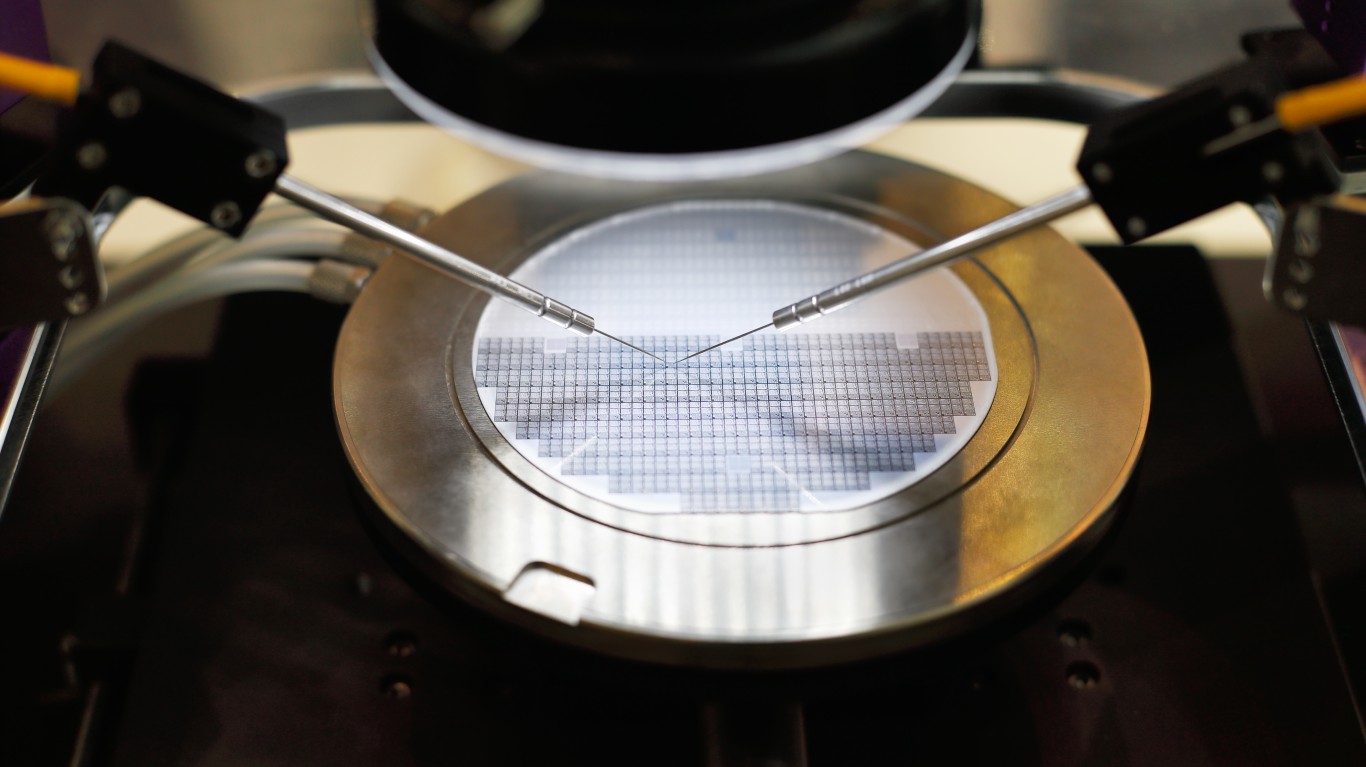

Taiwan Semiconductor reported results before U.S. markets opened on Thursday. The world’s largest semiconductor producer reported adjusted earnings per share of $0.38 on sales of $20.56 billion. First-quarter guidance was below expectations, but the company said it expects capital spending to be less than previously estimated. Shares traded up more than 5%.

We already have previewed what to expect when five of the nation’s largest banks and three other major companies (BlackRock, Delta Air Lines, United Healthcare) report quarterly results first thing Friday morning.

Though U.S. markets are closed Monday to observe the birthday of Rev. Martin Luther King Jr., one noteworthy report is due from Taiwan-based United Microelectronics Corp. (NYSE: UMC).

The Hsinchu-based UMC has a market cap of about $18.6 billion and is a manufacturer of semiconductor wafers for chipmakers Infineon, LSI, TI and others. Nearly 60% of its revenue is down to its top 10 customers. Over the past 12 months, the company’s share price has increased by almost 14%. Shares have added about 39% over the past three months. When UMC reported third-quarter earnings, the company said it expected wafer shipments to decline by 10% in the fourth quarter. UMC’s handsome dividend yield argues for patience.

Of 26 analysts covering the firm, 14 have Buy or Strong Buy ratings and 10 rate the stock at Hold. At a recent price of around $7.45, the American depositary shares (ADSs) trade near their median price target of $7.41. One ADS is equal to five shares of common stock. At the high ADS price target of $13.10, the upside potential is about 76%.

For UMC’s fourth quarter, analysts are looking for revenue of $2.2 billion, which would be down 6.1% sequentially but up 4.2% year over year. Adjusted earnings per ADS are expected to come in at $0.25, down 20% sequentially and flat year over year. For the full 2022 fiscal year, earnings per ADS are forecast at $1.15, up 42%, on revenue of $9.14 billion, up 19.4%.

TSMC stock trades at 6.3 times expected 2022 EPS, 5.9 times estimated 2023 earnings of $0.85 and 8.7 times estimated 2024 earnings of $0.85 per share. The stock’s 52-week trading range is $5.36 to $11.95, and the company pays an annual dividend of $0.50 (yield of 7.59%). Total shareholder return for the past 12 months was negative 30.3%.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.