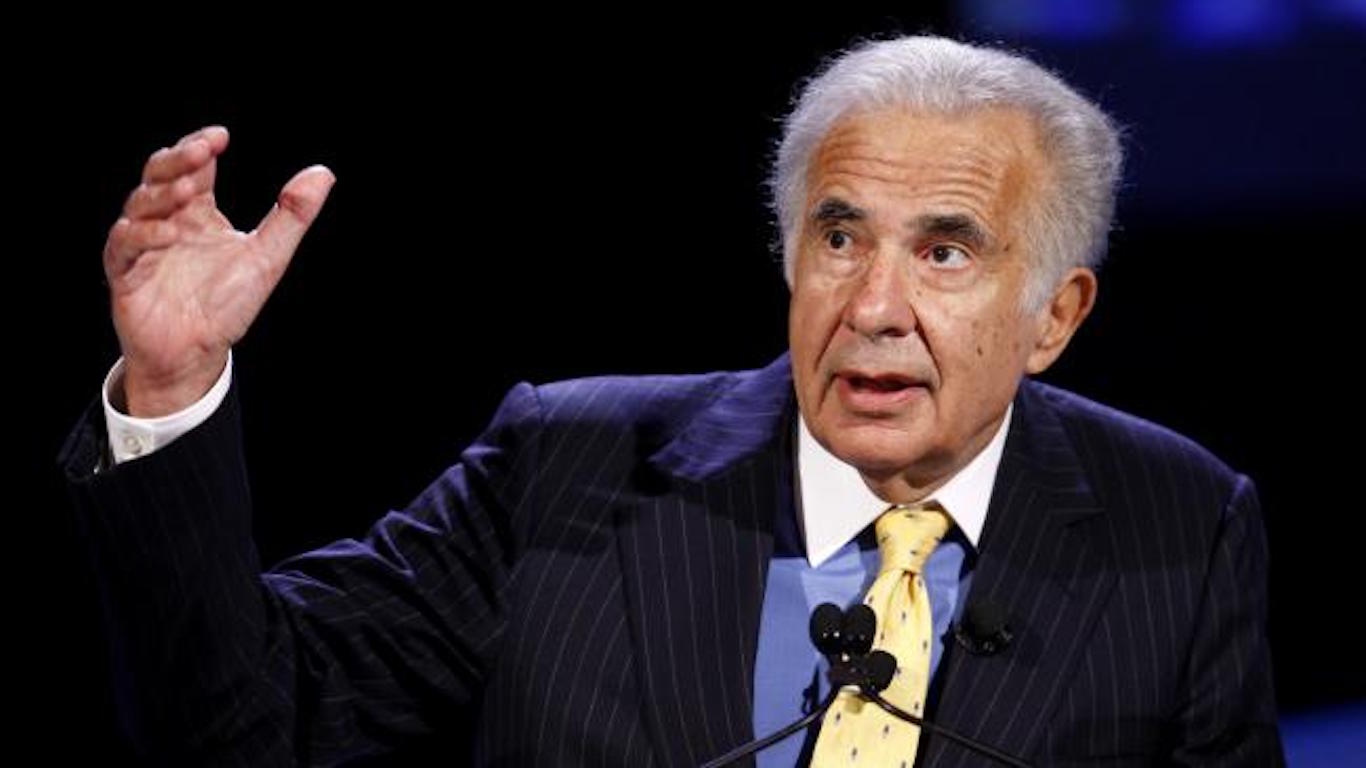

Fintel reports that Icahn Carl C has filed a 13D/A form with the SEC disclosing ownership of 3.34MM shares of Herc Holdings Inc (HRI). This represents 11.4% of the company.

In their previous filing dated December 15, 2022 they reported 3.70MM shares and 12.63% of the company, a decrease in shares of 9.77% and a decrease in total ownership of 1.23% (calculated as current – previous percent ownership).

Analyst Price Forecast Suggests 6.66% Upside

As of January 26, 2023, the average one-year price target for Herc Holdings is $163.07. The forecasts range from a low of $121.20 to a high of $256.20. The average price target represents an increase of 6.66% from its latest reported closing price of $152.89.

The projected annual revenue for Herc Holdings is $3,310MM, an increase of 30.79%. The projected annual EPS is $13.89, an increase of 36.01%.

Fund Sentiment

There are 546 funds or institutions reporting positions in Herc Holdings. This is a decrease of 43 owner(s) or 7.30%.

Average portfolio weight of all funds dedicated to US:HRI is 0.2811%, an increase of 4.9414%. Total shares owned by institutions decreased in the last three months by 3.10% to 34,883K shares.

What are large shareholders doing?

Alliancebernstein holds 2,151,329 shares representing 7.35% ownership of the company. In it’s prior filing, the firm reported owning 2,144,474 shares, representing an increase of 0.32%. The firm increased its portfolio allocation in HRI by 22.54% over the last quarter.

Gamco Investors, Inc. Et Al holds 1,882,987 shares representing 6.44% ownership of the company. In it’s prior filing, the firm reported owning 1,912,675 shares, representing a decrease of 1.58%. The firm increased its portfolio allocation in HRI by 21.84% over the last quarter.

Invesco holds 1,426,084 shares representing 4.87% ownership of the company. In it’s prior filing, the firm reported owning 1,340,230 shares, representing an increase of 6.02%. The firm increased its portfolio allocation in HRI by 30.25% over the last quarter.

Franklin Resources holds 1,168,529 shares representing 3.99% ownership of the company. In it’s prior filing, the firm reported owning 849,130 shares, representing an increase of 27.33%. The firm increased its portfolio allocation in HRI by 74.25% over the last quarter.

Wellington Management Group Llp holds 889,181 shares representing 3.04% ownership of the company. In it’s prior filing, the firm reported owning 97,884 shares, representing an increase of 88.99%. The firm increased its portfolio allocation in HRI by 1,007.12% over the last quarter.

Herc Holdings Background Information

(This description is provided by the company.)

Herc Holdings Inc., which operates through its Herc Rentals Inc. subsidiary, is one of the leading equipment rental suppliers with 277 locations in North America. With over 55 years of experience, Herc Holdings is a full-line equipment rental supplier offering a broad portfolio of equipment for rent. Herc Holdings’s classic fleet includes aerial, earthmoving, material handling, trucks and trailers, air compressors, compaction and lighting. The Company’s equipment rental business is supported by ProSolutionsR, its industry-specific solutions-based services, which includes power generation, climate control, remediation and restoration, and studio and production equipment, and its ProContractor professional grade tools. Herc Holdings’s product offerings and services are aimed at helping customers work more efficiently, effectively and safely. The Company has approximately 4,800 employees who equip ouritsrevenues were approximately $1.8 billion. All references to ‘Herc Holdings’ or the ‘Company’ in this press release refer to Herc Holdings Inc. and its subsidiaries, unless otherwise indicated.

This article originally appeared on Fintel

In 20 Years, I Haven’t Seen A Cash Back Card This Good

After two decades of reviewing financial products I haven’t seen anything like this. Credit card companies are at war, handing out free rewards and benefits to win the best customers.

A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges.

Our top pick today pays up to 5% cash back, a $200 bonus on top, and $0 annual fee. Click here to apply before they stop offering rewards this generous.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.